Last Update 13 Nov 25

Fair value Decreased 14%CRIS: Cost-Saving Initiatives Will Support Stronger Revenue Expansion Into 2026

Curis's analyst price target has been reduced from $16.33 to $14.00. This adjustment reflects analysts' concerns over softer profit margins, even with stronger revenue growth projections and an increased discount rate.

Analyst Commentary

Analyst sentiment regarding Curis remains mixed, with both bullish and bearish perspectives on the company's valuation, execution, and future growth. Below are the key takeaways from recent research coverage.

Bullish Takeaways- Bullish analysts have raised price targets for Curis, reflecting a degree of confidence in the company’s ability to achieve stronger revenue growth in upcoming periods.

- Some believe cost-saving initiatives could positively impact future earnings, especially as Curis pursues efficiencies heading into 2026.

- There is optimism for a recovery in sales volume and earnings per share over the medium term, with analysts referencing company guidance calling for growth in both metrics over the next few years.

- Bearish analysts remain cautious, expressing skepticism that reported improvements are sufficient to offset broader concerns around long-term profitability and business direction.

- Uncertainty persists regarding the sustainability of profit margins, as consumer responses to higher pricing may pressure gross margins well into 2026.

- Risks associated with external factors, such as the current tariff environment, are seen as ongoing headwinds to near-term earnings growth and execution.

- There is concern that anticipated growth may not fully materialize due to conservative forecasts from retail partners and lower-than-expected sales in the upcoming quarters.

What's in the News

- Curis received notice on August 21, 2025, that it was not in compliance with Nasdaq's $35 million minimum market value listing requirement and faced potential delisting unless an appeal was made before August 28, 2025 (Key Developments).

- The company requested a hearing to appeal the Nasdaq delisting determination, which paused suspension and delisting pending the outcome of the hearing (Key Developments).

- On October 20, 2025, Nasdaq granted Curis an exception until November 14, 2025, to regain compliance with listing requirements, with continued listing subject to ongoing events and conditions (Key Developments).

Valuation Changes

- Consensus Analyst Price Target has declined from $16.33 to $14.00, indicating a downward revision in perceived fair value.

- Discount Rate has risen from 9.17% to 10.37%, reflecting increased risk or a higher required return by analysts.

- Revenue Growth expectations increased from 45.17% to 51.09%, signaling higher projected sales expansion.

- Net Profit Margin has fallen from 16.06% to 13.95%, suggesting reduced profitability forecasts despite higher revenue growth.

- Future P/E multiple increased from 56.88x to 63.81x, which may reflect expectations for stronger earnings growth or a greater premium placed on future performance.

Key Takeaways

- Advancing a key therapy in multiple cancer types and expanding its use could unlock major new markets and drive long-term revenue growth.

- Strategic cost controls and externally funded trials are minimizing cash burn while maximizing pipeline value and supporting future profitability.

- Heavy reliance on a single clinical asset and lack of approved products expose Curis to substantial risk from setbacks, competition, and challenging funding and regulatory environments.

Catalysts

About Curis- A biotechnology company, engages in the discovery and development of drug candidates for the treatment of human cancers in the United States.

- Progress toward pivotal clinical data and potential accelerated approvals for emavusertib in hematologic cancers (PCNSL, CLL, AML, and MDS) may unlock significant new market opportunities, supporting future revenue growth as global cancer incidence rises and demand for innovative therapies expands.

- Expansion of emavusertib into additional indications and combinations, including with BTK inhibitors and standard-of-care regimens, positions the company to benefit from the increasing clinical adoption of targeted/precision oncology, amplifying potential earnings and long-term addressable markets.

- Ongoing investigator-sponsored trials in various solid tumor types-funded externally-could yield additional value-creating data with minimal cash burn, thereby increasing pipeline optionality and de-risking future earnings without materially impacting current net margins or requiring large R&D expenditures.

- Sustained KOL interest, positive regulatory interactions, and the prospect of supportive expedited approval pathways in areas of high unmet need (e.g., PCNSL) may accelerate time-to-market, driving earlier revenue realization and improving operating leverage.

