Key Takeaways

- Rapid uptake of RYTELO, strategic partnerships, and superior commercial execution could drive revenue and market share beyond current expectations.

- Strong leadership, financial resources, and innovative therapies position Geron for pipeline advancement and long-term value creation in a growing market.

- Heavy reliance on a single high-cost product amid pricing, regulatory, and competitive pressures threatens revenue growth, profitability, and long-term financial sustainability.

Catalysts

About Geron- A commercial-stage biopharmaceutical company, focuses on the development of therapeutics products for oncology.

- Analyst consensus expects gradual expansion of RYTELO into earlier lines of therapy and growing HCP awareness, but with sharply accelerating HCP education, rapid post-launch gains in first

- and second-line adoption could significantly outpace these projections, quickly expanding the patient base and driving outsized revenue growth through both higher patient duration and increased market share.

- While analysts broadly agree that EU approval and partnership could unlock new revenues starting 2026, Geron's focus on maximizing ex-US reimbursement and selecting commercial partners with established hematology networks may enable more rapid, high-margin ramp-up than expected, potentially boosting earnings faster than the Street projects.

- Geron's first-in-class telomerase inhibitor platform, validated by early U.S. commercial traction, positions the company for long-term leadership as aging populations and rising cancer incidence dramatically expand the addressable market, providing sustained multi-year revenue scalability.

- Strong payer coverage-now reaching around 90% of U.S. covered lives-combined with deployment of veteran commercial leadership and data-driven omnichannel execution, creates the conditions for superior net margin expansion as commercial efficiency and pricing power improve.

- With substantial cash reserves and highly experienced new CEO Harout Semerjian at the helm, Geron is uniquely positioned to accelerate future pipeline development and pursue high-impact partnerships or acquisitions, which could drive both top-line growth and create material long-term valuation uplift.

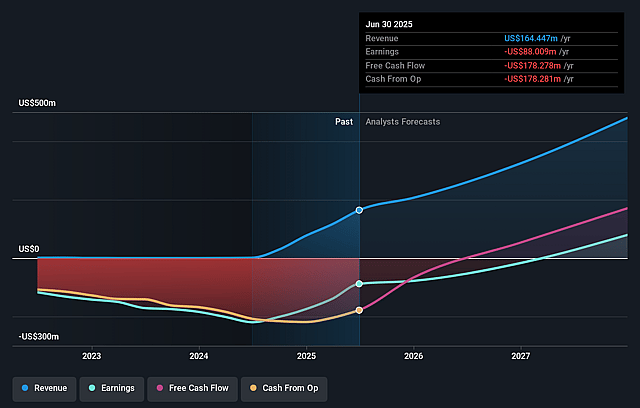

Geron Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Geron compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Geron's revenue will grow by 65.9% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from -53.5% today to 50.5% in 3 years time.

- The bullish analysts expect earnings to reach $379.0 million (and earnings per share of $0.52) by about September 2028, up from $-88.0 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 14.5x on those 2028 earnings, up from -9.9x today. This future PE is lower than the current PE for the US Biotechs industry at 15.3x.

- Analysts expect the number of shares outstanding to grow by 5.54% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.9%, as per the Simply Wall St company report.

Geron Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Geron faces increasing pricing pressure from government and payer negotiations, particularly as it seeks reimbursement rates in Europe, which could limit future revenue growth and reduce net margins if pricing power is diminished.

- The company shows heavy single-product concentration risk, as RYTELO is currently its only commercial product and a setback in adoption, side effect profiles, or strong competition from alternatives like luspatercept could lead to a sharp decline in revenue and earnings.

- Growing regulatory and public scrutiny around drug affordability may lead to restrictive policy interventions or price controls, negatively impacting the profitability and net margins of RYTELO, especially as it is positioned as a novel, potentially high-cost therapy.

- Ongoing high operating expenses and reliance on additional external funding, including preparations for EU launches and expansion of sales and medical teams, may result in continued dilution or suppressed earnings per share growth if revenue does not scale rapidly.

- Intensifying competition from established and emerging therapies in the lower-risk MDS space, including competitors gaining faster or broader approvals, poses a risk to both market share and pricing, threatening the sustainability of revenue growth and long-term profitability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Geron is $6.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Geron's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $6.0, and the most bearish reporting a price target of just $1.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $750.2 million, earnings will come to $379.0 million, and it would be trading on a PE ratio of 14.5x, assuming you use a discount rate of 6.9%.

- Given the current share price of $1.36, the bullish analyst price target of $6.0 is 77.3% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.