Key Takeaways

- Strong clinical data and precision medicine strategies position the company for broader market adoption and increased revenues in expanding oncology segments.

- Cost-cutting measures and strategic partnerships are set to improve margins, extend cash runway, and reduce financial risk.

- Heavy dependence on a single drug, ongoing losses, intensifying competition, regulatory uncertainty, and pricing pressures threaten growth, profitability, and long-term financial stability.

Catalysts

About ADC Therapeutics- Provides antibody drug conjugate (ADC) technology platform to transform the treatment paradigm for patients with hematologic malignancies and solid tumors.

- Recent clinical results from the LOTIS-7 and LOTIS-5 trials show ZYNLONTA-based combinations with glofitamab and rituximab achieving high complete response rates and durable efficacy, setting the stage for regulatory approvals and expansion into earlier DLBCL lines and indolent lymphomas, which should drive significant revenue growth.

- Shifting demographics, with an aging patient population and rising global healthcare spending, are expected to expand both the potential oncology patient pool and the financial resources allocated toward innovative therapies like ADCs, supporting long-term revenue and earnings growth.

- The company's focus on advancing more personalized and biomarker-driven regimens-evidenced by PSMA-targeted ADC progress and ZYNLONTA combination strategies-aligns with the broader industry move toward precision medicine, increasing the likelihood of payer and prescriber adoption and supporting higher future revenues and margins.

- Operational changes-including discontinuation of non-core early-stage programs, a 30% workforce reduction, and the shutdown of the UK facility-are expected to reduce operating expenses and extend the cash runway into 2028, improving net margins and reducing risk of near-term dilutive financings.

- Ongoing strategic flexibility and opportunities for compendia inclusion and partnerships with larger pharma companies (e.g., data collaborations, possible co-marketing) could accelerate commercialization timelines, de-risk product launches, and provide non-dilutive funding through upfront and milestone payments, positively impacting earnings and cash flow.

ADC Therapeutics Future Earnings and Revenue Growth

Assumptions

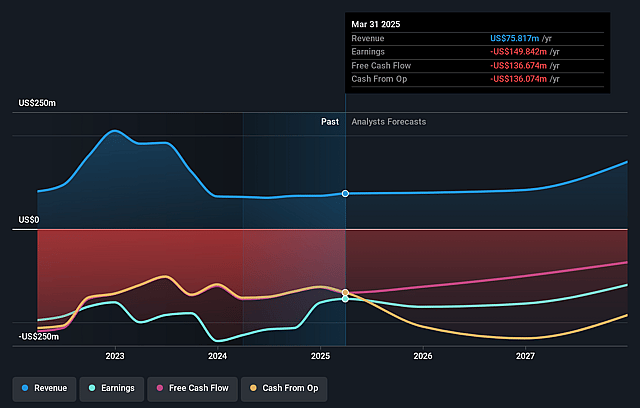

How have these above catalysts been quantified?- Analysts are assuming ADC Therapeutics's revenue will grow by 38.3% annually over the next 3 years.

- Analysts are not forecasting that ADC Therapeutics will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate ADC Therapeutics's profit margin will increase from -220.0% to the average US Biotechs industry of 16.1% in 3 years.

- If ADC Therapeutics's profit margin were to converge on the industry average, you could expect earnings to reach $32.8 million (and earnings per share of $0.24) by about September 2028, up from $-169.9 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 43.5x on those 2028 earnings, up from -2.2x today. This future PE is greater than the current PE for the US Biotechs industry at 15.5x.

- Analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.35%, as per the Simply Wall St company report.

ADC Therapeutics Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- ADC Therapeutics' strategic focus on ZYNLONTA as its primary revenue driver heightens its vulnerability to any clinical or regulatory setbacks; with ongoing reliance on a single product (ZYNLONTA) and the recent termination of early-stage solid tumor ADC programs, any delay, underperformance, or uncompetitive positioning of ZYNLONTA could result in significant revenue volatility and hinder long-term top-line growth.

- Persistent operating losses (net loss of $56.6 million in Q2 2025, higher than prior year) and negative free cash flow, coupled with high R&D expenses and a history of modest quarterly revenue growth, may require future equity issuances or increased debt financing-this would dilute existing shareholders and further pressure earnings per share and net margins over the long term.

- The competitive DLBCL and lymphoma treatment landscape, which is increasingly crowded with innovative therapies (CAR-T, bispecifics, next-generation ADCs, and combination regimens from large pharma), could erode ADC Therapeutics' market share, compress pricing power, and limit ZYNLONTA's and future pipeline assets' revenue and margin potential, especially as more accessible, less expensive, or more proven alternatives gain traction.

- Uncertainty in the regulatory environment, highlighted by the FDA's recent Complete Response Letter (CRL) to Roche's glofitamab in second-line DLBCL and increased scrutiny over efficacy and survival data, may contribute to prolonged approval timelines, higher clinical trial costs, or post-approval restrictions, all of which could negatively impact the timing and scale of revenue recognition from ZYNLONTA's indications.

- Broader secular trends, including growing payer pushback on costly oncology drugs, increased healthcare cost containment, and the global shift towards value-based and outcome-driven reimbursement, may restrict ADC Therapeutics' ability to fully realize premium pricing for ADCs, thus limiting long-term revenue growth and compressing net margins as the healthcare landscape evolves.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $8.2 for ADC Therapeutics based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $10.0, and the most bearish reporting a price target of just $5.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $204.3 million, earnings will come to $32.8 million, and it would be trading on a PE ratio of 43.5x, assuming you use a discount rate of 8.3%.

- Given the current share price of $3.29, the analyst price target of $8.2 is 59.9% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.