Key Takeaways

- Emavusertib's rapid adoption, premium pricing, and potential to redefine standards across multiple oncology indications could drive substantial revenue growth and market expansion for Curis.

- Disciplined R&D spending, externally funded trials, and favorable sector trends position Curis for improved margins and accelerated earnings not fully captured in current valuations.

- Curis faces substantial financial and regulatory risks that threaten its drug pipeline progress, market share, and long-term profitability prospects amid intense competition and funding uncertainty.

Catalysts

About Curis- A biotechnology company, engages in the discovery and development of drug candidates for the treatment of human cancers in the United States.

- Analyst consensus is encouraged by the potential for accelerated approval of emavusertib in PCNSL, but given the urgency of unmet need, strong backing from KOLs, and positive feedback from both FDA and EMA, there is a real possibility of rapid adoption and premium pricing upon approval, driving revenue growth and gross margins far beyond current expectations.

- While analysts broadly anticipate clinical enrollment expansion to translate into higher revenue over 12 to 18 months, the actual pace may be swifter due to heightened medical community enthusiasm and ultra-rare patient targeting, enabling earlier-than-expected data readouts and NDA submissions that could meaningfully accelerate near-term earnings.

- Emavusertib's novel mechanism may soon redefine the standard-of-care not only in PCNSL and AML, but also in larger indications like CLL and NHL, positioning Curis as a first-mover in time-limited, MRD-negative therapeutic regimens and significantly expanding its accessible market and long-term revenue potential as global demand for advanced oncology therapies rises.

- The company's disciplined R&D prioritization and substantial reductions in operating expenses, combined with externally sponsored trials in solid tumors at minimal cost, imply material improvement in net margins and earnings leverage, which is not adequately reflected in current valuations.

- Recent setbacks for competing therapies in high-risk MDS, combined with the global healthcare sector's growing willingness to pay for differentiated targeted treatments, set the stage for rapid emavusertib uptake in new hematologic and potentially solid tumor indications, amplifying forecasted top-line growth as precision medicine further embeds across oncology care pathways.

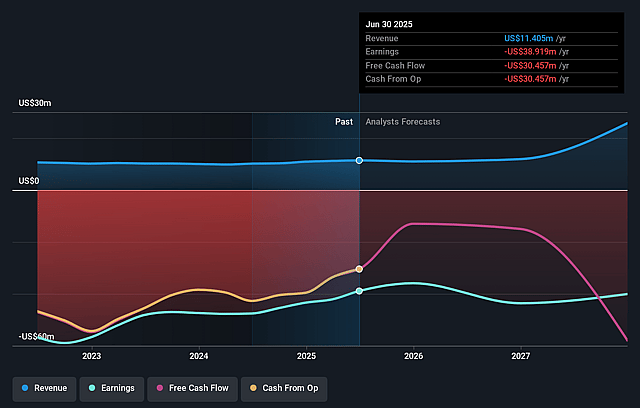

Curis Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Curis compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Curis's revenue will grow by 65.7% annually over the next 3 years.

- Even the bullish analysts are not forecasting that Curis will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate Curis's profit margin will increase from -341.2% to the average US Biotechs industry of 14.2% in 3 years.

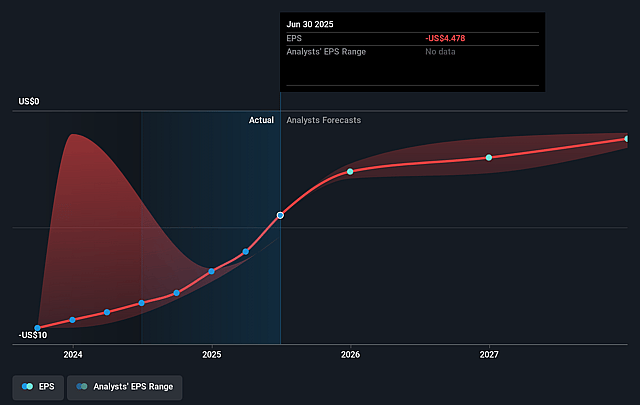

- If Curis's profit margin were to converge on the industry average, you could expect earnings to reach $7.4 million (and earnings per share of $0.49) by about September 2028, up from $-38.9 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 52.9x on those 2028 earnings, up from -0.6x today. This future PE is greater than the current PE for the US Biotechs industry at 15.3x.

- Analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.02%, as per the Simply Wall St company report.

Curis Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Curis faces significant funding risk due to a limited cash runway, with current reserves and recent fundraising only expected to support operations into the first quarter of 2026, which may force the company to conduct further dilutive financings, negatively impacting earnings per share and return on equity for existing shareholders.

- Approvals for Curis' lead drug emavusertib rely heavily on single-arm studies and accelerated pathways for ultra-rare diseases, making the company highly vulnerable to regulatory shifts or clinical setbacks; any failure or delay in pivotal trials could sharply reduce future revenue and result in impairment of R&D investments.

- The evolving competitive landscape in oncology, particularly in CLL and NHL, is seeing the emergence of next-generation BTK inhibitors, BTK degraders, and BCL2 inhibitors, as well as new entrants like tirabrutinib, which challenge emavusertib's ability to differentiate and potentially erode Curis' future market share and top-line revenue.

- Persistent net losses and ongoing cash burn, despite some reduction in expenses, signal long-term financial fragility that may limit investment in new pipeline development or commercialization, restricting the company's ability to grow margins and revenue.

- Heightened regulatory scrutiny at agencies like the FDA, combined with greater industry pressure on drug pricing and reimbursement, could delay product launches, increase R&D and compliance costs, and constrain the long-term profitability and net margins of any Curis-approved therapies.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Curis is $20.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Curis's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $20.0, and the most bearish reporting a price target of just $12.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $51.9 million, earnings will come to $7.4 million, and it would be trading on a PE ratio of 52.9x, assuming you use a discount rate of 9.0%.

- Given the current share price of $1.81, the bullish analyst price target of $20.0 is 91.0% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.