Key Takeaways

- Aggressive cost controls and rapid tech adoption are driving sustainable profitability, giving PSQ a structural advantage over peers in efficiency and margins.

- Strong fintech positioning and values-based growth fuel robust user engagement, network effects, and outsized revenue potential within emerging digital and crypto ecosystems.

- A narrow, values-driven focus and regulatory risks may hinder user growth, revenue expansion, and competitive positioning in an evolving fintech and digital payments landscape.

Catalysts

About PSQ Holdings- Operates an online marketplace through advertising and eCommerce in the United States.

- Analyst consensus broadly acknowledges the efficacy of expense reductions, but materially underappreciates just how quickly and durably these cost savings are being realized-in just half a year, PSQ captured more than 80 percent of its projected annualized savings, which sets the stage for a structural reset in net margins and sustainable profitability at a pace rarely seen in the sector.

- While analysts broadly agree that the fintech pivot and new payments/BNPL stack will drive higher revenue, they routinely underestimate just how powerful PSQ's position is as a financial technology provider to ideologically-motivated merchants and consumers: the accelerating onboarding pace and outsized bundled adoption suggest a rapid expansion in total payment volume and recurring revenue well ahead of forecasts.

- As trust in mainstream technology and marketplaces continues to erode, PSQ is uniquely positioned to attract disenfranchised merchants and consumers at an accelerating rate, with values-based commerce driving network effects that materially boost user growth, retention, and long-term monetization, resulting in higher lifetime value and rapid top-line expansion.

- The integration of AI-driven underwriting and advanced machine learning throughout PSQ's fintech operations has already slashed credit defaults and is poised to unlock a defensible advantage, optimizing risk-adjusted returns and credit margins while enabling scalable automation and cost efficiency across the business.

- PSQ's proactive embrace of cryptocurrency payments and digital asset treasury strategies positions it to harness the immense tailwinds of decentralization, giving the company novel, high-margin product verticals and the flexibility to serve affinity communities left behind by traditional finance, setting up PSQ for outsized earnings growth as the regulatory environment stabilizes and crypto adoption accelerates.

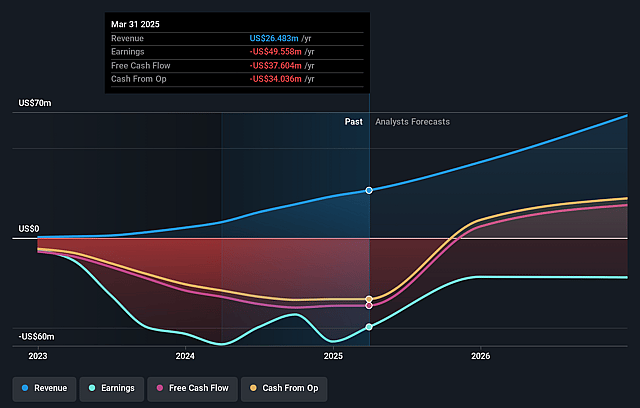

PSQ Holdings Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on PSQ Holdings compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming PSQ Holdings's revenue will grow by 59.8% annually over the next 3 years.

- Even the bullish analysts are not forecasting that PSQ Holdings will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate PSQ Holdings's profit margin will increase from -169.3% to the average US Interactive Media and Services industry of 10.6% in 3 years.

- If PSQ Holdings's profit margin were to converge on the industry average, you could expect earnings to reach $11.9 million (and earnings per share of $0.21) by about September 2028, up from $-46.7 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 48.8x on those 2028 earnings, up from -1.7x today. This future PE is greater than the current PE for the US Interactive Media and Services industry at 17.0x.

- Analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.02%, as per the Simply Wall St company report.

PSQ Holdings Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The strategic pivot away from the Marketplace and EveryLife brands to double down exclusively on fintech narrows PSQ's addressable market, and overreliance on a highly niche, values-driven user and merchant base may lead to long-term user growth stagnation and ultimately limit revenue expansion as core segments saturate.

- The company's ideological positioning and mission-driven focus make it particularly vulnerable to shifts in consumer sentiment, with increasing signs of polarization fatigue potentially reducing future merchant onboarding and customer demand, which would weigh directly on top-line revenue.

- While PSQ has demonstrated cost discipline and improved operating loss, continued high customer acquisition costs and the need to incentivize merchants in a crowded payments space could keep customer lifetime value low and prevent the company from achieving sustainable improvements in net margins.

- The industry's rapid move toward AI-powered personalization and large-scale integrated digital ecosystems dominated by established players raises the risk that PSQ's technological capabilities could be outpaced, making it more difficult to capture market share and pressuring both revenue and gross margin if user engagement lags.

- PSQ's exposure to tighter fintech and crypto regulation, combined with their stated intention to pursue a diversified digital assets treasury strategy and new crypto payments capabilities, could increase compliance and operational costs, distract management focus, and add volatility to earnings and cash flow, especially in the face of sector-wide regulatory scrutiny.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for PSQ Holdings is $8.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of PSQ Holdings's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $8.0, and the most bearish reporting a price target of just $3.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $112.5 million, earnings will come to $11.9 million, and it would be trading on a PE ratio of 48.8x, assuming you use a discount rate of 9.0%.

- Given the current share price of $1.76, the bullish analyst price target of $8.0 is 78.0% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.