Key Takeaways

- Enhanced AI-driven data monetization and granular segment disclosures are boosting investor confidence and unlocking higher valuation potential across diverse, profitable business verticals.

- Strategic global expansion and targeted acquisitions are accelerating recurring revenue streams, strengthening Ziff Davis's position in high-growth, high-margin technology and subscription markets.

- Structural shifts in digital media and tightening privacy rules threaten Ziff Davis's advertising reach, highlight overreliance on acquisitions, and raise risks of more volatile earnings.

Catalysts

About Ziff Davis- Operates as a digital media and internet company in the United States and internationally.

- Analyst consensus expects mid-single digit revenue growth and moderate margin expansion from segment performance and transparency, but given Ziff Davis is posting double-digit revenue and EBITDA growth across most segments, a return to sustained double-digit organic and inorganic revenue growth is now likely and could drive EBITDA margins back toward mid-30 percent levels, causing a significant upward re-rating of both earnings and net margin expectations.

- While analysts see the new segment disclosures as helping investor confidence, these granular disclosures are enabling clearer sum-of-the-parts valuation, which evidence suggests could reveal a material intrinsic value premium well above current trading levels as investors realize the diversity and profitability of each vertical, rapidly narrowing the current valuation discount.

- The company's enhanced use of proprietary AI-driven data platforms is unlocking unprecedented levels of first-party data monetization and privacy-protected audience targeting; this positions Ziff Davis to disproportionately benefit from the long-term shift away from third-party data and further increase advertising yields, lifting both revenues and net margins over time.

- Rapid expansion in emerging markets and growing global internet access are driving sharply higher engagement and monetization of flagship platforms like Speedtest, IGN, and Everyday Health, opening vast untapped audiences and increasingly shifting the revenue base toward high-growth, high-margin subscription and data licensing streams.

- Ziff Davis is leveraging its strong balance sheet and free cash flow to aggressively pursue M&A in high-growth, high-margin B2B SaaS and cybersecurity verticals, with acquisitions already contributing to organic growth and expected to accelerate recurring revenue, supporting ongoing EPS growth and further multiple expansion.

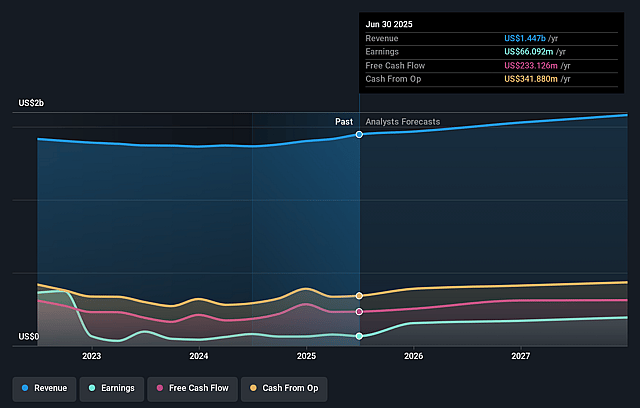

Ziff Davis Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Ziff Davis compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Ziff Davis's revenue will grow by 4.4% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 4.6% today to 14.0% in 3 years time.

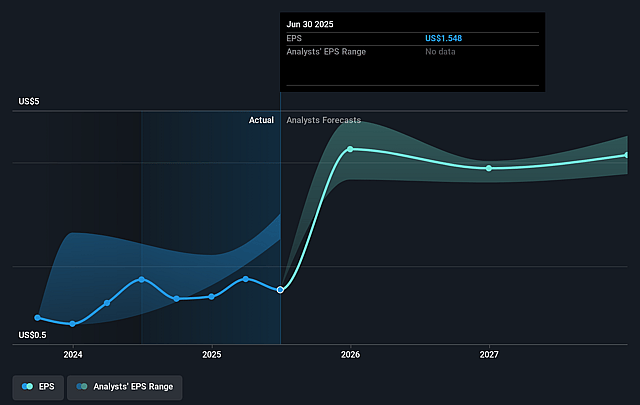

- The bullish analysts expect earnings to reach $229.9 million (and earnings per share of $5.36) by about September 2028, up from $66.1 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 12.1x on those 2028 earnings, down from 23.7x today. This future PE is lower than the current PE for the US Interactive Media and Services industry at 17.0x.

- Analysts expect the number of shares outstanding to decline by 4.07% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.44%, as per the Simply Wall St company report.

Ziff Davis Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Heightened privacy regulations and increasing restrictions on third-party data collection are likely to reduce Ziff Davis's ability to target ads effectively across its digital media properties, which would create long-term downward pressure on digital advertising revenue.

- Ongoing consolidation of digital advertising budgets towards mega-platforms such as Google, Meta, and Amazon could further dilute Ziff Davis's market share and bargaining power with advertisers, leading to declining ad yields and softening revenue growth for its core online businesses.

- Secular industry shifts towards generative AI search, zero-click experiences, and content aggregation mean that a significant portion of Ziff Davis's SEO-driven traffic faces the risk of sustained decline, which would erode user reach and ultimately threaten overall revenue and recurring earnings.

- Reliance on an acquisition-led growth model exposes Ziff Davis to ongoing integration challenges and potential goodwill impairments, which in a slowing or cyclical digital media environment could compress net margins and introduce volatility in reported earnings.

- Ziff Davis's limited diversification outside digital publishing and subscription services leaves it exposed to industry downturns such as increased ad fraud scrutiny, subscription fatigue among end users, and the growing preference for direct-to-consumer influencer content, all of which could contribute to more cyclical topline growth and earnings instability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Ziff Davis is $59.09, which represents two standard deviations above the consensus price target of $45.29. This valuation is based on what can be assumed as the expectations of Ziff Davis's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $60.0, and the most bearish reporting a price target of just $40.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $1.6 billion, earnings will come to $229.9 million, and it would be trading on a PE ratio of 12.1x, assuming you use a discount rate of 9.4%.

- Given the current share price of $38.27, the bullish analyst price target of $59.09 is 35.2% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Ziff Davis?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.