Catalysts

About Evolus

Evolus is a performance beauty company focused on cash pay injectable aesthetics, including neurotoxin and hyaluronic acid filler products.

What are the underlying business or industry changes driving this perspective?

- The rapid scale of Evolus Rewards, with 1.3 million members and 34% year on year growth in redemptions, points to deepening consumer loyalty in a cash pay category, which can support recurring revenue and more predictable earnings over time.

- Growing use of co-branded media across 1,400 accounts and over 300 million impressions is building local clinic visibility for Jeuveau and Evolysse, which can support higher procedure volumes per site and lift overall revenue.

- The focus on medical education, with more than 17,000 injectors engaged and clear evidence that second trainings double purchasing volumes for Evolysse accounts, directly supports higher account productivity and the potential for improved gross margins as scale builds.

- Pipeline products such as Evolysse Sculpt and the planned broader launch of Estym in Europe, both with defined regulatory and launch time lines, increase portfolio breadth in a large aesthetics market, which can diversify revenue and support future earnings growth.

- The emphasis on expense discipline, rebased operating costs, and a model built for operating leverage in a high growth aesthetics category creates room for margin expansion and supports the company’s goal of sustainable profitability and stronger net income.

Assumptions

This narrative explores a more optimistic perspective on Evolus compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts. How have these above catalysts been quantified?

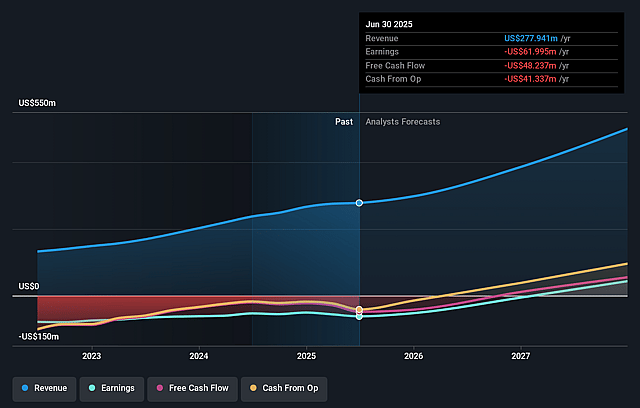

- The bullish analysts are assuming Evolus's revenue will grow by 24.6% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from -20.5% today to 26.2% in 3 years time.

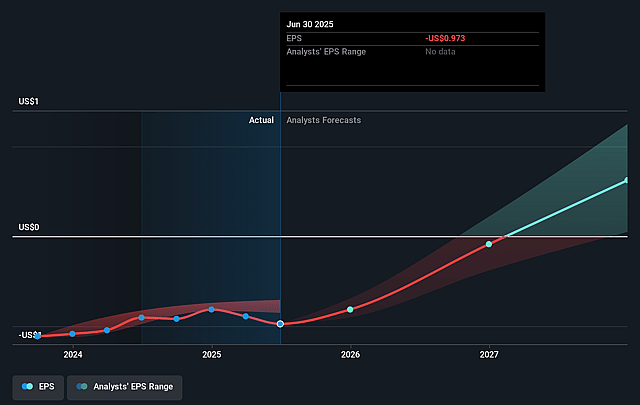

- The bullish analysts expect earnings to reach $144.8 million (and earnings per share of $1.95) by about January 2029, up from $-58.6 million today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as $17.0 million.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 11.6x on those 2029 earnings, up from -5.8x today. This future PE is lower than the current PE for the US Pharmaceuticals industry at 20.7x.

- The bullish analysts expect the number of shares outstanding to grow by 1.94% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.96%, as per the Simply Wall St company report.

Risks

What could happen that would invalidate this narrative?

- Evolus operates in a discretionary cash pay aesthetics category. Management highlights ongoing headwinds in U.S. consumer spending and a filler market that peers report is down double digits. This could limit procedure volumes, slow Jeuveau and Evolysse unit growth, and weigh on revenue and earnings.

- The company remains loss making on a non GAAP operating basis, with a non GAAP operating loss of US$3.1 million in the third quarter of 2025 and cash of US$43.5 million that declined from US$61.7 million in part due to inventory purchases. Any delay or shortfall in the path to the targeted profitability in late 2025 and 2026 could pressure net margins and earnings.

- The business model is heavily tied to key partners Daewoong and Symatese and to international trade terms. Management is still evaluating potential U.S. pharmaceutical tariffs, while Evolysse already faces a 15% tariff into the European Union, which could raise product costs, compress gross margin, and require higher pricing that might affect revenue.

- The growth narrative leans on scaling new products such as Evolysse Sculpt and a broader Estym launch in Europe with targeted approvals in 2026 and 2027. Any regulatory delay, less favorable clinical perception, or slower adoption by injectors could reduce expected portfolio breadth and limit future revenue and earnings contribution.

- The ramp of Evolysse depends on intensive medical education and repeated hands on trainings, with evidence that second trainings are needed to double purchasing volumes. If injector engagement weakens, clinics remain cautious on fillers, or competitors respond with stronger bundles, Evolus may see slower account productivity, lower portfolio share, and softer revenue growth.

Valuation

How have all the factors above been brought together to estimate a fair value?

- The assumed bullish price target for Evolus is $20.0, which represents up to two standard deviations above the consensus price target of $17.83. This valuation is based on what can be assumed as the expectations of Evolus's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $20.0, and the most bearish reporting a price target of just $10.0.

- In order for you to agree with the more bullish analyst cohort, you'd need to believe that by 2029, revenues will be $553.4 million, earnings will come to $144.8 million, and it would be trading on a PE ratio of 11.6x, assuming you use a discount rate of 7.0%.

- Given the current share price of $5.2, the analyst price target of $20.0 is 74.0% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Evolus?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.