- Recent R&D and G&A cost reductions demonstrate strategic financial discipline, potentially extending the cash runway and limiting near-term dilution, setting the stage for improved operating margins as key pipeline assets mature and approach commercialization.

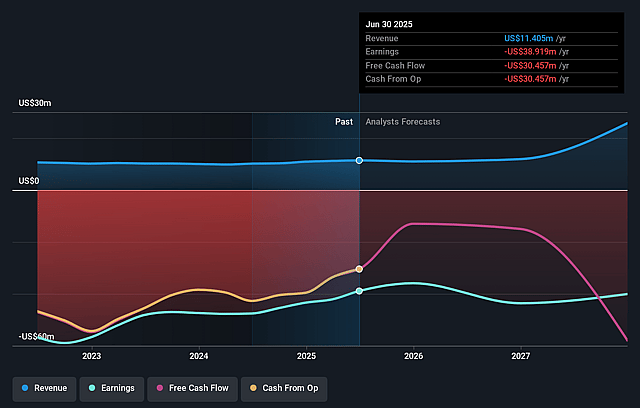

Curis Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Curis's revenue will grow by 45.2% annually over the next 3 years.

- Analysts are not forecasting that Curis will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate Curis's profit margin will increase from -341.2% to the average US Biotechs industry of 16.1% in 3 years.

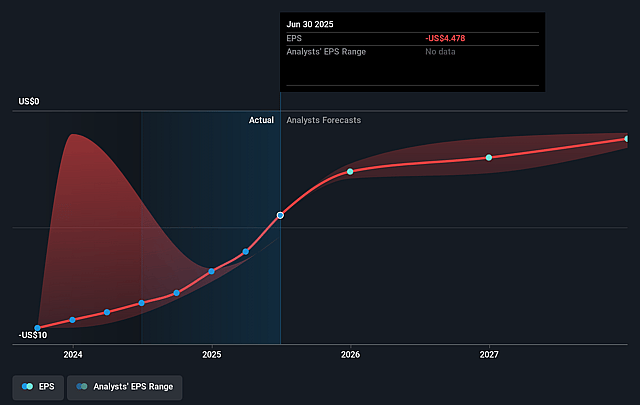

- If Curis's profit margin were to converge on the industry average, you could expect earnings to reach $5.6 million (and earnings per share of $0.37) by about September 2028, up from $-38.9 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 56.9x on those 2028 earnings, up from -0.6x today. This future PE is greater than the current PE for the US Biotechs industry at 15.5x.

- Analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.17%, as per the Simply Wall St company report.

Curis Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Curis's heavy reliance on a single lead asset, emavusertib, with nearly all clinical and business updates centered around its progress, exposes the company-and thus its future revenues-to significant binary risk if clinical, regulatory, or competitive setbacks occur in any of its targeted indications.

- The persistent lack of commercial-stage or approved products, coupled with ongoing net losses and limited cash runway (estimated to last only into Q1 2026), increases the likelihood of secondary equity offerings or dilutive financing, which can pressure future earnings per share and depress share price.

- Increasing competition in Curis's key markets-such as CLL, NHL, and AML-from emerging therapies (BTK degraders, next-gen BCL2 inhibitors, and newer BTKis like tirabrutinib)-raises the risk that Curis's products, even if approved, will struggle to achieve meaningful market share, limiting long-term revenue growth.

- The highly challenging regulatory environment in oncology-characterized by evolving FDA standards, uncertainty in accelerated approval pathways, and greater requirements for demonstrating clinical benefit-could delay product approvals and force costly additional studies, extending timelines to revenue generation and straining net margins.

- Macro trends such as rising R&D costs, ongoing industry-wide financial constraints, and the need to prioritize trials with limited internal capital may constrain Curis from fully exploiting its pipeline, leading to slow pipeline advancement, chronic negative net margins, and delayed or reduced revenue realization.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $16.333 for Curis based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $20.0, and the most bearish reporting a price target of just $12.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $34.9 million, earnings will come to $5.6 million, and it would be trading on a PE ratio of 56.9x, assuming you use a discount rate of 9.2%.

- Given the current share price of $1.72, the analyst price target of $16.33 is 89.5% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.