Catalysts

About Evolus

Evolus is a cash pay focused aesthetics company that markets neuromodulators and hyaluronic acid fillers to physicians and consumers.

What are the underlying business or industry changes driving this perspective?

- Although Jeuveau unit volumes are positive year to date in a toxin category that management describes as down single digits, the broader injectable market has shown periods of weakness that could limit how much of that unit strength ultimately converts into higher revenue and earnings if consumer spending tightens again.

- Although Evolus reports operating in a high growth facial aesthetics category supported by long term demand for injectables and self paid treatments, the cash pay model is directly exposed to any pullback in discretionary income, which can pressure revenue growth and slow the path to sustainable profitability.

- Although the Evolysse filler franchise has generated US$15.5 million since launch and is positioned for a broader rollout plus future additions like Sculpt and the Lyft trial, the current HA filler market has been reported by peers as down double digits, so a prolonged slowdown in that procedure category could cap portfolio revenue and delay improvement in gross margins.

- Although the company is building a larger aesthetics portfolio with Jeuveau, Evolysse and future products such as Sculpt and European aesteem, bundling efforts are only just beginning and many clinics remain tied to larger incumbent portfolios, which could limit market share gains and weigh on long term revenue and net margins if portfolio adoption is slower than expected.

- Although Evolus highlights long term partnerships with manufacturers Daewoong and Symatese and has pulled forward inventory to get ahead of potential trade changes, unresolved tariff risks on pharmaceuticals and existing 15% tariffs on Evolysse in the European Union introduce cost uncertainty that could restrict gross margin expansion and delay earnings improvement.

Assumptions

This narrative explores a more pessimistic perspective on Evolus compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts. How have these above catalysts been quantified?

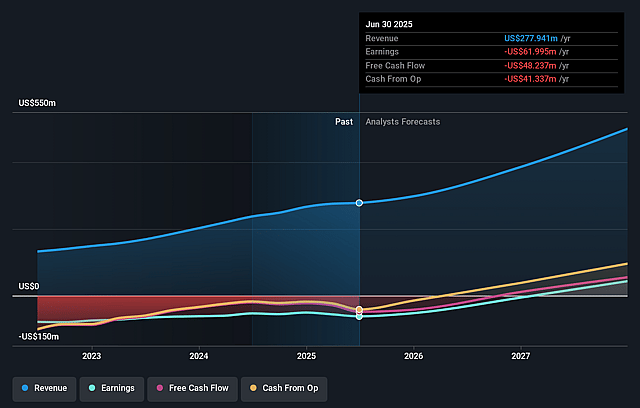

- The bearish analysts are assuming Evolus's revenue will grow by 15.9% annually over the next 3 years.

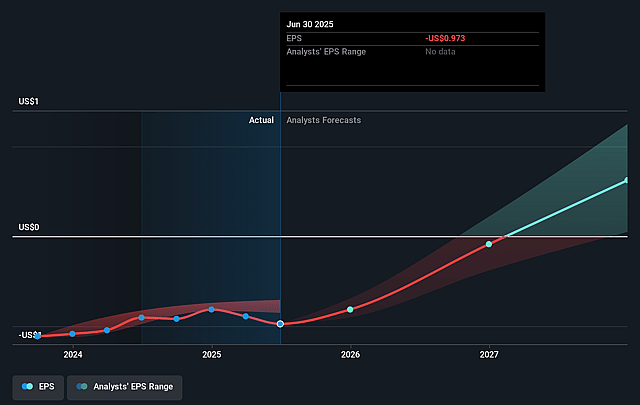

- The bearish analysts are not forecasting that Evolus will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate Evolus's profit margin will increase from -20.5% to the average US Pharmaceuticals industry of 20.9% in 3 years.

- If Evolus's profit margin were to converge on the industry average, you could expect earnings to reach $93.2 million (and earnings per share of $1.36) by about February 2029, up from $-58.6 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $147.9 million in earnings, and the most bearish expecting $-4.6 million.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 9.0x on those 2029 earnings, up from -5.2x today. This future PE is lower than the current PE for the US Pharmaceuticals industry at 20.4x.

- The bearish analysts expect the number of shares outstanding to grow by 1.94% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.96%, as per the Simply Wall St company report.

Risks

What could happen that would invalidate this narrative?

- The broader injectable aesthetics market has periods where procedure volumes soften, and peers have reported the HA filler segment down double digits. If this weaker backdrop persists or returns, Jeuveau and Evolysse volumes could be pressured, limiting revenue growth and constraining the path to higher earnings and net margins.

- Evolus relies on a cash pay model and middle income consumers are described by a competitor as sitting on the sidelines. Any renewed or prolonged pressure on discretionary spending for aesthetic procedures could reduce treatment frequency and new patient adoption, weighing on revenue and delaying improvement in profitability.

- New products such as Evolysse Sculpt and Lyft are subject to regulatory review, with PMA approval for Sculpt only anticipated in the second half of 2026 and Lyft not expected until 2027. Any delay, additional data requirements or competitive responses in the premium mid face and filler categories could cap portfolio expansion and limit future contributions to gross margin and earnings.

- The business model depends on long term supply relationships with Daewoong and Symatese and on imported product, while Jeuveau and Evolysse face unresolved tariff risks and a 15% tariff in the European Union. Adverse trade outcomes or higher import costs could compress gross margins or force price increases that slow unit growth and revenue.

- The company is building a bundled toxin and filler portfolio to compete with larger incumbents, but many clinics still commit to rivals in exchange for pricing on broader portfolios. If Evolus cannot meaningfully shift account purchasing behavior before competitors reinforce their bundles, market share gains could fall short of expectations and limit revenue growth and operating leverage.

Valuation

How have all the factors above been brought together to estimate a fair value?

- The assumed bearish price target for Evolus is $10.0, which represents up to two standard deviations below the consensus price target of $17.0. This valuation is based on what can be assumed as the expectations of Evolus's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $20.0, and the most bearish reporting a price target of just $10.0.

- In order for you to agree with the more bearish analyst cohort, you'd need to believe that by 2029, revenues will be $445.5 million, earnings will come to $93.2 million, and it would be trading on a PE ratio of 9.0x, assuming you use a discount rate of 7.0%.

- Given the current share price of $4.69, the analyst price target of $10.0 is 53.1% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Evolus?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.