Key Takeaways

- Unique mRNA platform enables rapid market expansion and premium positioning in vaccines, with strong potential for high-margin, recurring revenues and first-mover advantages.

- Operational efficiency and breakthrough pipeline support sustainable growth, while industry trends drive significant partnering and shareholder value-creation opportunities.

- Heavy reliance on a narrow pipeline and key partnerships, intensifying competition, regulatory hurdles, and weak new revenues all heighten risks to future profitability.

Catalysts

About Arcturus Therapeutics Holdings- Engages in the development of infectious disease vaccines and other products within liver and respiratory rare diseases.

- While analyst consensus views European approval for KOSTAIVE as a driver of incremental revenue, a more bullish perspective is that the vaccine's self-amplifying mRNA technology and broad variant adaptability position it as a potential new gold standard, opening doors for rapid penetration in upcoming booster markets and driving both sustained and accelerating multi-year revenue growth from annual vaccinations and variant updates, especially as pandemic preparedness rises as a global policy priority.

- Analyst consensus expects KOSTAIVE's U.S. and U.K. regulatory filings to expand market access over time, but Arcturus' strategic platform approval approach and rapid adaptation to variant requirements could position it to capture first-mover advantage for platform switching, resulting in significant outsized market share gains, premium pricing, and high-margin recurring revenues in the world's largest vaccine markets upon approval.

- Recent clinical and operational momentum in ARCT-032 for Cystic Fibrosis and ARCT-810 for OTC deficiency highlight Arcturus' breakthrough in mRNA delivery and purification, which can enable expansion into additional high-need indications related to chronic and age-related diseases, creating significant new addressable market segments and supporting long-term topline and earnings growth as society ages and healthcare needs shift.

- Arcturus' streamlined focus, cost discipline, and capital-efficient operational model following restructuring provide a unique platform for margin expansion and sustainable profit growth, as operating expenses have been significantly reduced and the company now has cash runway into 2028-dramatically increasing the chance for positive net margins in coming years even with moderate sales ramp-up.

- As regulators and payers increasingly favor innovative genetic and RNA therapies, Arcturus is positioned to benefit from outsized licensing, partnership, and M&A opportunities from major pharmaceutical firms aiming to secure differentiated mRNA delivery technologies, which could translate into large non-dilutive cash inflows, milestone payments, and premium company valuations, thus potentially boosting both near-term earnings and long-term shareholder value.

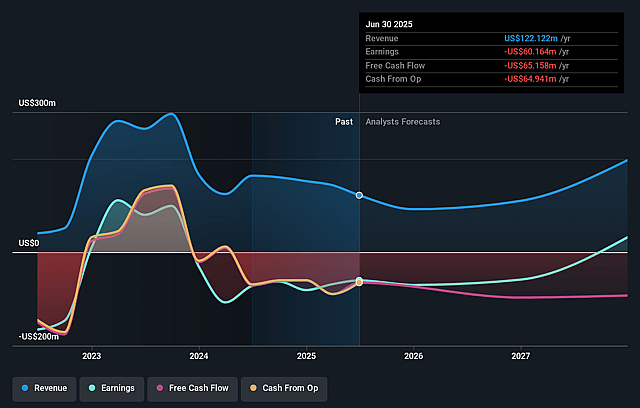

Arcturus Therapeutics Holdings Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Arcturus Therapeutics Holdings compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Arcturus Therapeutics Holdings's revenue will grow by 87.9% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from -49.3% today to 49.9% in 3 years time.

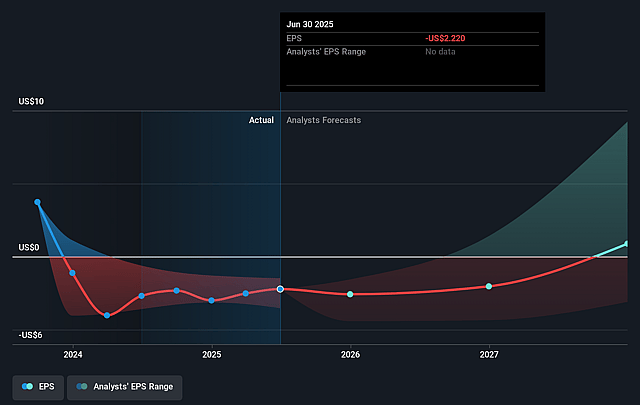

- The bullish analysts expect earnings to reach $404.2 million (and earnings per share of $12.5) by about August 2028, up from $-60.2 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 10.8x on those 2028 earnings, up from -7.9x today. This future PE is lower than the current PE for the US Biotechs industry at 17.1x.

- Analysts expect the number of shares outstanding to grow by 0.25% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.78%, as per the Simply Wall St company report.

Arcturus Therapeutics Holdings Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Heavy reliance on a narrow pipeline focused on Cystic Fibrosis and OTC programs, along with significant dependence on key partnerships such as CSL Seqirus, exposes Arcturus to concentration risk. If pivotal trials in these limited indications disappoint or partnerships falter, future revenues could decline sharply.

- The mRNA and LNP therapeutic space is becoming increasingly competitive, with larger pharmaceutical companies and competitors like Vertex and Moderna advancing their own RNA-based platforms. This intensifying rivalry could erode Arcturus' market share and limit long-term revenue growth.

- Persistent industry-wide regulatory hurdles, including heightened scrutiny over biosecurity risks and slow alignment with agencies on novel biomarkers and endpoints, may lengthen approval timelines and substantially increase compliance costs, which would negatively impact net margins and delay earnings generation.

- The company's financials reveal that revenue has declined compared to the prior year, mostly due to reduced CSL collaboration activities and amortization of upfront payments, suggesting that new commercial revenues are not yet strong enough to offset declining collaboration income, thus pressuring near-term earnings.

- Potential challenges in scaling mRNA and LNP manufacturing and commercialization infrastructure-combined with a cash runway that, while extended, depends on strict cost control-mean that any setbacks in product launches or delays in reaching regulatory or commercial milestones could quickly increase operating expenses faster than revenue growth, putting future net income at risk.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Arcturus Therapeutics Holdings is $132.96, which represents two standard deviations above the consensus price target of $70.89. This valuation is based on what can be assumed as the expectations of Arcturus Therapeutics Holdings's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $140.0, and the most bearish reporting a price target of just $42.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $810.2 million, earnings will come to $404.2 million, and it would be trading on a PE ratio of 10.8x, assuming you use a discount rate of 6.8%.

- Given the current share price of $17.48, the bullish analyst price target of $132.96 is 86.9% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.