Narratives are currently in beta

Key Takeaways

- Recent acquisitions and new product launches in MedTech and Innovative Medicine are poised to drive future revenue growth and market expansion.

- Strategic focus on high-innovation areas is expected to boost operational efficiencies and improve earnings and net margins.

- Ongoing legal challenges, competitive pressures, and increased debt from acquisitions could negatively affect revenues, earnings, and financial flexibility.

Catalysts

About Johnson & Johnson- Researches, develops, manufactures, and sells various products in the healthcare field worldwide.

- The recent acquisitions of V-Wave and Shockwave in the MedTech segment are expected to strengthen Johnson & Johnson's position in high-growth cardiovascular markets, which could enhance future revenue growth.

- Johnson & Johnson's pipeline in Innovative Medicine, with assets like RYBREVANT and TREMFYA, shows potential for significant market expansion through new approvals and line extensions, which could drive revenue and earnings growth.

- The expansion of the company's multiple myeloma portfolio, including CARVYKTI and TALVEY, along with the development of combination therapies, could lead to increased market share and improved earnings.

- The launch of new products in Vision and Surgery, as well as technological advancements like the OTTAVA robotic surgical system, are expected to fuel revenue growth in the MedTech segment.

- Johnson & Johnson's strategic focus on high-innovation and high-growth areas is anticipated to enhance operational efficiencies and potentially improve net margins over time.

