Last Update 07 May 25

Fair value Decreased 5.34%Digital Transformation And Sustainable Trends Will Fuel Retail Evolution

Key Takeaways

- Strong brand momentum, operational efficiency gains, and digital growth are positioning Gap for improved profitability and faster-than-expected revenue growth.

- Resonance with younger, values-driven consumers and Athleta's turnaround signal increased market share and long-term pricing power.

- Gap faces declining in-store traffic, brand dilution, squeezed margins, inventory missteps, and rising costs amid digital disruption and polarizing consumer preferences.

Catalysts

About Gap- Operates as an apparel retail company.

- Analyst consensus sees brand reinvigoration, particularly at Old Navy and Gap, as driving steady revenue gains, but recent data show these brands are growing comp sales quarter after quarter, regaining pop culture status, and setting industry records-this momentum indicates revenue could increase at a much faster pace than consensus expects as Gap becomes a destination for full-price, trend-driven shoppers.

- While analysts broadly agree that operational rigor and supply chain enhancements will improve margins, current efficiency gains and tech deployments-especially AI-driven inventory and employee enablement-are already unlocking significant cost savings, suggesting a path not just to net margin expansion, but to a step change in long-term profitability as fixed costs are permanently lowered.

- The rapid acceleration in digital adoption is converging with Gap's omnichannel strengths, leading to a direct-to-consumer mix that is growing faster than peers; as personalized digital and e-commerce initiatives scale, this will structurally elevate both revenue and margin by converting more transactions at higher average selling prices.

- Gap's brand positioning around inclusivity, sustainability, and accessible styles is uniquely resonant with Gen Z and millennial consumers, a demographic that prioritizes values-aligned shopping and is growing into peak spending years, driving a durable tailwind for market share gains, brand loyalty, and long-run pricing power-all of which support elevated earnings.

- As Athleta emerges from its reset under high-caliber new leadership (with Nike pedigree) and re-engages with the boom in athleisure, the potential exists for a rapid shift from drag to double-digit growth, restoring overall company growth rates and unlocking significant upside to company-wide revenue and EBITDA.

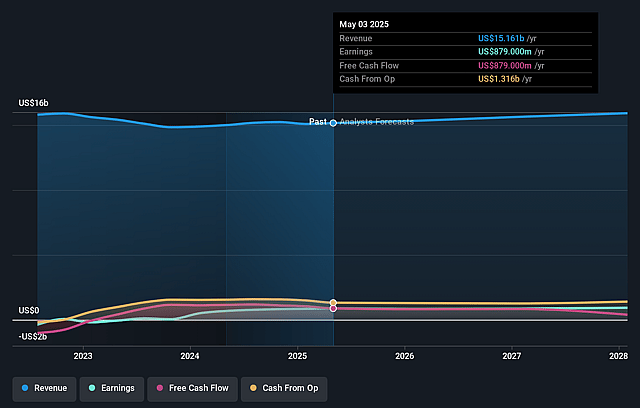

Gap Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Gap compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Gap's revenue will grow by 2.4% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 5.9% today to 6.2% in 3 years time.

- The bullish analysts expect earnings to reach $1.0 billion (and earnings per share of $2.82) by about September 2028, up from $889.0 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 14.4x on those 2028 earnings, up from 10.1x today. This future PE is lower than the current PE for the US Specialty Retail industry at 18.7x.

- Analysts expect the number of shares outstanding to decline by 1.4% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.81%, as per the Simply Wall St company report.

Gap Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The accelerating consumer shift to e-commerce and digital-first shopping continues to reduce foot traffic to Gap's brick-and-mortar stores, putting further pressure on its vast legacy retail network and likely leading to revenue and same-store sales declines, especially as younger consumers favor online-first competitors.

- Ongoing industry-wide polarization in consumer spending is favoring both luxury and value/discount retailers, while Gap's mid-tier positioning risks further erosion of market share and squeezed gross and net margins, as wealthier consumers trade up and cost-conscious shoppers trade down.

- Persistent brand confusion and dilution across Gap's multiple banners, along with inconsistent performance (e.g., Athleta's ongoing reset and sales decline), undermine brand loyalty and limit pricing power, which could depress future revenues and gross margins.

- Gap's chronic inventory management challenges, as seen with Athleta's heavy discounting and elevated inventory levels, risk further markdowns and inventory write-downs, exposing the company to volatile gross margins and unpredictable net earnings.

- Rising costs of customer acquisition and digital advertising, combined with the increasing need for costly sustainability and compliance investments, will likely lead to higher SG&A expenses, reduced marketing ROI, and compressed operating margins compared to more nimble, asset-light online rivals.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Gap is $30.73, which represents two standard deviations above the consensus price target of $24.38. This valuation is based on what can be assumed as the expectations of Gap's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $32.0, and the most bearish reporting a price target of just $19.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $16.3 billion, earnings will come to $1.0 billion, and it would be trading on a PE ratio of 14.4x, assuming you use a discount rate of 9.8%.

- Given the current share price of $24.1, the bullish analyst price target of $30.73 is 21.6% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.