Key Takeaways

- Heavy reliance on physical stores and brand dilution are eroding margins and weakening Gap's long-term revenue and market relevance.

- Fierce competition from online fast-fashion and shifting demographics are shrinking Gap's customer base, driving increased discounting, and amplifying margin and profitability pressures.

- Sustained brand revitalization, omnichannel innovation, and disciplined cost management are positioning Gap for continued revenue growth, margin strength, and long-term earnings resilience.

Catalysts

About Gap- Operates as an apparel retail company.

- As digital commerce continues to accelerate and foot traffic in physical stores declines, Gap's large legacy brick-and-mortar footprint will increasingly weigh on future same-store sales and revenue growth, particularly as consumer shopping migrates online and mall-based retail loses relevance.

- Intensifying competition from ultra-fast fashion and e-commerce-native rivals such as Shein and Temu is expected to erode Gap's market share and pricing power further, driving lower average unit retails and additional margin compression across core brands.

- Gap's ongoing struggle to clearly differentiate its brand portfolio risks further brand dilution, leading to greater reliance on heavy promotions and discounting to drive traffic, which will shrink gross margins and pressure long-term net earnings.

- Demographic shifts-particularly an aging population and widening income inequality-threaten to limit the company's ability to attract younger, more affluent customers, likely stagnating core-customer growth and resulting in a flattening or declining revenue base over time.

- Persistently rising labor and regulatory compliance costs, combined with the slower pace of Gap's supply chain transformation relative to newer, more agile competitors, are poised to elevate operating expenses substantially and undermine future profitability and operating margins.

Gap Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Gap compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

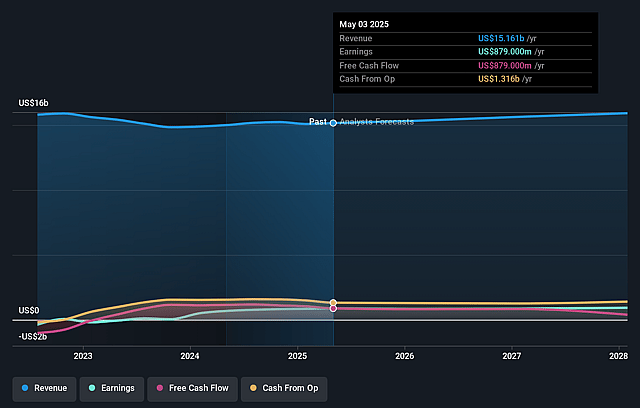

- The bearish analysts are assuming Gap's revenue will grow by 1.0% annually over the next 3 years.

- The bearish analysts assume that profit margins will shrink from 5.9% today to 5.2% in 3 years time.

- The bearish analysts expect earnings to reach $820.2 million (and earnings per share of $2.21) by about September 2028, down from $889.0 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 10.9x on those 2028 earnings, up from 10.0x today. This future PE is lower than the current PE for the US Specialty Retail industry at 18.7x.

- Analysts expect the number of shares outstanding to decline by 1.4% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.81%, as per the Simply Wall St company report.

Gap Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Gap's brand reinvigoration playbook is showing sustained success with seven consecutive quarters of positive comparable sales at the namesake brand, increasing average unit retail and greater spend per customer, which may continue to drive revenue growth and strengthen net margins over time.

- The company is achieving meaningful omnichannel progress, including digitally enabled stores and effective social-first marketing strategies, enabling Gap to adapt to long-term industry trends around e-commerce, potentially supporting revenue and operating profit expansion.

- Old Navy's continued leadership in key growth categories like denim and activewear, enhanced by successful influencer partnerships and strategic collaborations, positions Gap to capitalize on secular trends toward athleisure and casualwear, likely helping revenue and margin resilience.

- Investments in advanced supply chain technology, AI-driven demand planning, and inventory discipline are already driving efficiency gains and reducing costs, which can offset industry pressures and support improvements in gross margin and operating income going forward.

- Management demonstrated rigorous cost controls and capital discipline by expanding gross margins in recent years, maintaining high cash balances, and articulating clear mitigation plans for tariff impacts, giving the company flexibility to invest for future growth and enhance long-term earnings potential.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Gap is $19.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Gap's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $32.0, and the most bearish reporting a price target of just $19.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $15.6 billion, earnings will come to $820.2 million, and it would be trading on a PE ratio of 10.9x, assuming you use a discount rate of 9.8%.

- Given the current share price of $24.07, the bearish analyst price target of $19.0 is 26.7% lower.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Gap?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.