Key Takeaways

- Accelerating demand for connected IoT security and automation platforms drives recurring, high-margin revenue growth and broader market opportunities.

- Investment in AI-driven features and strategic international expansion strengthens product differentiation, reduces churn, and diversifies revenue streams.

- Increasing dependence on major partners, commoditized hardware, limited global reach, rising costs, and competition from tech giants threaten market share, margins, and revenue stability.

Catalysts

About Alarm.com Holdings- Provides various Internet of Things (IoT) and solutions for residential, multi-family, small business, and enterprise commercial markets in North America and internationally.

- Alarm.com’s growth is being powered by surging demand for unified smart property platforms as both consumers and enterprises adopt more connected IoT devices and seek seamless management of security, energy, and automation. This broadening adoption increases the company’s addressable market and is likely to drive sustained double-digit SaaS revenue growth.

- The rapid evolution toward cloud-managed security and automation—away from legacy hardware—positions Alarm.com’s subscription-based platform to benefit from predictable, high-margin recurring revenue, while the continued expansion of value-added services such as video analytics and energy management is expected to boost ARPU and lift gross margins over time.

- Breakout momentum in the commercial, international, and EnergyHub business lines, which collectively grew nearly 25 percent year over year and now make up over a quarter of total SaaS revenue, is opening material new revenue streams and diversifying the company’s growth, supporting both top-line acceleration and potential for improving revenue mix.

- Major investments in artificial intelligence and machine learning, exemplified by new AI-Deterrent products and dynamic load shaping capabilities, are enabling advanced proactive security and smarter energy management. These differentiated features are likely to reduce churn, increase penetration of video and automation solutions, and further enhance net margins as they scale.

- Alarm.com’s targeted international expansion and acquisition strategy is establishing a larger global footprint, particularly by onboarding regional and local partners and integrating adjacent technologies like those from CHeKT and EBS. This is expected to fuel faster international growth and further fortify long-term revenue and earnings visibility.

