Key Takeaways

- Advancements in generative AI and strategic AI model launches are projected to boost customer adoption, drive revenue growth, and increase ARPU.

- Integration of GenStudio and strategic partnerships are expected to expand Adobe's addressable market, enhancing earnings and subscription growth.

- Adobe's focus on AI integration and user growth faces challenges from data privacy, competitive pressures, financial headwinds, and execution risks, impacting revenue and margins.

Catalysts

About Adobe- Operates as a diversified software company worldwide.

- Adobe's advancements in generative AI models, including the integration of Firefly across flagship applications, are expected to increase customer adoption and offer tiered, higher-priced solutions, potentially driving revenue growth and increasing ARPU.

- The introduction and scaling of Adobe GenStudio, integrating Creative Cloud, Express, and Experience Cloud, aim to revolutionize content supply chains for enterprises, increasing Adobe's addressable market and potentially boosting revenue from enterprise customers.

- Adobe's strategic expansion into video and audio AI models, coupled with the expected launch of a comprehensive AI solution for creative professionals, could drive new user acquisitions, unlock new monetization opportunities, and enhance digital media ARR growth.

- The acceleration of AI-powered document productivity features, such as AI Assistant in Adobe Acrobat and Reader, is anticipated to boost Document Cloud revenue through improved user efficiency and enterprise adoption, thereby enhancing net margins.

- Strategic partnerships with companies like Amazon and integration into public clouds, combined with strong enterprise adoption of Adobe Experience Platform, could improve earnings by expanding Adobe's presence in customer experience management and increasing subscription revenue.

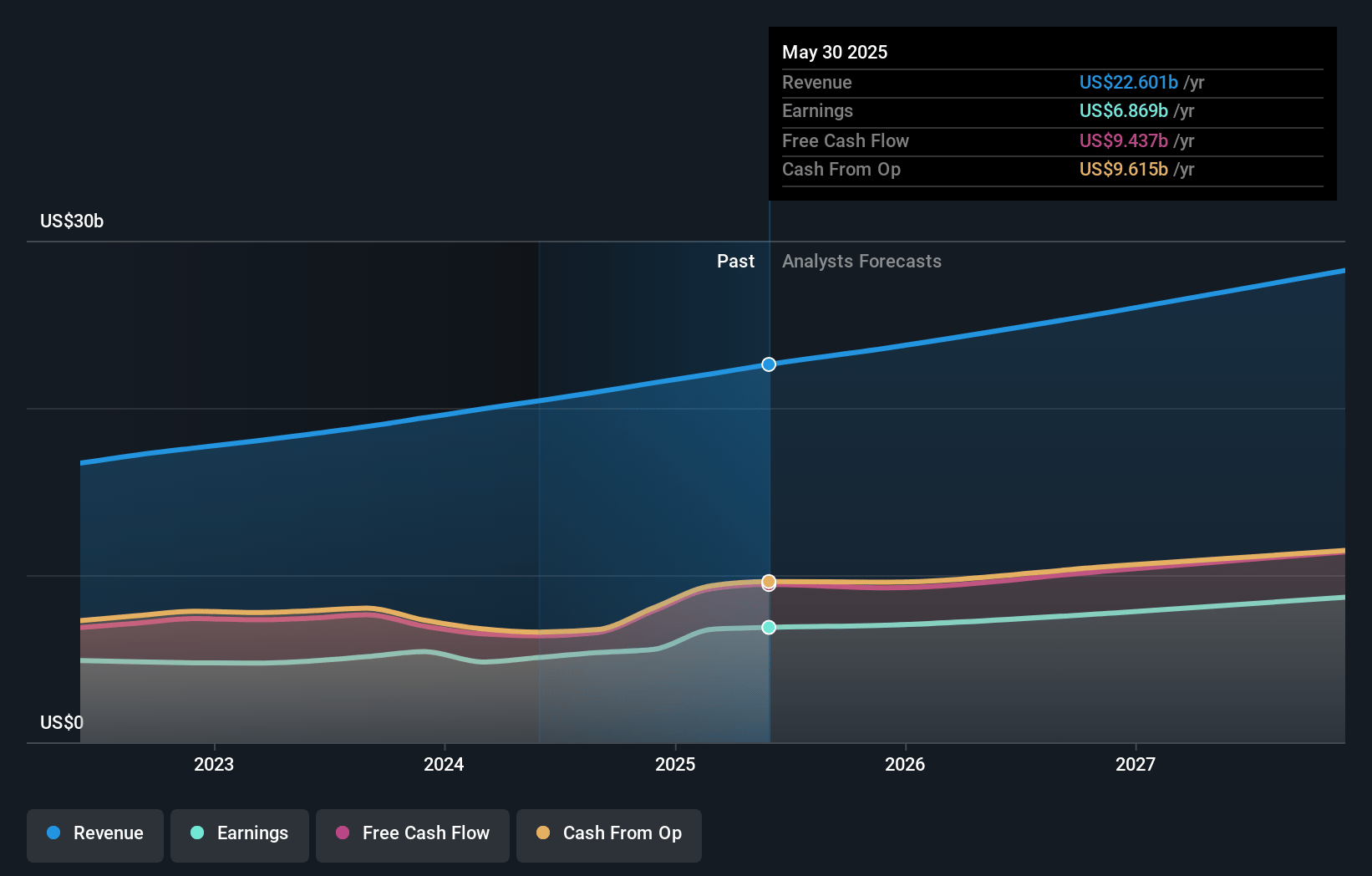

Adobe Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Adobe's revenue will grow by 9.6% annually over the next 3 years.

