Last Update23 Oct 25Fair value Decreased 5.74%

Arcturus Therapeutics Holdings' analyst price target has been revised downward from $69.89 to $65.88. This change reflects analyst concerns over shifting vaccine market dynamics, regulatory uncertainties, and recently moderated revenue growth expectations.

Analyst Commentary

Recent analyst activity for Arcturus Therapeutics Holdings reflects a mixed but thoughtful outlook, with both optimism for growth drivers and caution surrounding execution and regulatory risks. The following summarizes prevailing themes from recent research updates:

Bullish Takeaways

- Bullish analysts cite Arcturus as a "platform-validated" innovator in mRNA technology, with capabilities well positioned for next-generation vaccine development.

- Near-term clinical catalysts in the rare disease segment are seen as important opportunities that could materially improve the company’s valuation.

- Optimism persists that successful advancement in standalone mRNA flu vaccines could lead to a positive strategic re-rating for the stock.

- The company’s approach to addressing unmet medical needs in rare disease and infectious disease spaces remains a core driver for longer-term growth forecasts.

Bearish Takeaways

- Bearish analysts highlight ongoing regulatory uncertainty, particularly the lack of clarity on the development and approval path for COVID/Flu mRNA combination vaccines.

- Lowering of price targets reflects more tempered revenue growth expectations, with updated models signaling decreased vaccination trends in key markets like the U.S.

- Some analysts express concern about the necessity for standalone mRNA flu vaccine approvals before any potential approval for COVID/Flu combination products. This may delay key milestones.

- Uncertainty remains regarding the company’s overarching development strategy, especially around balancing standalone and combination vaccine structures amid evolving commercial contracting dynamics.

What's in the News

- Arcturus Therapeutics Holdings reported interim results from its ongoing Phase 2 clinical trial of ARCT-032, an investigational inhaled mRNA therapy for adults with cystic fibrosis. (Key Developments)

- Six adults with Class I cystic fibrosis received daily 10 mg inhaled doses of ARCT-032 for 28 days. Full lung function data is available on the company website. (Key Developments)

- A larger clinical study with a longer duration is planned to begin in the first half of 2026 to further evaluate the safety and efficacy of ARCT-032. (Key Developments)

- ARCT-032 has received both Orphan Medicinal Product Designation from the European Medicines Agency and Orphan Drug Designation from the U.S. Food and Drug Administration as a treatment for cystic fibrosis. (Key Developments)

Valuation Changes

- Consensus Analyst Price Target has declined from $69.89 to $65.88, reflecting a modest reduction in expected future share value.

- Discount Rate has risen slightly from 6.78% to 6.90%, indicating a marginal increase in perceived risk or cost of capital.

- Revenue Growth expectations have decreased from 33.29% to 32.24%, suggesting more cautious forecasts around near-term top-line expansion.

- Net Profit Margin projections have increased from 30.36% to 32.60%, which implies anticipated improvements in future profitability.

- Future P/E has fallen from 26.17x to 23.60x, which signals a lower valuation multiple now being assigned to forward earnings.

Key Takeaways

- Advancement in late-stage clinical programs and partnerships positions the company to capture rare disease and vaccine market opportunities, enhancing revenue growth and competitiveness.

- Operational restructuring and prioritized pipeline extend financial runway, enabling focused investment in high-potential assets while lowering dilution risk and operating expenses.

- Heavy dependence on a narrow late-stage pipeline and reduced collaboration revenues heightens regulatory, financial, and competitive risks, threatening margin stability and future market share.

Catalysts

About Arcturus Therapeutics Holdings- Engages in the development of infectious disease vaccines and other products within liver and respiratory rare diseases.

- Progression of late-stage clinical programs-particularly the ARCT-810 (OTC deficiency) and ARCT-032 (Cystic Fibrosis) trials-offers the potential to unlock significant rare disease markets with high pricing power and strong net margins if positive Phase II/III results lead to regulatory approval and commercialization.

- Strategic partnerships and successful regional commercial launches for COVID-19 vaccines (e.g., regulatory filings/anticipated approvals in the UK, Japan, and impending US BLA) expected to drive milestone payments and recurring royalties, directly supporting top-line revenue growth.

- The LUNAR® platform's proven ability to enhance safety/tolerability of mRNA delivery strengthens competitive positioning and expands licensing/partnering opportunities, potentially generating new and diversified multi-year revenue streams.

- Increased public and private funding for infectious disease preparedness and next-generation vaccines (e.g., BARDA-funded flu program and Fast Track designation for ARCT-2304) positions Arcturus to capture a share of growing global demand for advanced vaccine platforms, positively impacting future revenue and earnings stability.

