Key Takeaways

- New leadership and multichannel expansion could drive accelerated revenue growth and leverage the loyalty of an underserved customer demographic.

- Differentiation in inclusivity, sustainability, and new product categories may boost market share, deepen loyalty, and structurally enhance margins and earnings.

- An aging customer base, weak digital execution, slow product innovation, and rising competition threaten long-term growth, profitability, and market relevance.

Catalysts

About J.Jill- Operates as an omnichannel retailer for women’s apparel in the United States.

- Analysts broadly agree that new leadership under Mary Ellen Coyne will bring incremental store growth and digital enhancements, but this view understates her track record-her expertise in multichannel expansion and new category launches could accelerate J.Jill's revenue growth beyond expectations, especially as she leverages a fiercely loyal and underserved customer demographic.

- Analyst consensus sees store and OMS investments as supporting steady operating performance, but the reality is J.Jill's modern OMS paired with ramping ship-from-store capabilities and disciplined capital allocation creates a platform for outsized margin and earnings expansion as inventory turns improve and online accessibility widens.

- The aging and expanding 40+ female demographic in the U.S. is a long-term force that positions J.Jill to capture robust market share, leading to a larger, more resilient customer base that supports durable top-line growth and higher customer lifetime value.

- There is still unrecognized upside from J.Jill's opportunity to launch new product categories-including white space merchandise aligned with lifestyle and wellness trends-which could fuel both increased basket sizes and new customer acquisition, driving a sustained uplift in revenue.

- With a rising consumer focus on inclusivity and sustainability, J.Jill's ability to further differentiate its brand through transparent sourcing and responsible practices stands to deepen customer loyalty, justifying premium pricing and supporting a structural lift to gross margin and earnings over time.

J.Jill Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on J.Jill compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming J.Jill's revenue will grow by 3.5% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 6.5% today to 9.8% in 3 years time.

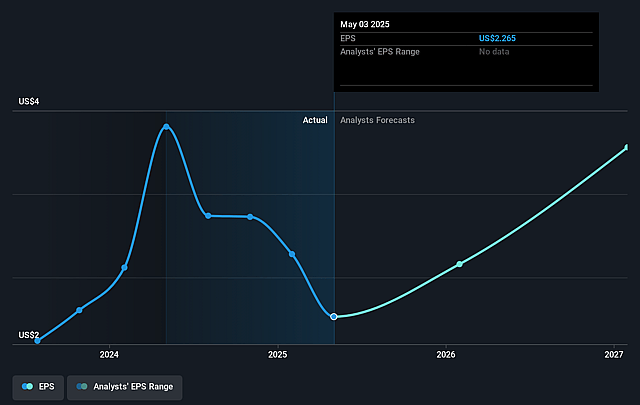

- The bullish analysts expect earnings to reach $66.8 million (and earnings per share of $4.06) by about June 2028, up from $39.5 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 13.9x on those 2028 earnings, up from 6.5x today. This future PE is lower than the current PE for the US Specialty Retail industry at 17.3x.

- Analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.74%, as per the Simply Wall St company report.

J.Jill Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company's core customer base is described as highly loyal but aging, and there is limited evidence of successful initiatives to broaden appeal to younger generations, which risks long-term revenue stagnation as the overall addressable market shrinks.

- Despite investments, the company acknowledged that its digital and e-commerce presence is not best-in-class relative to peers, reducing its ability to capture share from the secular shift toward online shopping and putting future revenue growth at risk.

- Slow assortment innovation and a lack of newness in products resulted in more frequent markdown sales and higher promotional activity during the quarter, indicating ongoing risk of gross margin erosion and lower net income if inventory freshness is not addressed.

- The company faces persistent external pressures, including volatile consumer spending, ongoing global trade tensions, inflation in labor and materials, and supply chain disruptions, all of which increase operating costs and threaten both gross margins and overall earnings.

- Increased competitive intensity from value-oriented and digital-native apparel brands is forcing J.Jill to raise marketing and promotional spend to retain customers, which could drive higher SG&A expenses and put continued pressure on profitability and free cash flow.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for J.Jill is $39.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of J.Jill's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $39.0, and the most bearish reporting a price target of just $21.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $677.9 million, earnings will come to $66.8 million, and it would be trading on a PE ratio of 13.9x, assuming you use a discount rate of 9.7%.

- Given the current share price of $16.84, the bullish analyst price target of $39.0 is 56.8% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on J.Jill?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.