Key Takeaways

- Digital automation and proprietary technology enable cost efficiencies, higher margins, and improved customer targeting, positioning Carvana for scalable growth.

- Expanding logistics and positive customer experiences drive platform adoption, strengthening brand presence and supporting long-term revenue and earnings growth.

- Shifting mobility trends, EV adoption, high costs, debt dependence, and intensifying competition all threaten Carvana's revenue growth, profitability, and financial stability.

Catalysts

About Carvana- Operates an e-commerce platform for buying and selling used cars in the United States.

- Carvana is well positioned to benefit from the ongoing shift toward online purchasing of high-value goods, as their fully digital car buying experience offers a broad selection, speed, and ease. As consumer comfort with large online transactions grows, Carvana is likely to see rapid gains in sales volumes and topline revenue as more customers choose their platform for used and potentially even new car purchases.

- The company continues to leverage digital technology to automate and streamline auto financing, trade-ins, and documentation, reducing friction and operational costs while improving conversion rates. These improvements directly support higher net margins and operating leverage as more elements of the car buying process are digitized and scaled.

- Expansion and utilization of logistics, inspection centers, and reconditioning infrastructure through acquisitions and organic growth allow Carvana to handle increasing volumes while reducing delivery times and per-unit reconditioning costs. This operating scale supports both higher revenue growth and expanding margins through fixed-cost leverage.

- Carvana’s proprietary data analytics and pricing algorithms continue to drive improvements in retail gross profit per unit and customer targeting. This technological advantage supports ongoing margin expansion and efficient customer acquisition, setting the stage for significant growth in earnings as the business scales.

- The positive feedback loop between increasing awareness, positive customer experiences, and inventory growth is accelerating adoption of the Carvana platform. As more customers encounter Carvana and share positive stories, word-of-mouth and trust help the company capture greater market share from traditional dealerships, which in turn drives sustainable long-term revenue and earnings growth as Carvana’s brand becomes synonymous with buying and selling cars.

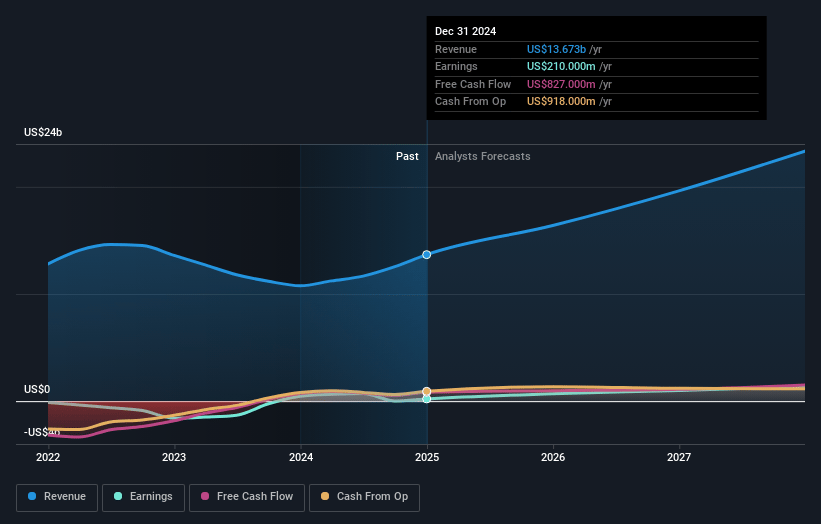

Carvana Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Carvana compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Carvana's revenue will grow by 33.6% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 2.7% today to 8.2% in 3 years time.

