Key Takeaways

- Expanding digital and omnichannel solutions, premium brand focus, and proprietary technology platforms are driving market share gains, revenue growth, and higher profitability.

- Investments in AI, logistics automation, and multi-brand management are boosting operational efficiency, recurring revenues, and business stability.

- Ongoing losses, sluggish core growth, client dependency, and cautious expansion strategies raise concerns about Baozun's long-term profitability and revenue stability amidst challenging market conditions.

Catalysts

About Baozun- Through its subsidiaries, engages in the provision of end-to-end e-commerce solutions in the People's Republic of China.

- Rising adoption of digitalization and a shift toward seamless online/offline integration in Chinese retail are boosting demand for end-to-end e-commerce and omnichannel solutions, allowing Baozun to capture greater market share and drive long-term revenue growth.

- Increase in consumer preference for premium and international brands-especially among China's expanding middle-class-directly supports higher average order values, growth in gross merchandise value (GMV), and improves profitability for Baozun's brand partner-driven business model.

- Acceleration in AI, data analytics, and logistics automation deployment is enabling Baozun to realize operational efficiencies through technology-led cost reduction and personalized brand services, which is positioned to positively impact net margins over time.

- Expansion and optimization of proprietary technology solutions and digital marketing tools are driving recurring high-margin revenue streams and supporting earnings stability, with growing brand interest in Baozun's integrated IT and marketing platforms.

- Strategic focus on multi-brand management and product mix optimization-particularly through the successful performance and expansion of Gap and Hunter-enhances business stickiness, supports revenue diversification, and lays a path toward consolidating profitability for the Brand Management segment.

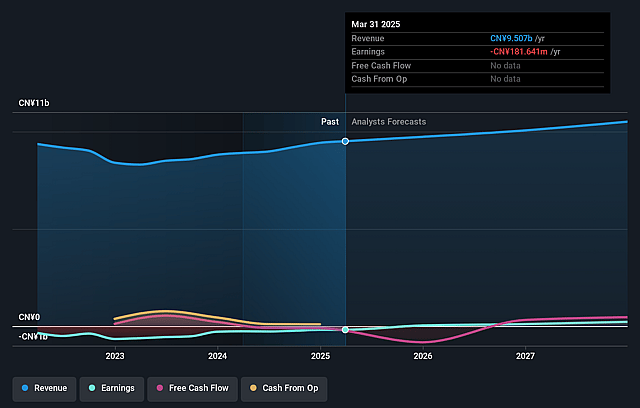

Baozun Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Baozun's revenue will grow by 3.9% annually over the next 3 years.

- Analysts assume that profit margins will increase from -1.9% today to 2.3% in 3 years time.

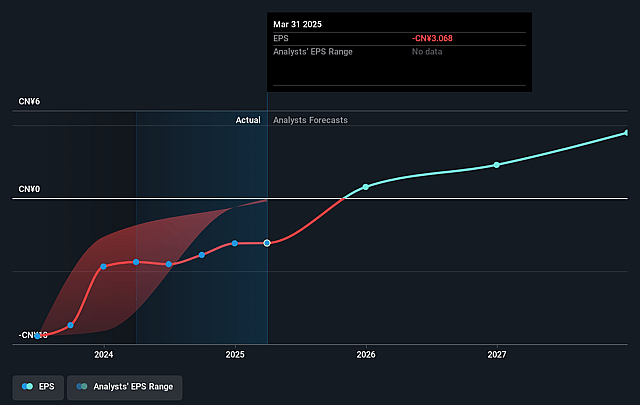

- Analysts expect earnings to reach CN¥241.7 million (and earnings per share of CN¥3.93) by about August 2028, up from CN¥-181.6 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting CN¥274.3 million in earnings, and the most bearish expecting CN¥178 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 9.4x on those 2028 earnings, up from -6.2x today. This future PE is lower than the current PE for the US Multiline Retail industry at 17.6x.

- Analysts expect the number of shares outstanding to decline by 4.06% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 13.58%, as per the Simply Wall St company report.

Baozun Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Baozun's revenue growth in the core E-Commerce segment remains sluggish (1.4% year-over-year) and service revenues are flat, signaling weak demand in its primary business and raising concerns over the sustainability of long-term revenue growth.

- The company continues to report adjusted operating losses at both the E-Commerce and Brand Management segments, and recurring restructuring costs along with strategic investments are eroding net margins, challenging the achievement of consistent profitability in the long run.

- Decreasing logistics and warehouse revenue due to reduced volume from several key clients in sportswear signals client concentration risk-churn or shrinking business from major customers could drive further revenue volatility and negatively affect earnings.

- Despite strong top-line growth in Brand Management (BBM), the segment remains lossmaking and its ongoing need for scale to reach breakeven introduces risk that persistent losses will dilute consolidated earnings and net margin if turnaround is slower than expected.

- The management's cautious approach to onboarding new brands amid unfavorable macroeconomic conditions and weak consumer sentiment in China suggests underlying risks related to softening consumer spending and intensifying industry competition, both of which may limit future revenue growth and margin expansion.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $4.243 for Baozun based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $6.01, and the most bearish reporting a price target of just $3.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be CN¥10.7 billion, earnings will come to CN¥241.7 million, and it would be trading on a PE ratio of 9.4x, assuming you use a discount rate of 13.6%.

- Given the current share price of $2.68, the analyst price target of $4.24 is 36.8% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.