Key Takeaways

- Heavy dependence on one unproven drug and a narrow pipeline creates significant risk to future growth and may require dilutive fundraising.

- Uncertainty in regulatory approvals and commercial viability could compress margins, delay profitability, and endanger long-term competitiveness.

- Heavy reliance on early-stage assets, ongoing financial strain, and rising competitive and regulatory pressures threaten sustainability, future growth prospects, and shareholder value.

Catalysts

About Curis- A biotechnology company, engages in the discovery and development of drug candidates for the treatment of human cancers in the United States.

- Although Curis is positioned to benefit from rising cancer incidence driven by an aging global population and the growing demand for novel targeted therapies, its future revenue streams are highly contingent on successful clinical progression and regulatory approval of emavusertib, which remains unproven in pivotal trials and still faces the risk of clinical setbacks or competitor advances.

- While increasing investment in precision medicine and a regulatory landscape that can offer incentives such as accelerated approvals could potentially expedite time to market and reduce development costs, the increasingly unpredictable stance of the FDA-especially in oncology-may result in unexpected delays, higher expenses, and uncertainty over timing of revenues.

- Although there is strong enthusiasm from key opinion leaders and clinicians for exploring emavusertib in additional indications within CLL and NHL, Curis is heavily dependent on a narrow pipeline and has limited financial runway, which could require several dilutive financings. This reliance threatens future per-share earnings and may erode any operational leverage from revenue growth.

- Even as Curis maintains focus on cost controls and maximizes use of investigator-sponsored trials to extend its cash, the need for substantial investment in commercial infrastructure if emavusertib succeeds may significantly compress net margins and delay any move to profitability, particularly given the unknowns of market access and uptake in competitive spaces.

- While the surge in M&A and licensing activity in the biotech sector could present strategic opportunities for Curis, the company risks falling behind if its assets fail to demonstrate clear commercial or clinical differentiation in a rapidly evolving oncology landscape that increasingly favors next-generation modalities, potentially diminishing its longer-term revenue prospects.

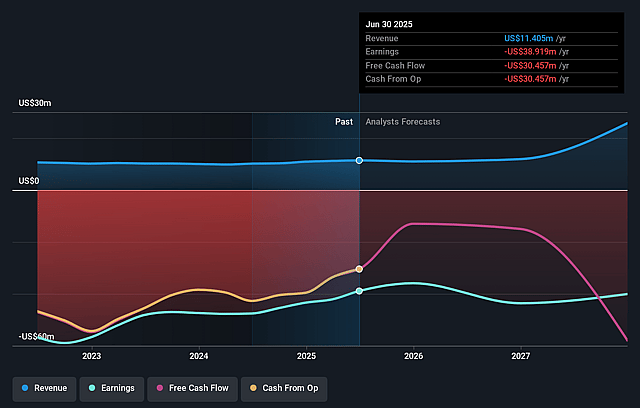

Curis Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Curis compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Curis's revenue will grow by 7.0% annually over the next 3 years.

- The bearish analysts are not forecasting that Curis will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate Curis's profit margin will increase from -341.2% to the average US Biotechs industry of 16.3% in 3 years.

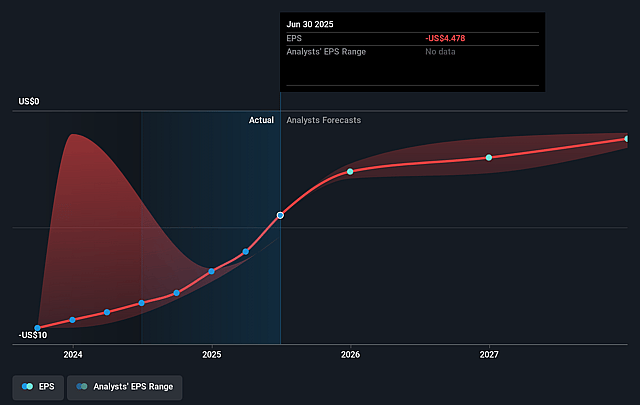

- If Curis's profit margin were to converge on the industry average, you could expect earnings to reach $2.3 million (and earnings per share of $0.15) by about September 2028, up from $-38.9 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 103.2x on those 2028 earnings, up from -0.6x today. This future PE is greater than the current PE for the US Biotechs industry at 15.4x.

- Analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.17%, as per the Simply Wall St company report.

Curis Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Curis' cash and cash equivalents of $10.1 million at the end of June 2025, together with recent capital raises, are only expected to fund operations into the first quarter of 2026, increasing the likelihood of further equity dilution or reliance on expensive financing, which could negatively impact per-share earnings and shareholder value.

- The company is heavily reliant on a small pipeline of early-stage and development-stage assets, with no commercial products, so any clinical setbacks or regulatory delays-especially regarding emavusertib in lymphoma, AML, or MDS-could abruptly stall potential revenue generation and jeopardize future earnings.

- Persistent net losses and ongoing cash burn indicate that Curis has yet to achieve sustainable profitability, and without near-term commercialization or large licensing deals, operational expenses will continue to be a drag on net margins and earnings.

- The oncology market is becoming increasingly competitive, with the emergence of BTK degraders, next-generation BCL2 inhibitors, and new BTK inhibitors like tirabrutinib; this intensifying landscape could erode Curis' potential market share and future revenue streams, especially if competitors' therapies prove more effective or secure faster approvals.

- Increasing regulatory uncertainty, particularly at the FDA, as mentioned by management, may slow the approval process or require additional studies, causing delays in time-to-market and elevating development costs, which could negatively impact both revenues and net margins over the long term.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Curis is $12.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Curis's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $20.0, and the most bearish reporting a price target of just $12.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $14.0 million, earnings will come to $2.3 million, and it would be trading on a PE ratio of 103.2x, assuming you use a discount rate of 9.2%.

- Given the current share price of $1.72, the bearish analyst price target of $12.0 is 85.7% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.