Last Update 29 Oct 24

Fair value Decreased 1.81%Innovation And MedTech Set To Outperform Historical Growth Rates

- JNJ reported $22.5B in quarterly sales, up by 5.2%. This is slightly below my 6% annual growth estimate, but well within the margin of error.

- For FY’24, the company expects operational sales around $89.6B, implying a 5.3% annual growth. While the future target is still below my estimated 6%, I think that JNJ still have a path to achieving $120B in sales in 2029.

- The company’s main segments: Innovative Medicine, and MedTech, posted quarterly growth of 4.9% and 5.8% respectively.

- Quarterly earnings came in at $2.694B, down by 37.5%. This is primarily due to a one-time special charge and acquiring IPR&D. Despite this, the adjusted earnings were still down by 13.3% to $5.876B. The 12% profit margin is still far from my 20% target margin. I expect JNJ to re-accelerate profitability after settling its pending court cases and start converging profits towards 20% after 2025.

Revenue growth is supported by Innovative medicine as sales exceeded $14B, with 11 key brands growing double digits. Darzalex reached $3B in sales in a single quarter. The company received five major U.S. and EU approvals for innovative medicines in Q3, including Rybrevant plus Lazcluze and Tremfya.

In MedTech, the company saw double-digit growth, particularly in cardiovascular markets, due to recent acquisitions like Shockwave and Abiomed. Management is estimating a weighted average growth from 2022 to 2027 from 5% to 7% in this segment.

I expect these combined tailwinds from Innovative Medicine drug introductions and MedTech market growth to help mitigate the biosimilar availability of Stelara from the EU, which is also expected to hit the U.S. in January 2025.

Valuation Implications

For the reasons mentioned above, I am maintaining my 6% annual revenue growth estimate and extending it to 2029, resulting in around $120B of sales in 2029. I believe that extrapolating the past 1.45% CAGR growth of the past 10 years is a misconception as JNJ will be focused on a higher return business ever-since the Kenvue spinoff.

In the future, JNJ expects a reduction of IPR&D expenses, operating expenses optimization, and an increased margin from MedTech. I think the company will be able to maintain and possibly keep improving the bottom line, now that the business is focused on the more profitable Innovative Medicine and MedTech segments.

This is why I am maintaining my profit margin of 20% in 2028, and expect it to continue in 2029.

Extending my 22x PE estimate to 2029, with a net income estimate of $24B, I get a future value of $528B, around $230 per share for JNJ.

Discounting back to today using Simply Wall St’s 5.8% rate, I get a new present value of $174 per share, which is $5 higher than my prior valuation estimate.

Key Takeaways

- Well-diversified drug pipeline with 52 drugs in late-stage approval - a good hedge for its patent expirations

- Kenvue spin off allows JNJ to focus on its more profitable Medical Devices and Pharmaceuticals segments

- Continued dividend increases and buybacks are affordable and will help capital returns

- Post Kenvue, I expect JNJ to grow revenues by 7.5% p.a. from its new baseline of $84B, and at higher margins

- Some risks around litigation, patent expiry and drug success are present

Catalysts

Robust Drug Pipeline: 52 Drugs Racing To The Finish Line In Late-Stage Approval

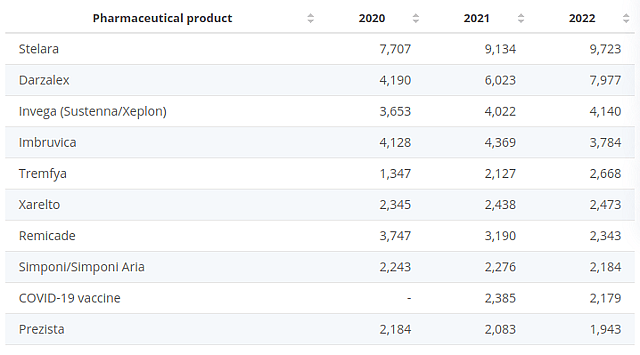

The key threat to a pharmaceutical stock is the patent expiration of their high value assets. Should a company lack a product pipeline to bolster its future product portfolio, then losing exclusivity to any one drug can be a hit to the business. In the table below, we can see the top selling drugs for JNJ up to 2022.

Statista: JNJ’s sales by top selling drugs

Stelara is expected to get its first competition from biosimilars in the second half of 2023 as the drug’s patent expires. This is a high-value drug for the company bringing in $9.7B in sales, a significant 10.2% of its 2022 revenues. From the list above, I note that Darzalex expires in 2029, Imbruvica in 2028, and Tremfya expires in 2031.

The company has a well-diversified drug pipeline with 45 products in stage 3 approval and 12 products in the (final) registration phase. There is a risk that not all products in the pipeline will get approved, but the number of treatments in the pipeline is a driver of potential future revenues.

