Key Takeaways

- Rapid clinical progress and global uptake could propel lead therapy to best-in-class status, transforming standard of care and significantly boosting revenue and margins.

- Advancing a diverse ADC pipeline and strong partnership potential enhance growth prospects, reduce single-asset risk, and position the company for increased profitability.

- High expenses, stagnant revenue, pipeline setbacks, and strong competition threaten the company's financial stability and ability to deliver meaningful long-term growth.

Catalysts

About ADC Therapeutics- Provides antibody drug conjugate (ADC) technology platform to transform the treatment paradigm for patients with hematologic malignancies and solid tumors.

- Analyst consensus expects ZYNLONTA's expansion into earlier lines of DLBCL to modestly boost revenue, but with complete response rates now approaching 91 percent in LOTIS-7 and a credible pathway to guideline-preferred status, this therapy could not only dominate second-line DLBCL but potentially disrupt CAR-T and other high-cost standards, multiplying addressable sales and dramatically improving gross margins.

- While analysts recognize the positive earnings impact from ongoing clinical progress, they may be substantially underestimating the compounding effect of rapid uptake if ZYNLONTA/glofitamab becomes the new best-in-class regimen, fueling both near-term revenue beats and a durable lift in net income as the standard of care resets across broader geographies.

- The accelerating global adoption of ADC-based therapies in cancer, driven by rising incidence in aging populations and escalating willingness by payers to reimburse highly effective targeted treatments, positions ADC Therapeutics to capture outsize market share growth in lymphoma and beyond, significantly expanding its future revenue base.

- With multiple differentiated ADCs advancing towards clinical development in high-unmet-need solid tumors, ADC Therapeutics is poised for substantial revenue diversification, reducing reliance on a single asset and enhancing long-term earnings stability and upward potential.

- Increasing pharmaceutical M&A and partnership activity, paired with ADC Therapeutics' proven platform and robust data, makes the company an attractive target for premium strategic deals or non-dilutive capital infusions, which could rapidly unlock shareholder value and increase cash runway, driving long-term profitability.

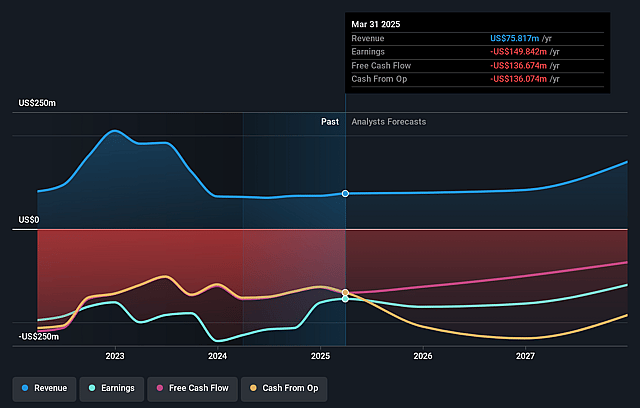

ADC Therapeutics Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on ADC Therapeutics compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming ADC Therapeutics's revenue will grow by 41.1% annually over the next 3 years.

- Even the bullish analysts are not forecasting that ADC Therapeutics will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate ADC Therapeutics's profit margin will increase from -197.6% to the average US Biotechs industry of 14.0% in 3 years.

- If ADC Therapeutics's profit margin were to converge on the industry average, you could expect earnings to reach $29.7 million (and earnings per share of $0.25) by about August 2028, up from $-149.8 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 52.2x on those 2028 earnings, up from -2.0x today. This future PE is greater than the current PE for the US Biotechs industry at 13.7x.

- Analysts expect the number of shares outstanding to grow by 2.62% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.63%, as per the Simply Wall St company report.

ADC Therapeutics Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Persistently high operating expenses and a significant net loss of $38.6 million in the first quarter of 2025, alongside declining cash reserves from $250.9 million to $194.7 million in just one quarter, raise the risk of future dilutive equity raises or costly debt that could erode net margins and shareholder value.

- ZYNLONTA's modest net product revenue growth, remaining flat year over year at $17.4 million and relying on milestone and royalty payments for additional revenue, suggests limited commercial momentum and questions the company's ability to achieve substantial long-term earnings growth.

- Discontinuation of the ADCT-602 program due to clinical data limitations highlights ongoing clinical trial risk and a lack of late-stage pipeline diversification, which could constrain future revenue streams if ZYNLONTA fails to meaningfully expand its indications or faces further setbacks.

- Regulatory uncertainty and the need to generate and follow up with data from larger patient cohorts over longer periods could prolong approval timelines, increase research and development expenses, and create a lag between clinical progress and revenue realization.

- Intense competition from alternative drug classes such as CAR-T, bispecifics, and emerging disruptive technologies, as well as growing payer scrutiny around drug value and pricing, could reduce ZYNLONTA's market share and revenue potential as physicians and payers may favor other therapies that demonstrate more established efficacy, durability, or cost-effectiveness.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for ADC Therapeutics is $10.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of ADC Therapeutics's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $10.0, and the most bearish reporting a price target of just $5.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $212.8 million, earnings will come to $29.7 million, and it would be trading on a PE ratio of 52.2x, assuming you use a discount rate of 8.6%.

- Given the current share price of $2.68, the bullish analyst price target of $10.0 is 73.2% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.