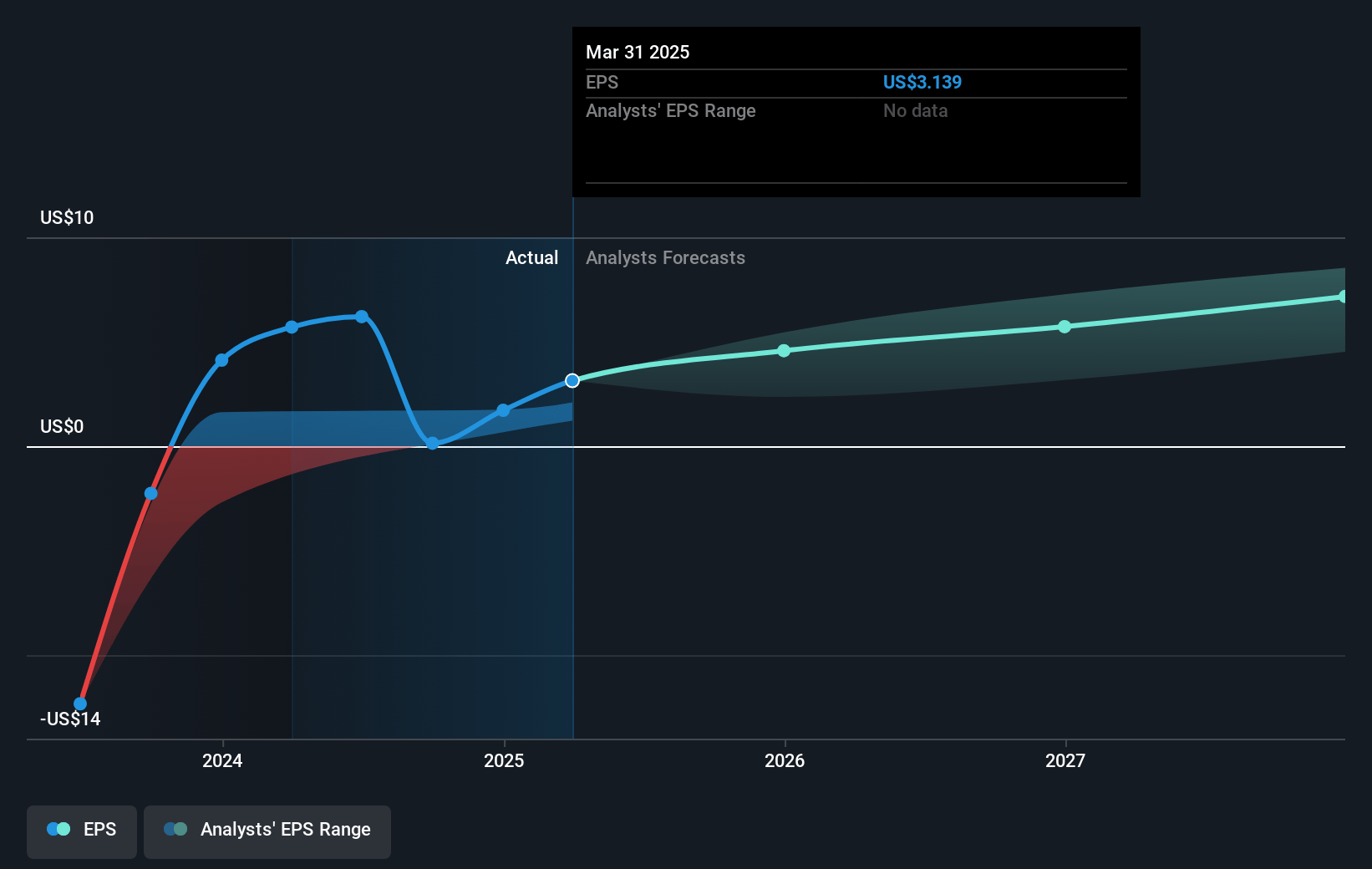

- The bullish analysts expect earnings to reach $2.9 billion (and earnings per share of $8.5) by about July 2028, up from $398.0 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 47.1x on those 2028 earnings, down from 115.9x today. This future PE is greater than the current PE for the US Specialty Retail industry at 17.6x.

- Analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.83%, as per the Simply Wall St company report.

Carvana Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Long-term shifts toward public transit and shared mobility could shrink Carvana's addressable market, limiting future revenue growth by reducing the pool of individual used car buyers.

- Acceleration in electric vehicle adoption may challenge Carvana’s inventory mix, as used EVs may not align with shifting consumer demand, leading to higher inventory obsolescence and lower revenues.

- Sustained high operating expenses and a need to prioritize growth over margin could threaten long-term net margins and make it hard to translate top-line revenue gains into consistent earnings, especially if operational efficiencies plateau.

- Heavy reliance on debt financing and significant historical leverage introduces vulnerability to financial distress, particularly if cash flows underperform during macroeconomic or industry downturns, putting earnings and shareholder value at risk.

- Rising regulatory scrutiny and increasing competition from both traditional and online-first auto retailers could compress gross margins, erode market share, and elevate customer acquisition costs, ultimately pressuring revenue and profitability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Carvana is $415.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Carvana's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $415.0, and the most bearish reporting a price target of just $230.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $35.4 billion, earnings will come to $2.9 billion, and it would be trading on a PE ratio of 47.1x, assuming you use a discount rate of 7.8%.

- Given the current share price of $341.56, the bullish analyst price target of $415.0 is 17.7% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.