Key Takeaways

- Strong clinical performance, rapid regulatory progress, and cost optimization position the company for higher profitability and earlier revenue acceleration than consensus expectations suggest.

- Expansion into new cancer indications and emerging markets offers significant untapped revenue opportunities beyond current projections.

- Overdependence on a single product, regulatory and competitive threats, and high costs create significant risks for sustainable growth, profitability, and market position.

Catalysts

About ADC Therapeutics- Provides antibody drug conjugate (ADC) technology platform to transform the treatment paradigm for patients with hematologic malignancies and solid tumors.

- While analyst consensus expects ZYNLONTA to achieve $600 million to $1 billion in peak U.S. revenue through expanded use in earlier DLBCL lines, the exceptionally high and durable complete response rates in LOTIS-7-far surpassing existing bispecific combinations-suggest the true market share and pricing power could exceed even the high end of these estimates, driving higher-than-expected long-term earnings and operating margins.

- Analysts broadly agree that regulatory approvals and guideline inclusions will drive growth, but given the rapid enrollment in pivotal trials, strong safety signals, and rising urgency from the unmet clinical need after competitor setbacks, regulatory timelines could dramatically accelerate, leading to an earlier-than-expected inflection in net product revenue and operating cash flow.

- The company's platform is uniquely positioned to benefit from rising global cancer incidence and improved access to advanced therapies due to healthcare expansion in emerging markets, presenting significant untapped international revenue upside that analyst consensus may not fully reflect.

- ADC Therapeutics' decisive restructuring and cost-optimization efforts-including 30% workforce reduction and facility consolidation-are expected to not only extend the cash runway into 2028 but also structurally lower operating expenses, amplifying operating income leverage as top-line expands.

- With pipeline advancement into solid tumors, specifically exatecan-based PSMA-targeting ADCs, ADCT is positioned to capture synergistic growth opportunities as the adoption of precision oncology and ADC technologies broadens across multiple indications, underpinning multi-year revenue acceleration potential beyond current DLBCL projections.

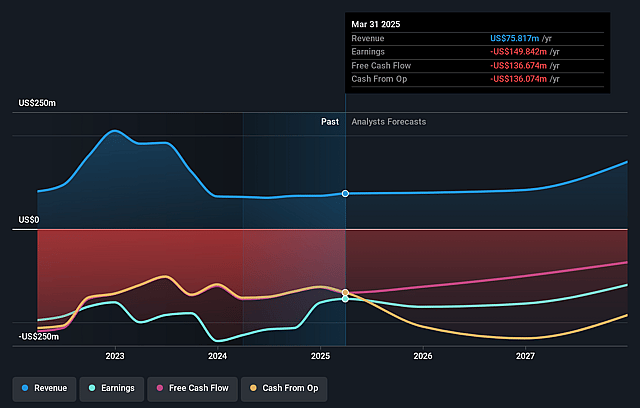

ADC Therapeutics Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on ADC Therapeutics compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming ADC Therapeutics's revenue will grow by 41.9% annually over the next 3 years.

- Even the bullish analysts are not forecasting that ADC Therapeutics will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate ADC Therapeutics's profit margin will increase from -220.0% to the average US Biotechs industry of 14.2% in 3 years.

- If ADC Therapeutics's profit margin were to converge on the industry average, you could expect earnings to reach $31.3 million (and earnings per share of $0.23) by about September 2028, up from $-169.9 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 55.7x on those 2028 earnings, up from -2.2x today. This future PE is greater than the current PE for the US Biotechs industry at 15.3x.

- Analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.29%, as per the Simply Wall St company report.

ADC Therapeutics Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- ADC Therapeutics remains heavily dependent on ZYNLONTA and a very limited pipeline, exposing it to the risk that any commercial setback or clinical failure could result in sustained revenue shortfalls and volatile earnings, as demonstrated by the company discontinuing all other early-stage preclinical solid tumor programs and shutting down its UK facility.

- Delays or failures in obtaining regulatory approvals for expanded indications or combination therapies-especially given increased global regulatory scrutiny and the complex, evolving standards for biologics-pose a direct threat to ADC Therapeutics' expected revenue growth and could elongate the time to break-even profitability.

- The company reported a net loss of $56.6 million for the second quarter of 2025, with total operating expenses growing by 8 percent year-on-year and R&D and SG&A costs high relative to modest revenue growth, risking persistent negative net margins and potential future cash burn.

- Competitive pressures continue to rise as larger pharma and agile biotech companies race to develop next-generation antibody-drug conjugates and alternative oncology treatments, which may erode ADC Therapeutics' future market share and limit its revenue trajectory if ZYNLONTA is surpassed in efficacy or safety.

- Reliance on international contract manufacturing and suppliers increases vulnerability to geopolitical instability and global supply chain disruptions, which could elevate cost of goods sold and operational risks, impacting both gross margins and overall profitability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for ADC Therapeutics is $10.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of ADC Therapeutics's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $10.0, and the most bearish reporting a price target of just $5.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $220.6 million, earnings will come to $31.3 million, and it would be trading on a PE ratio of 55.7x, assuming you use a discount rate of 8.3%.

- Given the current share price of $3.32, the bullish analyst price target of $10.0 is 66.8% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on ADC Therapeutics?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.