Johnson & Johnson Future Earnings and Revenue Growth

Assumptions

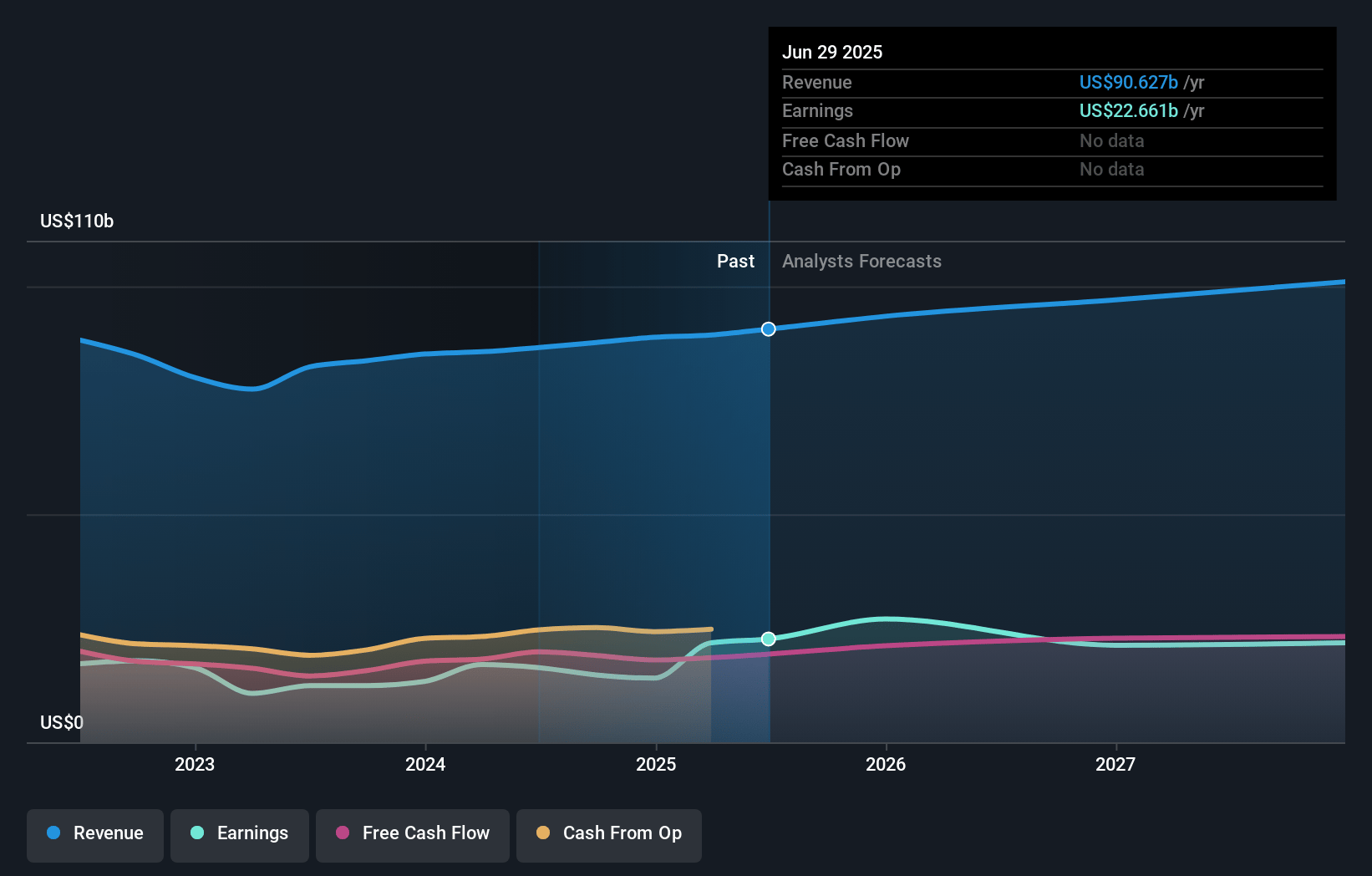

How have these above catalysts been quantified?- Analysts are assuming Johnson & Johnson's revenue will grow by 3.3% annually over the next 3 years.

- Analysts assume that profit margins will increase from 16.8% today to 23.7% in 3 years time.