- Analysts assume that profit margins will increase from 25.9% today to 30.8% in 3 years time.

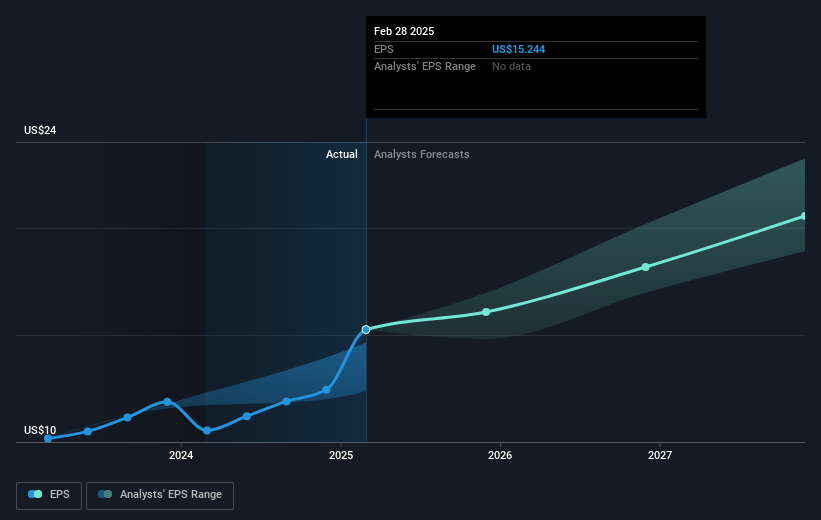

- Analysts expect earnings to reach $8.7 billion (and earnings per share of $20.41) by about January 2028, up from $5.6 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 34.4x on those 2028 earnings, down from 34.7x today. This future PE is lower than the current PE for the US Software industry at 43.6x.

- Analysts expect the number of shares outstanding to decline by 0.56% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.02%, as per the Simply Wall St company report.

Adobe Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The integration of AI models into Adobe's applications, while innovative, could face resistance or regulatory challenges related to data privacy and commercial safety, potentially affecting future revenue streams associated with these AI-driven products.

- Adobe's strategy to focus on proliferation and adoption at the lower end with products like Adobe Express may prioritize user growth over immediate monetization, which could impact net margins and earnings in the short term.

- Competitive pressures, especially in the generative AI and digital media markets, could limit Adobe's ability to tier its offerings and command higher pricing, which may affect its ability to increase its average revenue per user (ARPU) and overall profit margins.

- Foreign exchange rate fluctuations and the ongoing transition from perpetual licenses to subscriptions could present financial headwinds, impacting Adobe's revenue growth and possibly leading to a decrease in ARR growth, as noted in their fiscal year 2025 projections.

- The planned introduction and market acceptance of newer AI product offerings like Firefly Video Models and GenStudio could encounter execution risks, leading to potential delays in anticipated revenue contributions that may affect Adobe's ability to meet its forecasted business growth targets.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $573.34 for Adobe based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $660.0, and the most bearish reporting a price target of just $425.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $28.3 billion, earnings will come to $8.7 billion, and it would be trading on a PE ratio of 34.4x, assuming you use a discount rate of 7.0%.

- Given the current share price of $442.84, the analyst's price target of $573.34 is 22.8% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

BA

Equity Analyst

Increasing Total Addressable Market Through AI Will Strengthen Revenue Growth

Key Takeaways Adopting new technology like AI, AR/VR and browser-first cloud software will keep Adobe on top of the creative industry. AI Integration will empower commercial users and help onboard new users by making workflows simpler.

View narrativeUS$705.22

FV

37.0% undervalued intrinsic discount16.70%

Revenue growth p.a.

35users have liked this narrative

0users have commented on this narrative

5users have followed this narrative

5 months ago author updated this narrative

GO

Equity Analyst

Competition, Costs and Playing Catchup Will Compress Margins

Key Takeaways Slowing growth and margin pressure by new tech will force low return reinvestment Buying Figma is cheaper than competing, but regulators may block Experience Cloud is a growth story, but not Adobe's strong suit High-quality business, but high-growth perception is unsustainable and will likely subside Catalysts Company Catalysts Margins compressing from AI-driven design The adoption of AI-driven design - the $63B TAM can improve as more people utilize creative works, but the profitability of such projects may decline due to the higher availability of AI driven design. This may result in more revenue but lower profitability for Adobe.

View narrativeUS$317.27

FV

40.0% overvalued intrinsic discount9.00%

Revenue growth p.a.

16users have liked this narrative

0users have commented on this narrative

13users have followed this narrative

5 months ago author updated this narrative

WA

WallStreetWontons

Community Contributor

Adobe’s Canvas of Creativity: Monetizing Imagination with AI in its suite

Catalysts Products and Services Impacting Sales and Earnings : Adobe has a diverse portfolio of products and services that contribute to its revenue growth. Here are some key highlights: Creative Cloud : Adobe’s Creative Cloud suite includes popular software like Photoshop, Illustrator, and Premiere Pro.

View narrativeUS$898.28

FV

50.5% undervalued intrinsic discount16.66%

Revenue growth p.a.

7users have liked this narrative

0users have commented on this narrative

7users have followed this narrative

5 months ago author updated this narrative