Key Takeaways

- Rapidly accelerating AUCATZYL adoption and advanced manufacturing could drive stronger revenue growth and operating leverage than analysts expect.

- Robust long-term demand and untapped expansion into new indications position Autolus for sustained revenue growth and strategic partnership opportunities.

- Heavy dependence on one product, persistent financial losses, and tough European access and competitive pressures threaten future growth, funding ability, and business stability.

Catalysts

About Autolus Therapeutics- A clinical-stage biopharmaceutical company, develops T cell therapies for the treatment of cancer and autoimmune diseases in United Kingdom and internationally.

- Analyst consensus expects ongoing launch momentum in the U.S., but the pace of AUCATZYL adoption is being significantly underestimated-rapid expansion across major treatment centers, very high physician and patient enthusiasm, and accelerating reorder rates indicate potential to capture a dominant share of the adult ALL CAR-T market much faster than currently modeled, driving strong near-term revenue beats.

- Analysts broadly agree that margin improvement will occur gradually as manufacturing ramps, but Autolus's advanced automated manufacturing technology and rapid scaling at volume-rich, high-flow centers point toward structurally higher gross margins and positive operating leverage emerging earlier than the Street anticipates, with a transformative impact on earnings power.

- The accelerating prevalence of hematologic malignancies due to global demographic shifts, coupled with robust payer coverage and growing public health investment in curative therapies, creates a long-term demand tailwind that is not fully reflected in current models, positioning Autolus for multi-year durable revenue compounding.

- Autolus's expansion into additional high-value indications, including pediatric ALL, frontline consolidation, lupus nephritis, and progressive multiple sclerosis-not yet reflected in most consensus models-offers a pathway to exponential pipeline-driven revenue growth and significant de-risking of commercial execution.

- The possibility for near-term landmark pharma or biotech partnership deals, enabled by strong real-world data, an attractive product safety/efficacy profile, and highly differentiated manufacturing capabilities, has the potential to inject substantial non-dilutive capital and accelerate both pipeline development and market penetration, directly supporting future earnings growth and balance sheet strength.

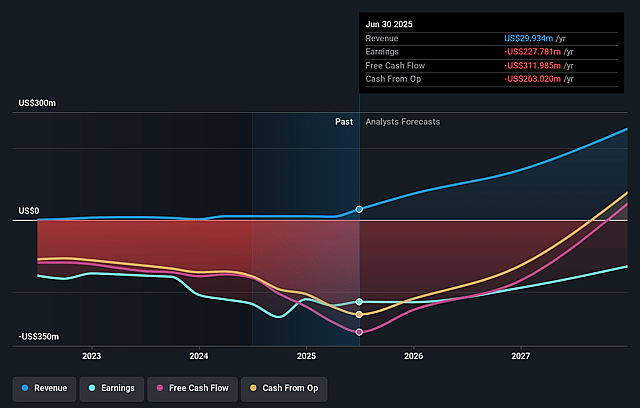

Autolus Therapeutics Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Autolus Therapeutics compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Autolus Therapeutics's revenue will grow by 166.3% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from -760.9% today to 9.3% in 3 years time.

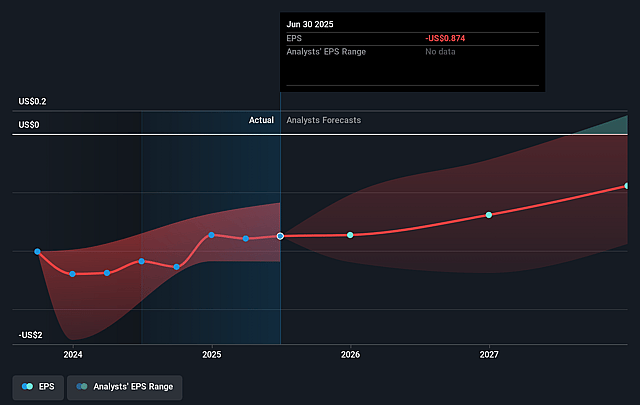

- The bullish analysts expect earnings to reach $52.5 million (and earnings per share of $0.21) by about August 2028, up from $-227.8 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 83.5x on those 2028 earnings, up from -2.1x today. This future PE is greater than the current PE for the US Biotechs industry at 15.6x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.19%, as per the Simply Wall St company report.

Autolus Therapeutics Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Prolonged or unsuccessful market access and reimbursement negotiations in Europe, particularly due to complex and inconsistent health technology assessment frameworks and constrained healthcare budgets, may result in delayed or even absent sales in major EU markets, directly reducing future revenue opportunities.

- High and persistent cost of sales, driven by early stage manufacturing inefficiencies, out-of-spec product write-offs, third-party royalties, and idle capacity, are currently outweighing product revenue and may continue to depress gross and net margins for a prolonged period.

- Ongoing negative operating earnings and significant cash burn, with no near-term timeline to profitability, leave Autolus financially vulnerable in an environment of higher interest rates and tighter biotech capital markets, potentially limiting access to future funding for R&D and commercialization initiatives.

- Reliance on a single commercial asset (obe-cel/AUCATZYL) exposes the company to material downside risk if regulatory, clinical, or competitive events reduce market adoption, which could lead to volatile and unpredictable earnings and threaten business sustainability.

- The rapidly intensifying competition from larger pharmaceutical companies and the risk of disruptive technological advances in cell and gene therapy could result in price erosion, lower-than-expected uptake, and ultimately pressure longer-term revenue growth and profitability expectations.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Autolus Therapeutics is $13.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Autolus Therapeutics's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $13.0, and the most bearish reporting a price target of just $5.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $565.6 million, earnings will come to $52.5 million, and it would be trading on a PE ratio of 83.5x, assuming you use a discount rate of 8.2%.

- Given the current share price of $1.78, the bullish analyst price target of $13.0 is 86.3% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.