Key Takeaways

- Baozun's disciplined execution, technology innovation, and early platform leadership position it for stronger, margin-expanding growth than currently expected by the market.

- The scalable brand management playbook and asset-light expansion create long-term revenue diversification and sustained high-margin earnings potential.

- Rising competition, platform dominance, and costly innovation threaten Baozun's margins, while its pivot toward lower-margin businesses poses long-term risks to profit growth.

Catalysts

About Baozun- Through its subsidiaries, engages in the provision of end-to-end e-commerce solutions in the People's Republic of China.

- Analyst consensus expects demand for end-to-end e-commerce and omnichannel solutions to grow steadily, but they may be underestimating Baozun's accelerating momentum, as BEC's disciplined execution is already generating record operating profit and BBM's revenue surge of over 35% signals that revenue growth and profitability could substantially outperform expectations. This sets up for above-consensus revenue growth and margin expansion in coming quarters.

- While analysts broadly agree that technology innovation will enable operational efficiencies, the scope and pace of Baozun's AI and data-driven platform deployments are likely to be transformative, allowing for greater automation, inventory optimization, and targeted marketing than currently priced in, which could meaningfully amplify net margin expansion and recurring high-margin earnings.

- Baozun's brand management segment is becoming a growth flywheel: success in scaling Gap and Hunter not only diversifies revenues, but also provides a replicable playbook for onboarding and rapidly scaling future international or premium brands from their large existing e-commerce client base, providing a long runway for top-line growth and improving long-term operating leverage.

- Early leadership on high-growth, next-generation retail platforms (including being a top-tier partner on RedNote, Douyin, and Tmall) gives Baozun privileged access to new high-value clients and emerging revenue streams, likely driving faster market share gains and recurring service revenue growth versus both peers and consensus.

- The asset-light expansion strategy in offline retail, coupled with reduced inventory days and enhanced supply chain efficiency, makes BBM's profit trajectory far more scalable, setting the stage for rapid margin expansion and sustainable earnings growth as new brands are added and operational synergies are realized.

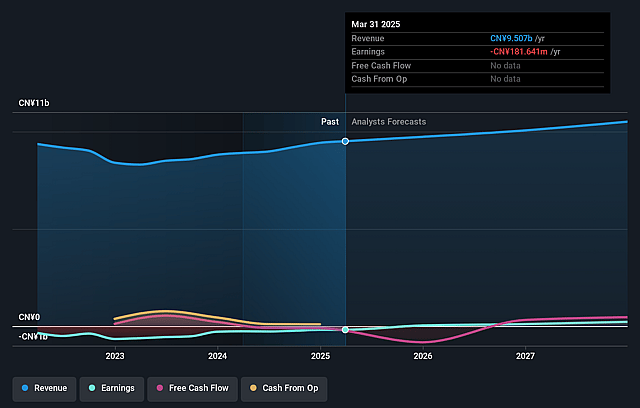

Baozun Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Baozun compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Baozun's revenue will grow by 6.7% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from -1.9% today to 3.9% in 3 years time.

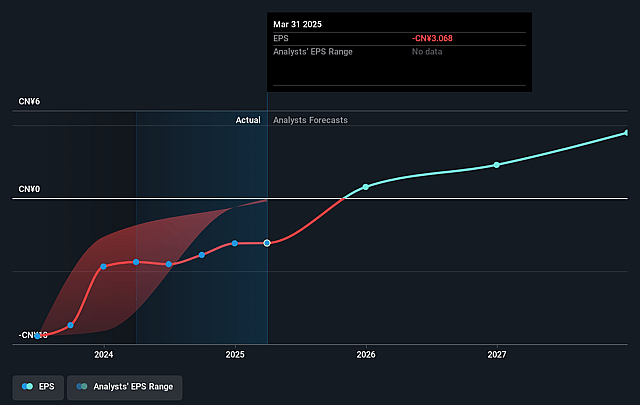

- The bullish analysts expect earnings to reach CN¥460.4 million (and earnings per share of CN¥8.23) by about September 2028, up from CN¥-185.0 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 7.1x on those 2028 earnings, up from -8.6x today. This future PE is lower than the current PE for the US Multiline Retail industry at 21.6x.

- Analysts expect the number of shares outstanding to decline by 2.77% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 13.22%, as per the Simply Wall St company report.

Baozun Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Intensifying competition in instant retail shopping and the rise of alternative shopping channels like Douyin, RedNote, and livestreaming threaten Baozun's traditional e-commerce enablement model, which could erode its client value proposition and pressure long-term revenues and margins.

- Mega-platforms like Alibaba, JD.com, and Tencent-backed ecosystems are exerting growing influence over traffic and service allocation, increasing the risk that brands may bypass third-party enablers like Baozun or squeeze their pricing power, which can dampen Baozun's revenue growth and profitability.

- Persistent industry commoditization and price competition among e-commerce solution providers, compounded by growing overcapacity and new entrants, may further compress Baozun's gross margins and limit its ability to achieve sustained profitability.

- Large ongoing investments in technology, AI, and process innovation to remain competitive with leading platforms and enable omnichannel solutions are becoming increasingly costly and are currently focused on operational efficiency rather than top-line growth, which could strain free cash flow and earnings over time.

- The company's shift toward distribution-heavy and logistics-intensive businesses, such as Baozun Brand Management, exposes it to lower-margin operating models and store-related risks, which could permanently weigh down group net margins and slow earnings growth despite periodic improvements in top-line performance.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Baozun is $6.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Baozun's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $6.0, and the most bearish reporting a price target of just $3.02.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be CN¥11.7 billion, earnings will come to CN¥460.4 million, and it would be trading on a PE ratio of 7.1x, assuming you use a discount rate of 13.2%.

- Given the current share price of $3.85, the bullish analyst price target of $6.0 is 35.8% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.