Key Takeaways

- Overdependence on a single product and rising competition threaten revenue stability and long-term market share.

- Stricter global pricing, regulatory pressures, and challenging funding conditions may constrain growth, margins, and future innovation.

- Expanding adoption and payer access, combined with strong financial flexibility, position Geron for sustained revenue growth, improved margins, and significant long-term earnings potential.

Catalysts

About Geron- A commercial-stage biopharmaceutical company, focuses on the development of therapeutics products for oncology.

- As governments and private insurers around the world intensify cost-control measures on drug pricing and reimbursement, Geron's future revenue growth could be structurally constrained, especially as RYTELO is moved into broader, lower-risk patient pools and as it seeks reimbursement in international markets that prioritize budget impact over clinical differentiation.

- Global regulatory agencies are adopting increasingly stringent post-marketing safety and data commitments, which could delay or restrict approval timelines for imetelstat in future indications and escalate compliance costs, diminishing the company's net margins and overall earnings potential.

- Geron's dependence on RYTELO as its single core commercial asset leaves it acutely exposed to revenue and earnings volatility if prescriber uptake plateaus or if any safety or efficacy issues emerge in the real-world patient population-thereby increasing the risk of disappointing future top-line performance.

- Macroeconomic headwinds and higher interest rates are likely to curtail risk appetite among the investor base and drive up the company's cost of capital, reducing access to the funding needed to sustain ongoing R&D, which could limit both pipeline progress and long-term earnings leverage.

- Intensifying competition from established large-cap pharmaceutical companies and emerging biotechs pursuing novel therapies in the MDS and myelofibrosis space threatens Geron's ability to sustain premium pricing and market share, further compressing long-term revenues and undermining its ability to defend profitability as exclusivity wanes.

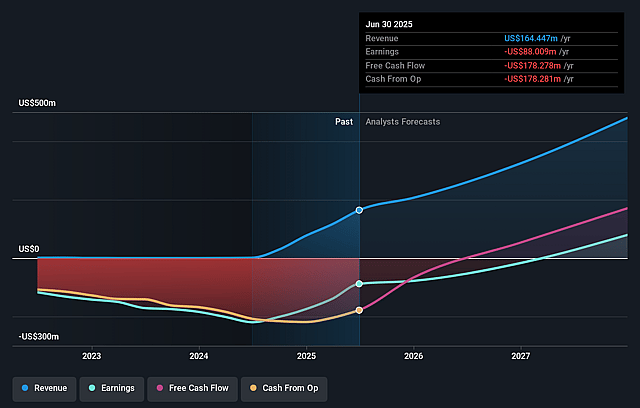

Geron Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Geron compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Geron's revenue will grow by 38.2% annually over the next 3 years.

- The bearish analysts are not forecasting that Geron will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate Geron's profit margin will increase from -53.5% to the average US Biotechs industry of 16.3% in 3 years.

- If Geron's profit margin were to converge on the industry average, you could expect earnings to reach $70.5 million (and earnings per share of $0.09) by about September 2028, up from $-88.0 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 13.0x on those 2028 earnings, up from -10.1x today. This future PE is lower than the current PE for the US Biotechs industry at 15.4x.

- Analysts expect the number of shares outstanding to grow by 5.54% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.84%, as per the Simply Wall St company report.

Geron Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Geron's focused execution on the commercial launch of RYTELO, with quarter-over-quarter net revenue growth of 24 percent driven by increased patient starts and expanded sales force, suggests that top-line revenue could continue to increase in the coming years if this momentum is sustained.

- The company is rapidly expanding healthcare provider (HCP) awareness and prescriber confidence, backed by educational efforts, KOL engagement, and omnichannel marketing-if these initiatives maintain or accelerate first

- and second-line adoption, sales volumes have a pathway to robust long-term growth and improved earnings.

- Nearly 90 percent of covered U.S. lives now fall under favorable RYTELO medical coverage policies, indicating strong payer access that may support premium pricing power and reduce reimbursement headwinds, positively impacting net margins.

- Enrollment progress in the Phase III IMpactMF trial and the potential to expand imetelstat into the significant myelofibrosis indication creates a pipeline opportunity that, if successful, would materially increase the company's future revenue streams and earnings base.

- Geron's strengthening financial profile, with over $430 million in cash and marketable securities and access to additional debt funding, coupled with declining R&D expenses post-approval, provides capital flexibility that could support scaling operations and achieving profitability, improving net margins over time.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Geron is $1.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Geron's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $6.0, and the most bearish reporting a price target of just $1.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $434.1 million, earnings will come to $70.5 million, and it would be trading on a PE ratio of 13.0x, assuming you use a discount rate of 6.8%.

- Given the current share price of $1.4, the bearish analyst price target of $1.0 is 40.0% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Geron?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.