Key Takeaways

- Shrinking digital advertising budgets and increased use of ad-blockers threaten revenue and profitability, intensified by stricter global privacy regulations.

- Dependence on saturated verticals and affiliate revenues exposes the business to sudden declines from partner changes and shifting digital consumption trends.

- Strong execution in high-growth verticals, diversified revenue streams, and disciplined capital allocation position Ziff Davis for sustained margin expansion and stable long-term profitability.

Catalysts

About Ziff Davis- Operates as a digital media and internet company in the United States and internationally.

- The accelerating shift of digital advertising budgets towards a handful of dominant tech platforms like Google, Meta, and Amazon is expected to further shrink the available advertising market for publishers such as Ziff Davis over time, which could depress advertising revenue growth and reduce profitability over the long term.

- Growing prevalence of ad-blockers and privacy-oriented browsing, coupled with heightened regulatory scrutiny and tightening of privacy regulations globally, may further limit the company’s ability to monetize its audience and erode effectiveness in performance marketing, presenting ongoing risks to both top-line digital revenue and net margins.

- Structural headwinds in digital media consumption, such as the proliferation of generative AI tools and content aggregation services, threaten to divert organic traffic away from publisher websites. This could disintermediate users and sharply reduce high-margin monetizable audience reach, leading to potential declines in both revenue and EBITDA.

- Core growth verticals like tech, health, and gaming are at risk of saturation or even secular stagnation, as evidenced by uneven performance across segments, with some (such as Cybersecurity & Martech) already experiencing organic revenue declines. Prolonged stagnation or decline in user engagement in these critical businesses would weigh on future earnings and margin expansion.

- Ziff Davis' heavy reliance on affiliate and lead-generation revenue increases exposure to abrupt changes in partner terms or major platform algorithm updates, threatening the predictability of EBITDA and the stability of free cash flow. A deterioration in these commercial relationships or changes beyond the company's control could result in sudden downward adjustments to both revenue and profitability guidance.

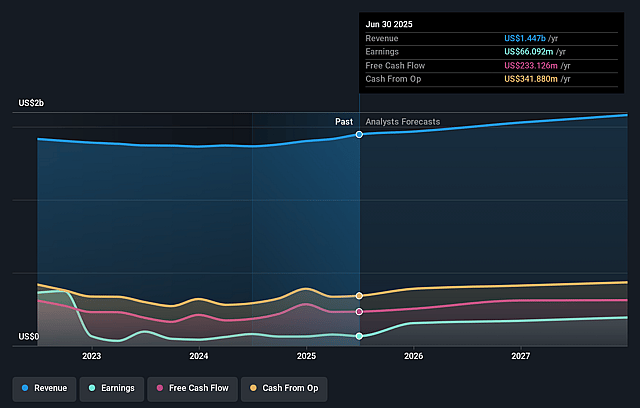

Ziff Davis Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Ziff Davis compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Ziff Davis's revenue will grow by 3.3% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 5.4% today to 13.0% in 3 years time.

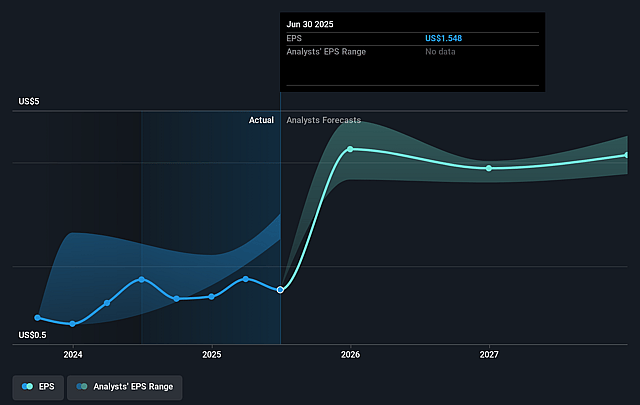

- The bearish analysts expect earnings to reach $202.3 million (and earnings per share of $3.78) by about May 2028, up from $76.7 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 7.1x on those 2028 earnings, down from 18.4x today. This future PE is lower than the current PE for the US Interactive Media and Services industry at 17.4x.

- Analysts expect the number of shares outstanding to decline by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.82%, as per the Simply Wall St company report.

Ziff Davis Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Robust growth across four out of five reportable segments, with key verticals such as Tech & Shopping showing nearly 18% revenue growth and over 44% adjusted EBITDA growth in the most recent quarter, suggests sustained revenue and margin expansion opportunities in these high-value sectors.

- Ongoing success with disciplined capital allocation, including active share repurchases that have reduced the share count by nearly 12% over the past year and consistent accretive M&A, increases the potential for long-term earnings per share growth and shareholder value creation.

- Diversified revenue streams from advertising, performance marketing, subscriptions, and licensing, along with multiple consumer and enterprise end markets, lower the company’s dependence on any single business model or market, thereby supporting revenue stability and margin resilience.

- Strength in proprietary technology and services like Speedtest, Downdetector, and Moz, and a positive outlook for initiatives such as WiFi 7 deployment and the Best of CES awards, position Ziff Davis to capitalize on ongoing digitization and evolving digital infrastructure, likely sustaining or increasing EBITDA and cash flows.

- The relatively low exposure to programmatic advertising and the company’s focus on direct, endemic advertising partnerships in high-value verticals, combined with a growing subscription base and robust licensing business, reduce vulnerability to shifts in digital ad ecosystems and support long-term profitability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Ziff Davis is $34.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Ziff Davis's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $60.0, and the most bearish reporting a price target of just $34.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $1.6 billion, earnings will come to $202.3 million, and it would be trading on a PE ratio of 7.1x, assuming you use a discount rate of 8.8%.

- Given the current share price of $33.45, the bearish analyst price target of $34.0 is 1.6% higher. The relatively low difference between the current share price and the analyst bearish price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.