Spun Off The Consumer Health Segment To Focus on Growth And Profitability

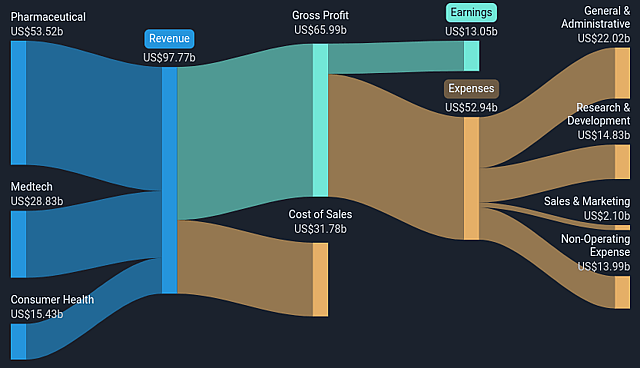

Johnson & Johnson (JNJ) is a leading healthcare company with a diversified business model and a long track-record of success. The company operates in three segments: Consumer 15.8% of revenue (now spinned off as Kenvue), Medtech 29.5% revenue, Pharmaceutical 54.7% revenue.

SimplyWallSt: JNJ’s sales by revenue segment

In 2023, JNJ spun off its Consumer Health segment into Kenvue, allowing the company to focus on its more profitable Medical Devices and Pharmaceuticals segments. The company will lose the $15.4B consumer health segment by next year's reporting and revenues will drop by around $13B - slightly offset by the growth of the other two segments.

This focus is expected to drive long-term growth, and management has increased revenue growth expectations to 7.5%, starting from a baseline of $84B post separation. The spin-off will reduce JNJ’s share count to 2.557, as it’s expecting a tax-free gain of approximately $20B in Q3 '23 and has received $13.2B as part of the transaction, this would reflect a 7% reduction in shares resulting from a $33B repurchase this year.

While I agree that the remaining business segments have higher margins and growth potential, they also come at a higher risk as the company is now more reliant on drug approvals and patient adoption.

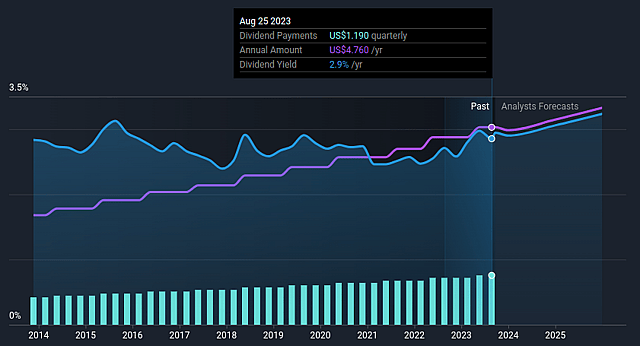

Johnson & Johnson Is Returning More Than Its $4.76 Dividend

JNJ is considered a reliable dividend paying stock with over 50 years of dividend payments. Currently standing at a 2.9% yield, with a $4.76 annual dividend. Before the Kenvue spin-off, the company paid out around $8B in buybacks and $12.8B in dividends, amounting to a total capital return of $21B, representing an adjusted yield of around 5%.

SimplyWallSt: JNJ’s dividend history

I expect the company to be able to successfully maintain and increase its dividends and buybacks in the future, given that it has consistently produced more than $17B in earnings and can afford the capital returns.

Assumptions

- I expect the company to grow revenues by 7.5% annually in the next five years, starting from their new $84B baseline post separation, to $120.6B in 2028.

- The new business mix has higher margin characteristics, which is why I think JNJ will be able to maintain a 20% profit margin in the future, yielding $24B in earnings in 2028.

- I expect around $8B buybacks annually, reducing the share count from 2.557B at the end of 2023 by 2% every year to 2.32B in 2028.

- JNJ’s forward PE ratio is 20.8x and the U.S. 10-year biotech median PE is 18.3x. While I believe that JNJ will converge to these averages in the long-term, I think that the business justifies a 22x PE in the next five years because of its growth potential from its diversified drug pipeline.

Risks

- Pending lawsuits: JNJ is facing a number of pending lawsuits, including litigation related to its talcum powder products and its role in the opioid crisis. JNJ had proposed to pay $8.9B for a settlement but the case is not resolved yet. These lawsuits could have a material impact on the company.

- Patent expirations: Some of JNJ's key patents are expiring in the next few years, which could lead to increased competition and lower sales for those products.

- Success of its drug pipeline: JNJ's pharmaceutical business is a major driver of revenue and profits. However, there is no guarantee that JNJ's drug pipeline will be successful.

Have other thoughts on Johnson & Johnson?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

Simply Wall St analyst Goran_Damchevski holds no position in NYSE:JNJ. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. This narrative is general in nature and explores scenarios and estimates created by the author. The narrative does not reflect the opinions of Simply Wall St, and the views expressed are the opinion of the author alone, acting on their own behalf. These scenarios are not indicative of the company's future performance and are exploratory in the ideas they cover. The fair value estimate's are estimations only, and does not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that the author's analysis may not factor in the latest price-sensitive company announcements or qualitative material.