Last Update 13 Dec 25

Fair value Increased 17%PSQH: Expanded Partnerships And New Platforms Will Drive Long-Term Upside Potential

Analysts have raised their price target on PSQ Holdings from approximately 3 dollars to 3 dollars and 50 cents, citing higher expected revenue growth and a willingness to pay a richer future earnings multiple, despite slightly lower projected profit margins and a modestly higher discount rate.

What's in the News

- Expanded partnership with Aero Precision, integrating PublicSquare Payments and Credova credit to provide a unified, end to end payments and financing stack across Aero's e commerce operations (Key Developments)

- Launch of PSQ Impact, a next generation political fundraising platform targeting Conservative campaigns and non profits, featuring low fees, enhanced data privacy, cancel proof payments, and AI driven reporting tools (Key Developments)

- Introduction of advanced fundraising features within PSQ Impact, including Allied Fundraising networks and crypto donation capabilities designed to increase flexibility and protect economic freedom for values aligned donors (Key Developments)

- Partnership with IDX Advisors to roll out cryptocurrency Treasury as a Service for PublicSquare merchants, enabling custody, trading, and yield strategies so businesses can more easily integrate digital assets (Key Developments)

- Reaffirmed guidance calling for approximately 6 million dollars in fourth quarter 2025 revenue and at least 32 million dollars in full year 2026 revenue, underscoring confidence in the growth trajectory (Key Developments)

Valuation Changes

- The fair value estimate has risen modestly from approximately 3 dollars per share to 3 dollars and 50 cents, reflecting higher expected long term earnings power.

- The discount rate has edged higher from about 9.19 percent to roughly 9.62 percent, indicating a slightly increased required return for equity investors.

- The revenue growth forecast has increased meaningfully from around 7.95 percent to approximately 12.02 percent, signaling stronger top line expectations.

- The net profit margin assumption has declined from roughly 11.02 percent to about 9.78 percent, incorporating expectations for somewhat higher operating costs or investment spending.

- The future P/E multiple has expanded from about 57.2 times to roughly 68.2 times, implying a richer valuation on projected earnings.

Key Takeaways

- Strategic focus on fintech and ideological alignment increases vulnerability to concentration risk and limits broad user and advertiser growth potential.

- Regulatory shifts, reputational concerns, and competition from larger platforms may constrain margin expansion and long-term revenue scalability.

- The company's focus on ideologically aligned fintech limits market reach, concentrates risk, and faces structural challenges amid regulatory, competitive, and profitability pressures.

Catalysts

About PSQ Holdings- Operates an online marketplace through advertising and eCommerce in the United States.

- While PSQ Holdings has demonstrated strong year-over-year revenue growth and significant improvements in operating expense control, the company's highly focused pivot toward fintech exposes it to concentration risks; this strategic narrowing could limit diversification and make top-line revenue highly sensitive to disruption or stagnation in its niche financial technology product suite.

- Despite growing demand for values-aligned platforms and distrust of mainstream institutions-which at first glance seem to favor PSQ's mission-driven commerce-intensifying social and political polarization may restrict the total addressable user base, ultimately capping future user acquisition and advertiser growth even as secular tailwinds benefit the broader affinity-commerce trend; this poses a structural constraint on long-term revenue and potential gross margin expansion.

- Although effective operational streamlining has led to substantial cost reductions and a narrowing net loss, the company's over-reliance on an ideologically unified audience and the risk that mainstream advertisers or larger merchants may shy away from the platform due to reputational or reach concerns suggest that, over time, scaling advertising revenue and driving higher net margins could become increasingly challenging.

- While PSQ's investment in AI-driven underwriting has markedly improved credit portfolio performance and reduced default rates, the digital financial services sector is subject to evolving regulatory scrutiny around data privacy and targeted advertising, meaning that margin gains and cost advantages from technology may be offset by growing compliance costs and restrictions on ad-driven or data-monetization business models.

- Despite the promise of crypto payments and alternative financial infrastructure-which could create high-margin new revenue streams-PSQ's bet on building payments systems for segments distrusted or underserved by mainstream providers leaves it vulnerable to competitive pressure from dominant mega-platforms and future regulatory policy shifts. This could threaten both gross margin and net income scalability in the long run.

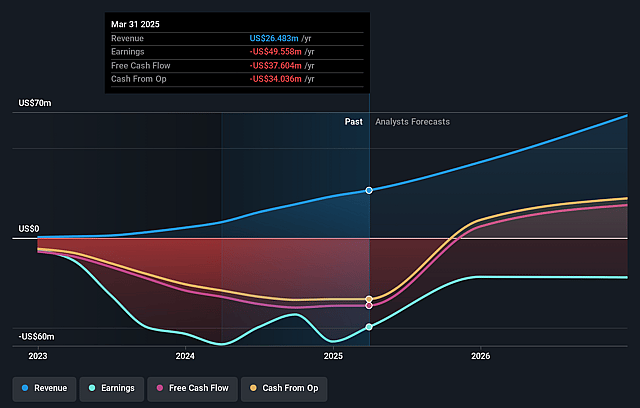

PSQ Holdings Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on PSQ Holdings compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming PSQ Holdings's revenue will grow by 7.9% annually over the next 3 years.

- The bearish analysts are not forecasting that PSQ Holdings will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate PSQ Holdings's profit margin will increase from -169.3% to the average US Interactive Media and Services industry of 11.0% in 3 years.

- If PSQ Holdings's profit margin were to converge on the industry average, you could expect earnings to reach $3.8 million (and earnings per share of $0.07) by about September 2028, up from $-46.7 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 57.2x on those 2028 earnings, up from -1.6x today. This future PE is greater than the current PE for the US Interactive Media and Services industry at 16.7x.

- Analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.19%, as per the Simply Wall St company report.

PSQ Holdings Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company's long-term strategy is to focus almost exclusively on ideologically aligned fintech services for a patriotic audience, which inherently limits addressable market size and could slow revenue growth and diversification opportunities over time.

- Ongoing reliance on values-driven commerce exposes PSQ Holdings to risks from deepening social and political polarization, making it difficult to win mainstream users and advertisers, which may restrain expansion of revenues and compress long-term earnings growth.

- A strategic pivot away from diversified revenue streams-by divesting higher-growth brands like EveryLife and its Marketplace-concentrates operational risk in the fintech segment, so any disruption in regulatory climate, competition, or customer preference in this niche could significantly impact future revenue and net margins.

- The introduction of new payment and crypto solutions relies on a favorable regulatory environment; accelerating regulatory scrutiny of data privacy, digital assets, and compliance-as well as competition from established financial and technology giants-may drive up compliance costs and cap profitability.

- Declining gross margins (from 67% to 53% year-over-year) and continued operating losses, despite cost-cutting, highlight persistent structural challenges, and recent reductions in sales and marketing investment may hamper the company's ability to efficiently scale user acquisition and revenue in an already fragmented and competitive fintech landscape.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for PSQ Holdings is $3.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of PSQ Holdings's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $8.0, and the most bearish reporting a price target of just $3.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $34.7 million, earnings will come to $3.8 million, and it would be trading on a PE ratio of 57.2x, assuming you use a discount rate of 9.2%.

- Given the current share price of $1.65, the bearish analyst price target of $3.0 is 45.0% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on PSQ Holdings?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.