- Recent operational restructuring and pipeline prioritization have extended the company's cash runway into 2028, reducing near-term dilution risk and allowing focused investment in high-potential programs, supporting long-term earnings leverage as operating expenses continue to decline.

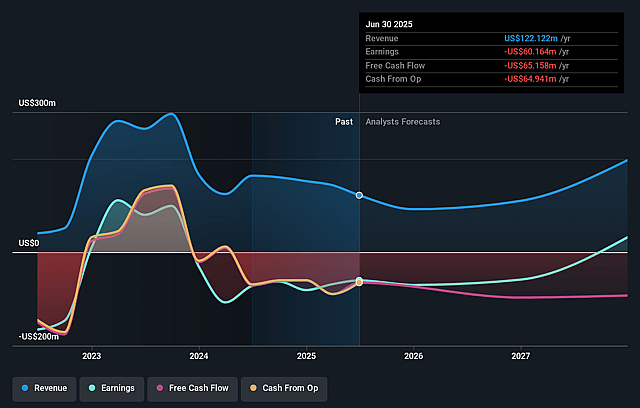

Arcturus Therapeutics Holdings Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Arcturus Therapeutics Holdings's revenue will grow by 33.3% annually over the next 3 years.

- Analysts assume that profit margins will increase from -49.3% today to 30.4% in 3 years time.

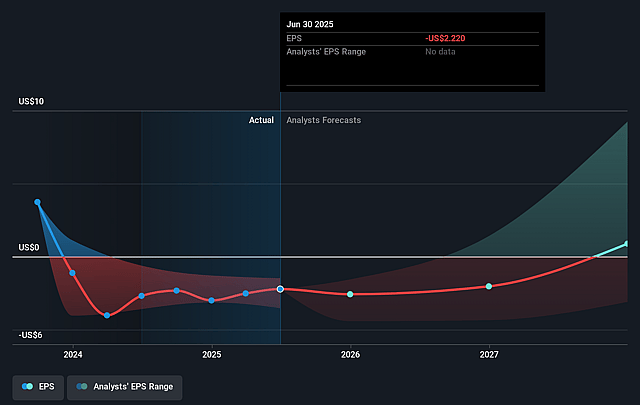

- Analysts expect earnings to reach $87.8 million (and earnings per share of $2.48) by about September 2028, up from $-60.2 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $299.5 million in earnings, and the most bearish expecting $-93.2 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 26.2x on those 2028 earnings, up from -7.8x today. This future PE is greater than the current PE for the US Biotechs industry at 15.5x.

- Analysts expect the number of shares outstanding to grow by 0.25% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.78%, as per the Simply Wall St company report.

Arcturus Therapeutics Holdings Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Heavy reliance on a narrow pipeline focused primarily on ARCT-032 (for cystic fibrosis) and ARCT-810 (for OTC deficiency) exposes Arcturus to high clinical and regulatory risk-failure or delays in pivotal Phase III trials or inability to demonstrate significant efficacy could severely reduce future revenues and undermine investor confidence.

- Decreasing revenues from the CSL collaboration due to lower supply agreement activity and amortization of upfront payments, coupled with persistent net operating losses despite cost reductions, may result in ongoing negative operating cash flows, raising risks of future shareholder dilution or unfavorable fundraising that could impact earnings per share.

- The transition of key pipeline programs to late-stage development heightens dependence on successful regulatory outcomes and timely approvals; any tightening of global regulatory standards or challenges in aligning new biomarkers as endpoints with agencies like the FDA could prolong timelines, delaying product launches and associated cash flows.

- Increasing competition from larger, better-capitalized companies such as Vertex and Moderna-especially as seen in overlapping clinical trial recruitment-poses a risk of being outpaced in mRNA/lipid nanoparticle (LNP) technological advancements, potentially leading to lower-than-expected market share, compressed margins, and reduced long-term profitability.

- Persistent industry-wide pressures-including accelerated patent expirations, growing generic/biosimilar threat, and intensifying scrutiny over the safety, tolerability, and cost-effectiveness of mRNA therapeutics-could result in stricter reimbursement, lower pricing power, or unforeseen regulatory hurdles, directly reducing future net margins and revenue potential.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $69.89 for Arcturus Therapeutics Holdings based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $140.0, and the most bearish reporting a price target of just $42.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $289.2 million, earnings will come to $87.8 million, and it would be trading on a PE ratio of 26.2x, assuming you use a discount rate of 6.8%.

- Given the current share price of $17.19, the analyst price target of $69.89 is 75.4% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.