Key Takeaways

- Broader digital adoption and omnichannel expansion fuel revenue growth, improved client retention, and increased high-margin online services income.

- Transition to higher-value offerings, technology upgrades, and successful brand integrations drive sustained margin expansion and diversification of revenue sources.

- Rising competition, margin pressures, client concentration risks, regulatory hurdles, and challenges in new brand integration threaten Baozun's growth, profitability, and overall business stability.

Catalysts

About Baozun- Through its subsidiaries, engages in the provision of end-to-end e-commerce solutions in the People's Republic of China.

- Accelerating e-commerce and digital adoption in China and broader Asian markets continues to drive demand for Baozun's core e-commerce and brand management services, delivering high single

- to double-digit revenue growth in both segments and supporting future topline expansion.

- Expansion of omnichannel and social commerce ecosystems (such as Douyin and RedNote), coupled with early leadership positions on new platforms, increases client stickiness and recurring revenue streams, while also driving higher-quality, margin-accretive online services revenue.

- Baozun's ongoing transition to higher-value service offerings-such as digital marketing, IT, and SaaS solutions-has resulted in notable gross and operating margin expansion, which is likely to boost net earnings as these services grow as a share of revenue.

- Successful operational integration and store expansion of managed brands (e.g., Gap and Hunter) demonstrate the company's capability to leverage experience and infrastructure across new acquisitions, unlocking new high-margin revenue streams and mitigating client concentration risk.

- Technology-driven enhancements in inventory, supply chain, and content creation are reducing fulfillment and back-office costs, anchoring recent operating margin improvements, and setting the stage for further net profit growth as these initiatives scale.

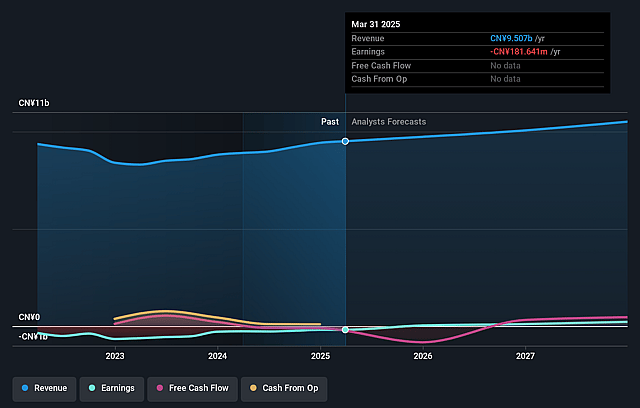

Baozun Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Baozun's revenue will grow by 4.4% annually over the next 3 years.

- Analysts assume that profit margins will increase from -1.9% today to 2.6% in 3 years time.

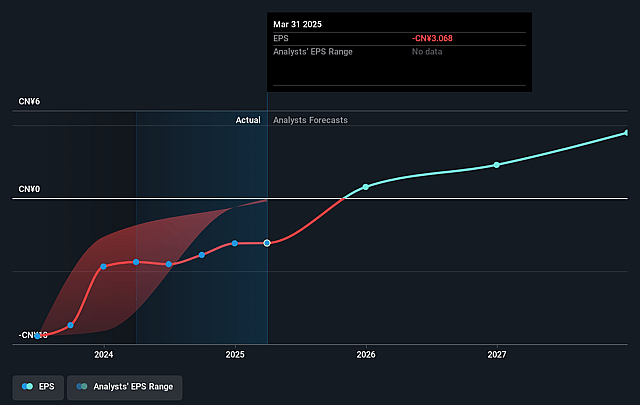

- Analysts expect earnings to reach CN¥289.0 million (and earnings per share of CN¥5.16) by about September 2028, up from CN¥-185.0 million today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as CN¥165 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 8.3x on those 2028 earnings, up from -9.0x today. This future PE is lower than the current PE for the US Multiline Retail industry at 20.9x.

- Analysts expect the number of shares outstanding to decline by 2.77% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 13.27%, as per the Simply Wall St company report.

Baozun Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Intensifying competition from integrated e-commerce giants (e.g., Alibaba's Tmall, JD.com, Pinduoduo), who are prioritizing direct merchant programs, increased rebates, and traffic allocation for brands, could disintermediate service providers like Baozun, suppressing demand for third-party solutions and threatening long-term revenue growth and market share.

- Persistent pressure on net margins may arise from the company's ongoing need for high sales and marketing expenditures to drive brand management (BBM) growth and to keep up with aggressive promotional campaigns on key e-commerce holidays, indicating that profitability improvements may be difficult to sustain.

- Continued margin compression and risk of revenue volatility may occur if Baozun fails to diversify its client base sufficiently; current business remains heavily dependent on a core set of retail and brand partners, so losing key contracts or under-performing in major partnerships (like Gap or Hunter) could have outsized negative impacts on earnings.

- Prolonged underperformance, delayed breakeven, or asset write-downs in newly acquired or managed brands within BBM (such as potential setbacks with Gap Greater China, Hunter, or new yoga/lifestyle brands) could drag on consolidated group earnings and cash flows in the long run.

- Growing regulatory complexity and the emergence of stricter consumer data privacy requirements, both within China and globally, could elevate compliance costs, limit the scalability of Baozun's data-driven and AI-enabled business models, and thus negatively affect operational efficiency and long-term profitability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $4.345 for Baozun based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $6.0, and the most bearish reporting a price target of just $3.02.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be CN¥11.0 billion, earnings will come to CN¥289.0 million, and it would be trading on a PE ratio of 8.3x, assuming you use a discount rate of 13.3%.

- Given the current share price of $4.03, the analyst price target of $4.35 is 7.3% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.