Key Takeaways

- Heavy reliance on a few clinical programs and uncertain commercialization timelines create considerable risk for sustained revenue and earnings growth.

- Elevated cash burn, history of losses, and potential delays in partnerships heighten the risk of future dilution or unprofitable expansion.

- Heavy reliance on a narrow pipeline and uncertain commercialization success heightens revenue risk amid persistent losses, rising competition, and regulatory challenges.

Catalysts

About Arcturus Therapeutics Holdings- Engages in the development of infectious disease vaccines and other products within liver and respiratory rare diseases.

- While global trends such as rising healthcare outlays and an aging population could expand the addressable market for advanced RNA therapeutics, Arcturus faces significant near-term revenue headwinds as its historical collaboration income declines and commercialization timelines for its cystic fibrosis and OTC deficiency therapies are uncertain, potentially prolonging low topline growth.

- Despite progress in both rare disease and vaccine pipelines, the company remains heavily dependent on a limited number of clinical candidates, increasing concentration risk if key programs encounter setbacks or fail to reach pivotal milestones, which could severely impact future revenues and overall earnings growth.

- Although increasing government and private investment in pandemic preparedness could bolster demand for innovative vaccine platforms-including Arcturus's self-amplifying mRNA technology-future revenue realization is subject to regulatory approvals, intense competition from larger mRNA peers, and the risk of further reimbursement and pricing pressure that may compress net margins.

- While Arcturus has cut operating expenses significantly through restructuring and pipeline prioritization, its high ongoing cash burn rate paired with a history of net losses raises the risk of future dilution or unprofitable scaling, especially if new commercial launches or partnership payments are delayed beyond the projected cash runway into 2028.

- Although innovation in lipid nanoparticle delivery and nucleic acid purification differentiates Arcturus from competitors and may eventually attract strategic partners or acquirers, escalating industry competition and the possibility of regulatory tightening on healthcare pricing globally could limit the company's ability to achieve premium pricing and sustainable improvements in net earnings.

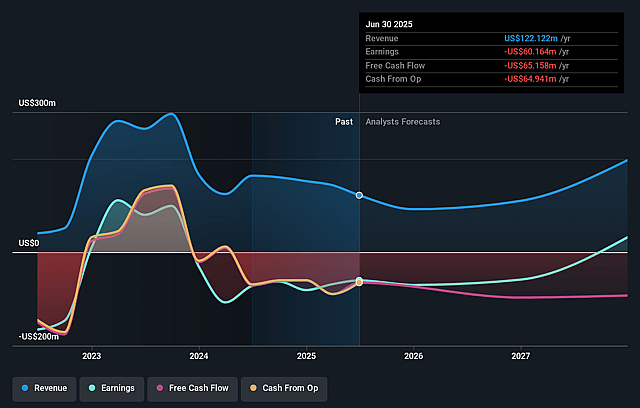

Arcturus Therapeutics Holdings Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Arcturus Therapeutics Holdings compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Arcturus Therapeutics Holdings's revenue will decrease by 47.2% annually over the next 3 years.

- The bearish analysts are not forecasting that Arcturus Therapeutics Holdings will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate Arcturus Therapeutics Holdings's profit margin will increase from -49.3% to the average US Biotechs industry of 16.3% in 3 years.

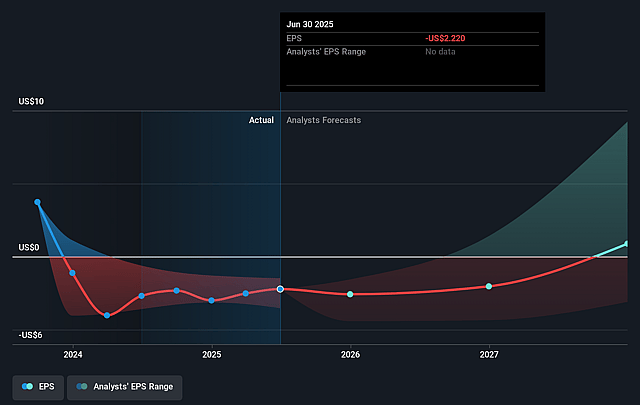

- If Arcturus Therapeutics Holdings's profit margin were to converge on the industry average, you could expect earnings to reach $2.9 million (and earnings per share of $0.11) by about September 2028, up from $-60.2 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 471.7x on those 2028 earnings, up from -7.5x today. This future PE is greater than the current PE for the US Biotechs industry at 15.4x.

- Analysts expect the number of shares outstanding to grow by 0.25% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.78%, as per the Simply Wall St company report.

Arcturus Therapeutics Holdings Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Arcturus reported a significant year-over-year decline in revenues, mainly due to lower activity in its main collaboration and the transition of CoStave from development to commercial phase, increasing the risk that new sources of revenue will not ramp quickly enough to offset these declines and potentially harming future topline growth.

- The company has narrowed its internal pipeline to focus on cystic fibrosis and OTC deficiency, which exposes it to high concentration risk-if either of these programs encounters development or regulatory setbacks, the impact on overall revenue and earnings could be severe.

- Despite cost reductions and an extended cash runway, Arcturus continues to report net losses each quarter, and achieving profitability will depend on successful commercialization and regulatory approval of its leading programs, creating ongoing risk to net margins and shareholder dilution.

- Growing competition from established and emerging players in both mRNA vaccines and rare disease therapeutics, including companies with more robust financial resources and larger pipelines, threatens future market share and may pressure the company's sales growth and gross margins.

- Uncertainty around regulatory endpoints and alignment with agencies, as well as the need for additional data on placebo comparisons and longer-term efficacy in pivotal trials, could prolong development timelines, increase R&D costs, and delay potential revenue streams from product launches.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Arcturus Therapeutics Holdings is $42.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Arcturus Therapeutics Holdings's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $140.0, and the most bearish reporting a price target of just $42.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $18.0 million, earnings will come to $2.9 million, and it would be trading on a PE ratio of 471.7x, assuming you use a discount rate of 6.8%.

- Given the current share price of $16.7, the bearish analyst price target of $42.0 is 60.2% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Arcturus Therapeutics Holdings?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.