Last Update 07 Aug 25

Fair value Decreased 19%Evolus’s valuation outlook is slightly more cautious due to a higher discount rate, while future earnings expectations remain stable, resulting in an unchanged consensus price target of $23.57.

What's in the News

- Evolus updated 2025 earnings guidance, projecting total net revenues between $295–$305 million (11%–15% growth over 2024) and increasing Evolysse injectable HA gels' revenue contribution to 10%–12%.

- An independent head-to-head trial published in JAMA Dermatology found Jeuveau® outperformed competitors with faster onset, strongest peak effect, and longer duration versus Botox®; Jeuveau® now holds over 14% U.S. market share.

- Evolus partnered with Symatese to distribute Nuceiva (botulinum toxin type A) in France; clinical data and key opinion leaders reinforce Nuceiva's efficacy and millennial appeal in the evolving European aesthetics market.

- CFO Sandra Beaver resigned (effective June 13, 2025) for a new position; departure was not due to disagreements, and a search for her successor is underway with finance team oversight during transition.

- U.S. pivotal study results for Evolysse Form and Evolysse Smooth HA gels were published, demonstrating statistical superiority, long-term safety, and effectiveness for treating moderate to severe facial wrinkles.

Valuation Changes

Summary of Valuation Changes for Evolus

- The Consensus Analyst Price Target remained effectively unchanged, at $23.57.

- The Discount Rate for Evolus has risen from 6.40% to 6.78%.

- The Future P/E for Evolus remained effectively unchanged, moving only marginally from 27.35x to 27.64x.

Key Takeaways

- Global expansion, new product launches, and strong loyalty engagement drive long-term revenue growth, diversification, and increased demand for both existing and future offerings.

- Operational realignment and automation support margin improvement and profitability while digital engagement and loyalty programs enhance market share and consumer retention.

- Heavy dependence on Jeuveau and limited near-term international growth expose Evolus to volatility amid market contraction, weak consumer demand, and risks from unproven pipeline products.

Catalysts

About Evolus- A performance beauty company, delivers products in the cash-pay aesthetic market in the United States, Canada, Europe, and Australia.

- The expansion of Evolus's international footprint, with launches like Nuceiva in France and presence in 9 global markets representing over 70% of their international addressable market, positions the company to benefit from rising global demand for aesthetic treatments, supporting long-term revenue growth and diversification.

- Successful early adoption and strong performance of new product launches (notably Evolysse, the strongest first-quarter filler launch in over a decade) and robust pipeline progress (Sculpt and lips products on track for 2026–2027 approvals) point to expanding revenue streams and earnings leverage beyond their legacy Jeuveau franchise.

- Demographic momentum from an aging population and increased cultural normalization of minimally invasive aesthetic procedures (reflected in record Evolus Rewards loyalty engagement and repeat patient rates) suggests enduring demand drivers for both Jeuveau and new filler products, bolstering long-term revenue visibility.

- Strategic operational realignment-with $25M+ in targeted, mostly non-customer-facing expense reductions and automation initiatives-supports sustainable margin improvement and positions Evolus to achieve meaningful operating profitability beginning in late 2025, further enhancing future earnings.

- As the market stabilizes, continued market share gains, particularly in the U.S. toxin space and growing consumer stickiness through direct digital engagement and loyalty programs, set the company up for accelerated top-line growth and higher net margins as consumer discretionary spending recovers.

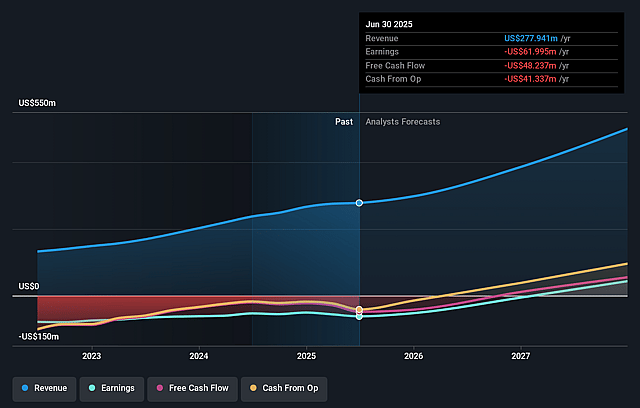

Evolus Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Evolus's revenue will grow by 26.5% annually over the next 3 years.

- Analysts assume that profit margins will increase from -22.3% today to 12.8% in 3 years time.

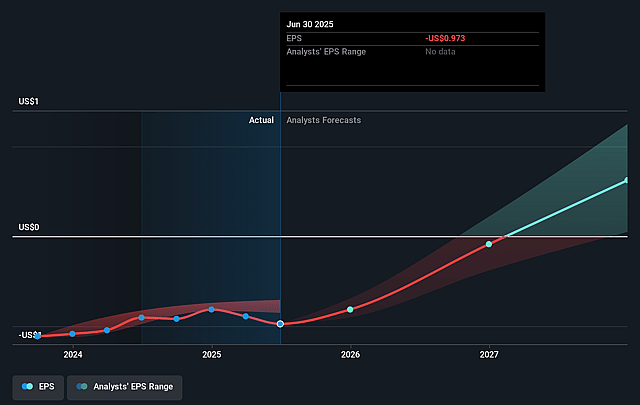

- Analysts expect earnings to reach $71.9 million (and earnings per share of $1.02) by about September 2028, up from $-62.0 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $83.6 million in earnings, and the most bearish expecting $3.1 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 21.9x on those 2028 earnings, up from -7.7x today. This future PE is greater than the current PE for the US Pharmaceuticals industry at 19.5x.

- Analysts expect the number of shares outstanding to grow by 2.15% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.78%, as per the Simply Wall St company report.

Evolus Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Jeuveau experienced its first-ever year-over-year decline, driven by a sharp reduction in consumer sentiment and broad softness across the U.S. aesthetic toxin market; persistent consumer headwinds or slower-than-expected recovery could dampen long-term revenue growth expectations.

- Evolus remains highly reliant on Jeuveau as its lead revenue driver, making the company vulnerable to future market downturns, competitive pressures, or shifts in physician/patient preferences, which could result in long-term revenue and earnings volatility.

- The overall aesthetics procedure market has now declined for three consecutive quarters, driven by macroeconomic challenges and consumer pocketbook pressure, particularly among consumers earning under $150,000-this trend, if sustained, could structurally limit Evolus's addressable market and net revenue growth.

- Strong initial results from Evolysse (the filler product) partly reflect inventory stocking rather than pure end-user demand, creating the risk of revenue volatility or disappointment in subsequent quarters if true underlying procedural volume does not materialize, impacting revenue smoothing and net margin realization.

- While international expansion and pipeline development are cited as growth drivers, the call acknowledges potentially modest near-term international contribution and a multi-year timeline for new product approvals, implying risk that expansion or diversification may not offset near

- or medium-term softness, delaying long-term operating income and margin improvement.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $19.0 for Evolus based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $20.0, and the most bearish reporting a price target of just $17.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $562.5 million, earnings will come to $71.9 million, and it would be trading on a PE ratio of 21.9x, assuming you use a discount rate of 6.8%.

- Given the current share price of $7.38, the analyst price target of $19.0 is 61.2% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.