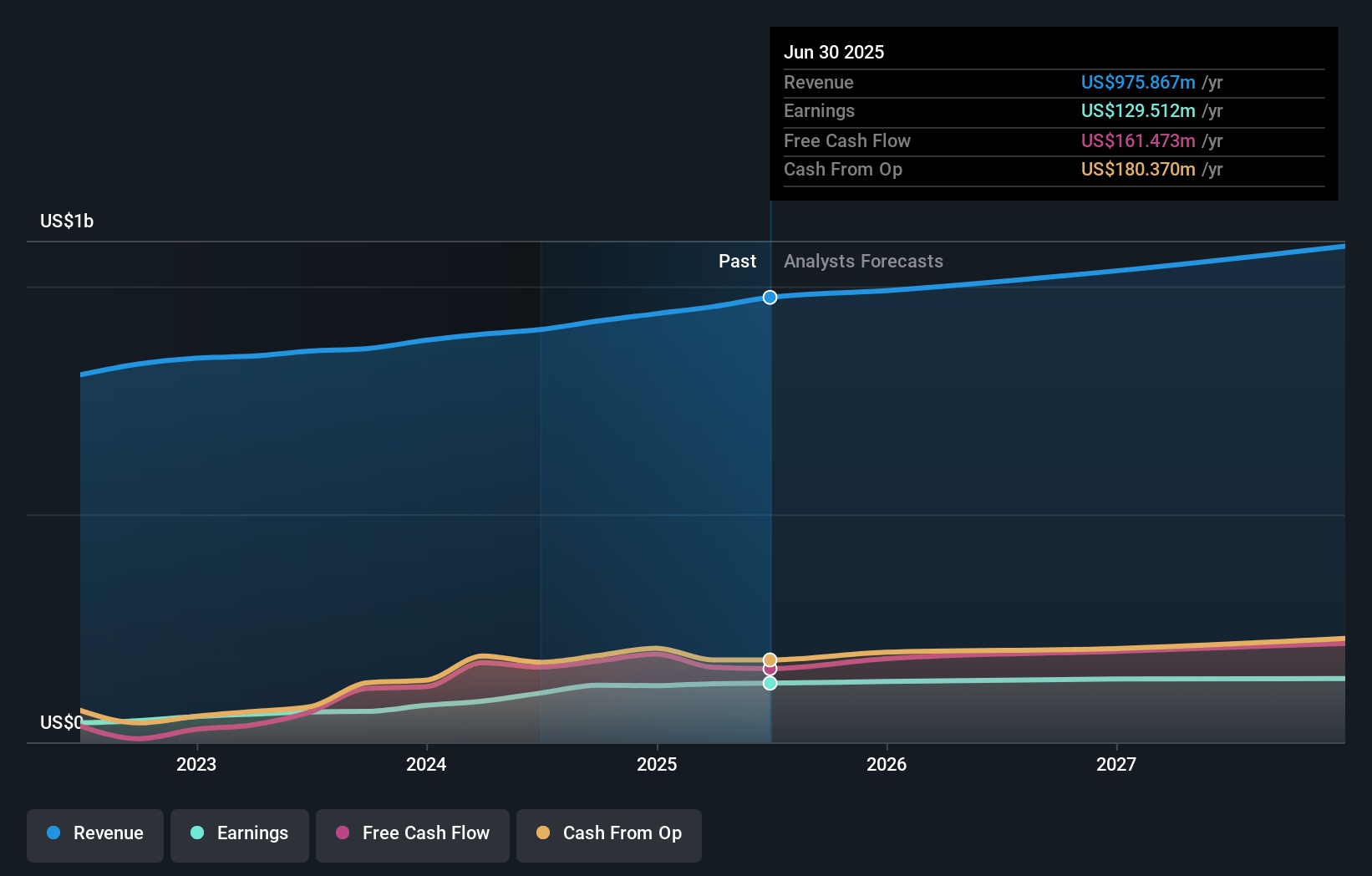

Alarm.com Holdings Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Alarm.com Holdings compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Alarm.com Holdings's revenue will grow by 5.0% annually over the next 3 years.

- The bullish analysts assume that profit margins will shrink from 13.4% today to 12.9% in 3 years time.

