Key Takeaways

- Accelerating adoption, regulatory progress, and expanded clinical indications position Autolus for increased market share and long-term revenue growth in advanced cancer therapies.

- Improved manufacturing efficiency and financial discipline strengthen margins, enabling investment in innovation and geographic expansion while supporting sustained profitability.

- Delays in European market access, high costs, regulatory hurdles, and rising competition threaten Autolus's revenue growth, margins, and long-term financial sustainability.

Catalysts

About Autolus Therapeutics- A clinical-stage biopharmaceutical company, develops T cell therapies for the treatment of cancer and autoimmune diseases in United Kingdom and internationally.

- Robust early uptake and positive physician feedback on AUCATZYL, combined with expanding treatment center coverage (targeting 60+ authorized centers by year-end) and 90% of U.S. medical lives insured, position Autolus to capture a larger share of the growing demand for advanced cancer therapies, supporting sustainable increases in top-line revenue.

- Ongoing improvements in manufacturing efficiency and anticipated higher product volumes are expected to drive down cost of goods sold and improve gross margins over time, potentially reducing net losses and accelerating the path to profitability.

- Regulatory progress with recent conditional marketing authorizations in the U.K. and EU, together with ongoing engagement for market access, creates a pathway for future geographic expansion, which could materially increase the company's total addressable market and long-term revenue growth.

- Strong real-world data on durability of response and safety from obe-cel, along with expanding clinical exploration into other indications (pediatric ALL, frontline consolidation, and autoimmune diseases), leverages the trend toward personalized medicine and positions Autolus to benefit from increasing adoption of cell and gene therapies, supporting both pipeline value and future sales.

- Strategic discipline in market launches (only entering new geographies when economically viable) and a solid cash position ($454M) provide financial flexibility to weather near-term risks and to invest in next-generation products, increasing resilience and supporting long-term earnings visibility.

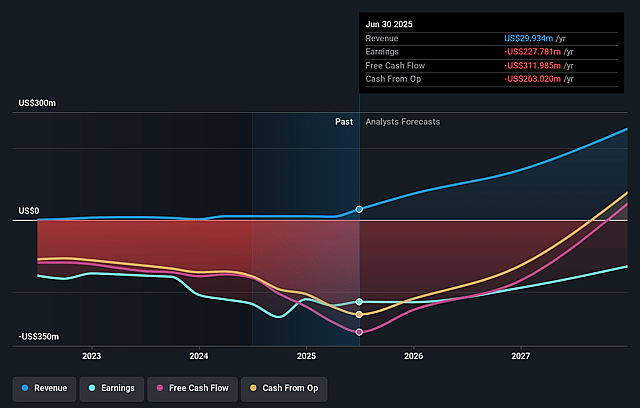

Autolus Therapeutics Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Autolus Therapeutics's revenue will grow by 127.9% annually over the next 3 years.

- Analysts are not forecasting that Autolus Therapeutics will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate Autolus Therapeutics's profit margin will increase from -760.9% to the average US Biotechs industry of 16.1% in 3 years.

- If Autolus Therapeutics's profit margin were to converge on the industry average, you could expect earnings to reach $56.9 million (and earnings per share of $0.21) by about September 2028, up from $-227.8 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 57.4x on those 2028 earnings, up from -1.7x today. This future PE is greater than the current PE for the US Biotechs industry at 15.5x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.49%, as per the Simply Wall St company report.

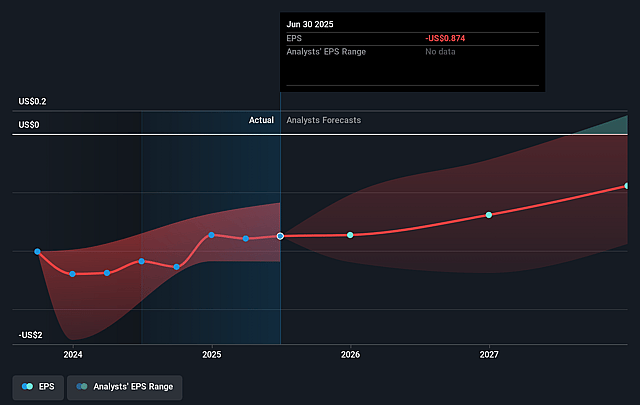

Autolus Therapeutics Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Autolus's long-term revenue growth is at risk due to persistent challenges and delays in achieving economically viable market access and reimbursement agreements in key European countries, as evidenced by the company's expectation of no EU sales in 2025 and 2026 and the need for a country-by-country approach amid regulatory and methodological barriers-potentially capping global revenue expansion and prolonging dependence on the U.S. market.

- Elevated cost of goods sold (COGS) and ongoing losses from operations, driven by high manufacturing costs, out-of-spec products, growing SG&A expenses, and the significant upfront investment required to scale up manufacturing, threaten Autolus's path to sustainable positive net margins even amid a successful U.S. launch, increasing risk of continued net losses.

- Market access in Europe and the rest of the world is increasingly complicated by global regulatory trends: price transparency, reference pricing, increased regulatory scrutiny, and cost-effectiveness methodologies may lead to pricing pressures, reimbursement delays, or launches below cost-negatively impacting both future revenues and gross margins.

- The biotech sector is experiencing rapid advancements in next-generation and "off-the-shelf" cell therapies, which may render Autolus's autologous CAR-T platform less competitive or even obsolete over time; intensifying competition from larger biopharma players and innovative new entrants poses a long-term risk to market share, limiting revenue and potentially compressing margins.

- Sustained high R&D, manufacturing costs, and cash burn (with cash, cash equivalents, and marketable securities falling from $588 million to $454.3 million in 6 months and ongoing operating losses) create risk of future dilution or funding shortfalls before Autolus achieves commercial scale and profitability, potentially impacting earnings per share and long-term shareholder value.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $9.622 for Autolus Therapeutics based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $13.0, and the most bearish reporting a price target of just $5.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $354.3 million, earnings will come to $56.9 million, and it would be trading on a PE ratio of 57.4x, assuming you use a discount rate of 8.5%.

- Given the current share price of $1.44, the analyst price target of $9.62 is 85.0% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.