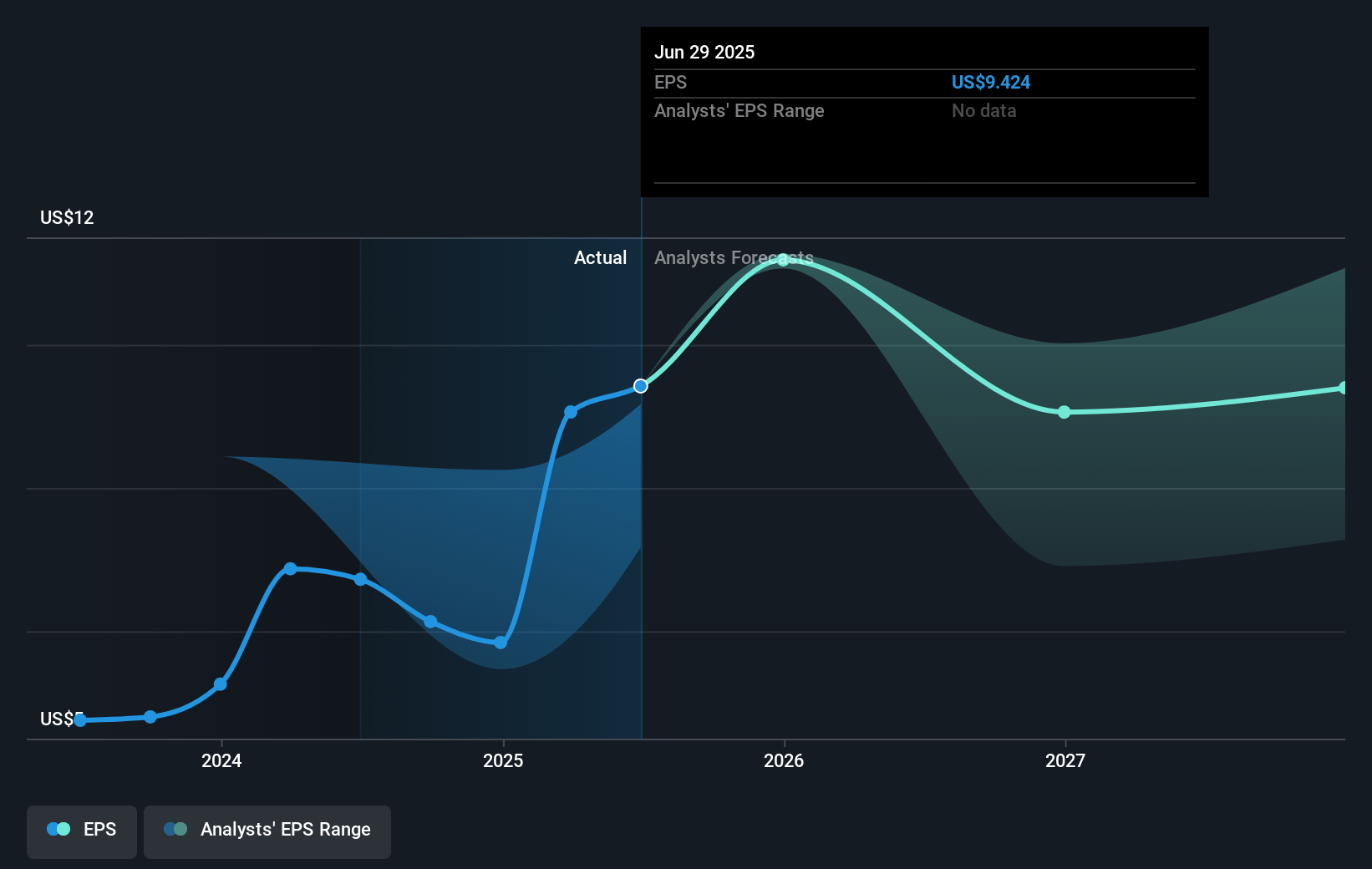

- Analysts expect earnings to reach $22.9 billion (and earnings per share of $9.72) by about January 2028, up from $14.8 billion today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $27.3 billion in earnings, and the most bearish expecting $16.8 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 21.1x on those 2028 earnings, down from 23.8x today. This future PE is greater than the current PE for the US Pharmaceuticals industry at 18.3x.

- Analysts expect the number of shares outstanding to decline by 0.73% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 5.92%, as per the Simply Wall St company report.

Johnson & Johnson Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The talc litigation settlement proposal and ongoing legal challenges could lead to significant financial liabilities and negatively impact net earnings.

- Declining sales in STELARA due to upcoming biosimilar competition could lead to decreased revenues in the immunology segment.

- MedTech's performance is being hindered by competitive pressures and macroeconomic challenges in the Asia Pacific region, specifically in China, which could impact future sales growth.

- The decrease in adjusted net earnings and earnings per share compared to the previous year, partly due to acquired R&D expenses, could indicate pressure on net margins.

- Higher debt levels primarily related to recent acquisitions could constrain financial flexibility and increase interest expenses, impacting earnings.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $172.43 for Johnson & Johnson based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $190.0, and the most bearish reporting a price target of just $155.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $96.6 billion, earnings will come to $22.9 billion, and it would be trading on a PE ratio of 21.1x, assuming you use a discount rate of 5.9%.

- Given the current share price of $146.23, the analyst's price target of $172.43 is 15.2% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

GO

Equity Analyst

Rich Drug Pipeline Will Push Revenues and Earnings Higher

Key Takeaways Well-diversified drug pipeline with 52 drugs in late-stage approval - a good hedge for its patent expirations Kenvue spin off allows JNJ to focus on its more profitable Medical Devices and Pharmaceuticals segments Continued dividend increases and buybacks are affordable and will help capital returns Post Kenvue, I expect JNJ to grow revenues by 7.5% p.a. from its new baseline of $84B, and at higher margins Some risks around litigation, patent expiry and drug success are present Catalysts Robust Drug Pipeline: 52 Drugs Racing To The Finish Line In Late-Stage Approval The key threat to a pharmaceutical stock is the patent expiration of their high value assets. Should a company lack a product pipeline to bolster its future product portfolio, then losing exclusivity to any one drug can be a hit to the business.

View narrativeUS$173.55

FV

15.3% undervalued intrinsic discount6.30%

Revenue growth p.a.

15users have liked this narrative

0users have commented on this narrative

14users have followed this narrative

3 months ago author updated this narrative

ST

Equity Analyst and Writer

Industry Tailwinds, Company Headwinds And New Products Will Lead To Stable Revenue Growth

Key Takeaways I expect JNJ to remain an established and mature market performer in a relatively stable sector. Some short-term company-related headwinds are cancelled out by long-term industry-related tailwinds Two main risks come from the talc-related litigation issue and patent expiration Most promising revenue growth opportunities are from cancer therapy drugs, with a TAM of $21.6b.

View narrativeUS$133.00

FV

10.5% overvalued intrinsic discount3.00%

Revenue growth p.a.

15users have liked this narrative

0users have commented on this narrative

6users have followed this narrative

7 months ago author updated this narrative