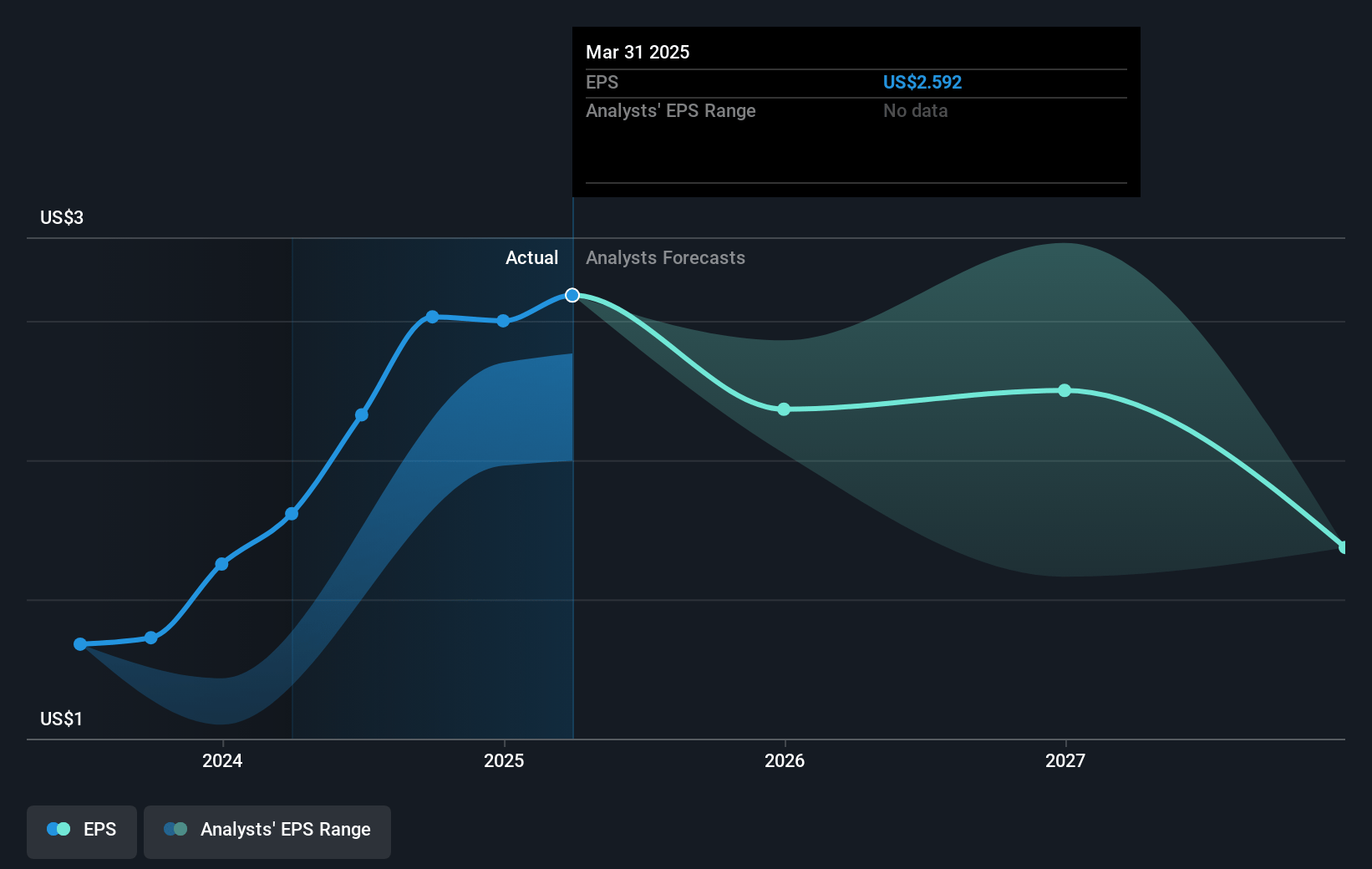

- The bullish analysts expect earnings to reach $142.7 million (and earnings per share of $1.59) by about July 2028, up from $128.5 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 39.3x on those 2028 earnings, up from 21.5x today. This future PE is lower than the current PE for the US Software industry at 42.7x.

- Analysts expect the number of shares outstanding to grow by 1.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.96%, as per the Simply Wall St company report.

Alarm.com Holdings Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The transition of major service provider partner ADT to its own ADT+ platform is expected to be a significant headwind for revenue growth in 2025 and highlights Alarm.com’s vulnerability to customer concentration among large partners, which could drive future revenue and earnings volatility.

- Accelerating commoditization of smart home hardware, noted in the flat or declining hardware sales and lower hardware gross margins, is likely to create sustained pricing pressure and margin compression in the core business, challenging overall profitability and long-term net margins.

- International expansion remains a small share of total revenue (6%) and is dependent on attracting regional and local partners; slower global adoption due to regulatory differences, data privacy restrictions, and required localization efforts could limit revenue growth and add compliance costs impacting margins as operations outside North America scale.

- Rising R&D and sales/marketing expenses, as demonstrated by increased investments to sustain brand awareness and technology leadership, could persistently outpace mid-single-digit revenue growth in the core residential business, weighing on operating margin improvement and risking future net margins if topline growth slows.

- Intensifying competition from large technology incumbents (Google, Amazon, Apple) with their own smart home platforms, paired with the rapid growth of DIY and lower-cost alternatives, threatens Alarm.com’s future revenue by pressuring market share, especially in residential SaaS, and reducing the demand for professionally-installed solutions.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Alarm.com Holdings is $85.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Alarm.com Holdings's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $85.0, and the most bearish reporting a price target of just $50.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $1.1 billion, earnings will come to $142.7 million, and it would be trading on a PE ratio of 39.3x, assuming you use a discount rate of 9.0%.

- Given the current share price of $55.59, the bullish analyst price target of $85.0 is 34.6% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.