Key Takeaways

- Heavy reliance on a single drug exposes the company to revenue volatility and risks from competitive and regulatory developments.

- High costs and intense competition from emerging therapies may constrain profitability and limit future market share.

- Heavy dependence on a single drug and restructuring amid ongoing losses heightens risks from market competition, regulatory delays, and limited pipeline diversification.

Catalysts

About ADC Therapeutics- Provides antibody drug conjugate (ADC) technology platform to transform the treatment paradigm for patients with hematologic malignancies and solid tumors.

- Although ADC Therapeutics is poised to benefit from the rising incidence of cancer in aging populations globally and the corresponding emphasis on innovative treatments, the company's sustained dependence on ZYNLONTA as its primary commercial asset leaves it exposed to pipeline concentration risk. Single-asset vulnerability could result in volatile or constrained future revenue if clinical or regulatory outcomes disappoint, especially as competitive therapies expand.

- While continued healthcare prioritization for cancer and potential product expansions into earlier lines of therapy may improve long-term pricing and market access, the reality is that cost-containment policies among payers and increasing regulatory scrutiny are likely to restrict pricing power, directly impacting achievable net revenues and pressuring margins on future launches.

- Despite encouraging clinical data for ZYNLONTA-based combinations and expansion into indolent lymphomas, persistent high R&D and SG&A expenses-compounded by ongoing trial costs-have consistently led to negative net margins. Unless revenue scales meaningfully, the company risks further dilution or cash burn in the longer term.

- Even though ADC Therapeutics' platform aligns well with the broader trend toward personalized and targeted oncology therapies, the rapid emergence of alternative modalities like CAR-T, bispecifics, and gene editing technologies may erode the competitive relevance of ADCs. This could limit potential market share and put downward pressure on both future sales and earnings growth.

- Although regulatory shifts increasingly favor accelerated approval paths for transformative cancer therapies, heightened safety requirements and concerns over adverse effects in the ADC class may subject new candidates or label extensions to additional delays, trial failures, or market access hurdles, thereby impacting the timing and scale of revenue realization.

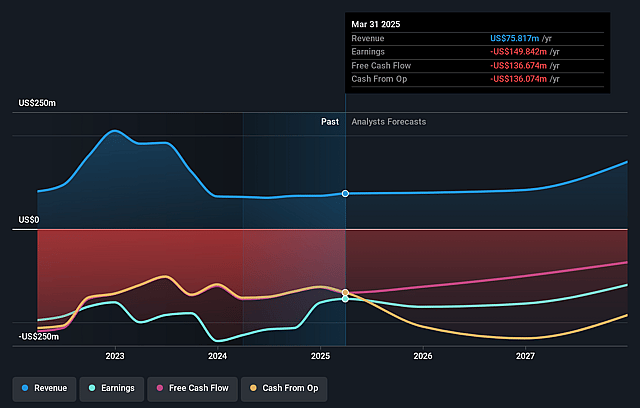

ADC Therapeutics Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on ADC Therapeutics compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming ADC Therapeutics's revenue will grow by 25.3% annually over the next 3 years.

- The bearish analysts are not forecasting that ADC Therapeutics will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate ADC Therapeutics's profit margin will increase from -220.0% to the average US Biotechs industry of 16.3% in 3 years.

- If ADC Therapeutics's profit margin were to converge on the industry average, you could expect earnings to reach $24.7 million (and earnings per share of $0.18) by about September 2028, up from $-169.9 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 35.3x on those 2028 earnings, up from -2.2x today. This future PE is greater than the current PE for the US Biotechs industry at 15.4x.

- Analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.35%, as per the Simply Wall St company report.

ADC Therapeutics Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Persistent net losses are widening, with second quarter 2025 net loss at $56.6 million compared to $36.5 million the prior year, while revenues grew only slightly to $18.1 million, indicating that continued high R&D and restructuring expenses could threaten future net margins and increase risk of equity dilution if commercial ramp disappoints or approvals are delayed.

- Reliance on ZYNLONTA as the core commercial and clinical asset and discontinuation of most other preclinical programs have created a high pipeline concentration risk, making future revenues and earnings highly vulnerable to setbacks in the LOTIS-5 or LOTIS-7 trials, regulatory rejections, or stronger competition in the DLBCL market.

- The evolving DLBCL treatment landscape is seeing rapid advancement of complex and next-generation therapies such as CAR-T and bispecifics, as well as shifting guidelines and payer preferences, which could reduce ADC Therapeutics' market relevance and lead to competitive pressure that constrains revenue and margin growth in the out years.

- Recent regulatory setbacks for similar products, such as the FDA's complete response letter to Roche on glofitamab in second-line DLBCL, raise uncertainty about the regulatory path and time-to-market for ZYNLONTA combinations, which could push back revenue inflection points and delay break-even.

- Significant restructuring, including a 30% workforce reduction and facility closure, signals operational pressure and an urgent need to conserve cash, which may impact the company's ability to execute on commercialization, limit R&D productivity, and threaten longer-term earnings and growth if revenue expansion lags expectations.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for ADC Therapeutics is $5.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of ADC Therapeutics's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $10.0, and the most bearish reporting a price target of just $5.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $152.0 million, earnings will come to $24.7 million, and it would be trading on a PE ratio of 35.3x, assuming you use a discount rate of 8.3%.

- Given the current share price of $3.29, the bearish analyst price target of $5.0 is 34.2% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on ADC Therapeutics?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.