Key Takeaways

- Heavy dependence on an aging, niche customer base and slow product innovation may hinder revenue growth and reduce brand relevance with younger shoppers.

- Structural pressures from e-commerce adoption, supply chain risks, and a highly promotional environment threaten store profitability and limit margin improvement opportunities.

- Weak sales, rising costs, and shifting consumer behavior threaten profitability, while trade uncertainties and retail footprint challenges could hinder future growth and adaptability.

Catalysts

About J.Jill- Operates as an omnichannel retailer for women’s apparel in the United States.

- While J.Jill benefits from a loyal and affluent core customer base that has historically proven resilient, the company's concentrated focus on middle-aged women means that evolving consumer preferences-particularly a continued shift toward athleisure, gender-neutral, and younger styles-may limit top-line revenue growth as its main demographic ages and younger consumers are less drawn to the brand.

- Although the overall apparel market is growing for older female consumers with greater spending power, the rapid pace of e-commerce adoption and the rise of online-only competitors is reducing foot traffic to physical stores-a key part of J.Jill's distribution strategy-threatening long-term relevance and bringing structural pressure to store-level sales and operating margins.

- While the new CEO brings strong expertise in merchandising and omnichannel expansion, J.Jill's product assortment has lacked newness, and if refresh cycles remain slow, the brand could increasingly rely on promotions to clear inventory, compressing gross margins and net profitability in the coming quarters.

- Despite recent investments in omnichannel systems, including ramping up ship-from-store capabilities, J.Jill's ongoing exposure to supply chain disruptions and rising input costs, such as tariffs and logistics, raises the risk of further margin headwinds-particularly if tariffs increase or vendor negotiations fail to fully offset these impacts.

- While digital and loyalty program enhancements provide some foundation for future growth, persistent over-reliance on traditional merchandising and store models, combined with limited brand differentiation in a highly promotional industry, may set expectations for only modest improvements in earnings and cash flow, absent a material refresh to the brand's appeal and customer experience.

J.Jill Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on J.Jill compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming J.Jill's revenue will decrease by 0.3% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 5.7% today to 10.3% in 3 years time.

- The bearish analysts expect earnings to reach $62.5 million (and earnings per share of $4.29) by about June 2028, up from $34.5 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 5.2x on those 2028 earnings, down from 6.3x today. This future PE is lower than the current PE for the US Specialty Retail industry at 17.6x.

- Analysts expect the number of shares outstanding to grow by 1.32% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 10.31%, as per the Simply Wall St company report.

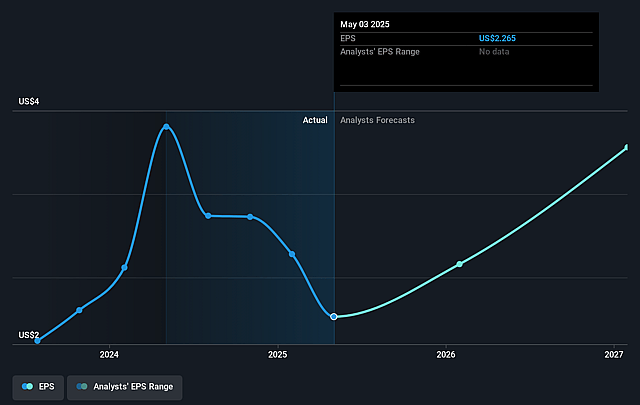

J.Jill Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Sustained declines in both store and direct sales, with comparable sales down 5.7% year over year and ongoing softness in customer demand, suggest that revenue and gross profits may remain under pressure if these trends persist beyond short-term macro headwinds.

- Increasing reliance on promotions and markdown sales-especially in the direct channel-combined with higher SG&A expenses, is compressing gross margins and risks further decline in net margins and earnings if shoppers continue to migrate to discounted merchandise.

- The company's core demographic of middle-aged women is described as cautious and quick to reduce spending during periods of economic or market uncertainty, limiting J.Jill's revenue growth potential and leaving it vulnerable to consumer preference shifts and downturns in discretionary spending.

- Tariff volatility and global trade uncertainties, particularly related to China, could increase input costs and exert new pressure on gross margins, especially if current mitigation strategies fall short or geopolitical tensions escalate.

- Slowed brick-and-mortar expansion, persistent store closures, and increased capital requirements for store investments and systems upgrades indicate a risk that J.Jill's traditional retail footprint and fixed costs may become less productive amid the shift to e-commerce, pressuring future earnings and scalability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for J.Jill is $16.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of J.Jill's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $30.0, and the most bearish reporting a price target of just $16.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $608.8 million, earnings will come to $62.5 million, and it would be trading on a PE ratio of 5.2x, assuming you use a discount rate of 10.3%.

- Given the current share price of $14.11, the bearish analyst price target of $16.0 is 11.8% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on J.Jill?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.