Key Takeaways

- Ad-driven revenues face structural headwinds from stricter privacy laws, rising competition, and shifting advertising budgets to social and video platforms.

- Acquisition dependence heightens integration risks and earnings variability, while AI content proliferation and ad blockers erode profitability and audience reach.

- Strategic acquisitions, diverse segment growth, advanced data-driven advertising, and strong capital discipline are positioning Ziff Davis for sustained expansion and long-term margin stability.

Catalysts

About Ziff Davis- Operates as a digital media and internet company in the United States and internationally.

- Leadership in digital content and advertising faces major threats from increasing privacy regulations and stricter data protection laws, which will limit user targeting and dramatically reduce the effectiveness of Ziff Davis's advertising-driven revenue streams, resulting in structural revenue headwinds and lowering net margins as ad rates and campaign performance decline over time.

- The company's independent platforms are likely to lose market share as tech giants such as Google, Meta, and Amazon continue to dominate digital advertising and content distribution, leading to audience erosion and intensifying pricing pressure that will undercut Ziff Davis's top-line growth and suppress long-term earnings power.

- As advertising budgets shift toward video and influencer-led social platforms like TikTok, YouTube, and Instagram, legacy digital publishers such as Ziff Davis are likely to see diminished advertiser interest, making it increasingly difficult to secure lucrative campaigns; this will stifle revenue growth and cause margin compression as operating leverage deteriorates.

- Reliance on acquisition-driven growth rather than robust organic expansion leaves Ziff Davis exposed to mounting integration costs, potential impairment of acquired assets, and greater variability in earnings, making future margins and earnings per share increasingly unpredictable and vulnerable to downside shocks.

- The proliferation of AI-generated content is expected to saturate the market with low-cost alternatives, eroding Ziff Davis's differentiation and causing cost per mille rates to collapse; coupled with widespread ad blocker adoption and user migration away from traditional web portals, this will significantly reduce effective ad inventory, resulting in falling revenues and structurally lower profitability for the long term.

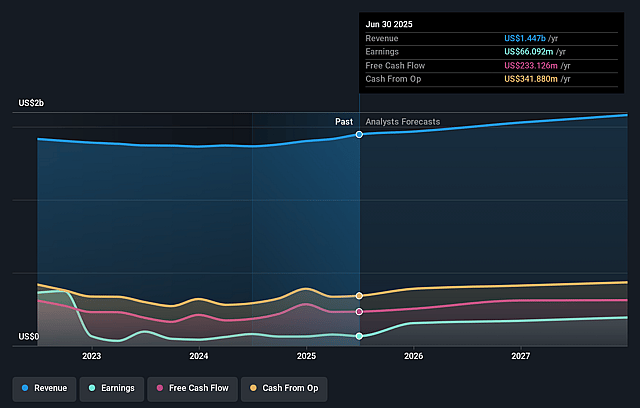

Ziff Davis Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Ziff Davis compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Ziff Davis's revenue will grow by 3.2% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 4.6% today to 14.1% in 3 years time.

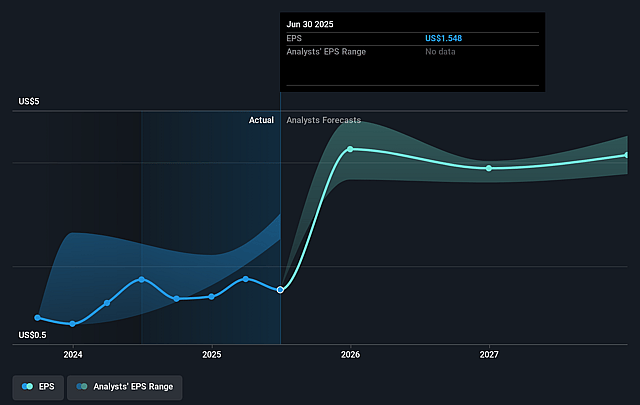

- The bearish analysts expect earnings to reach $224.6 million (and earnings per share of $4.26) by about August 2028, up from $66.1 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 6.8x on those 2028 earnings, down from 22.8x today. This future PE is lower than the current PE for the US Interactive Media and Services industry at 16.5x.

- Analysts expect the number of shares outstanding to decline by 6.72% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.52%, as per the Simply Wall St company report.

Ziff Davis Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Ziff Davis has demonstrated strong and diverse revenue growth across its core segments, with four out of five divisions increasing revenues in the latest quarter and Health & Wellness, Connectivity, and Gaming & Entertainment achieving double-digit growth, which suggests resiliency and continued expansion of the top line.

- Strategic acquisitions and ongoing integration, particularly in high-value verticals like cybersecurity, martech, and health & wellness, are driving incremental value and enabling Ziff Davis to diversify its revenue streams, supporting sustained margin growth and improved earnings visibility.

- The company maintains a disciplined capital allocation framework, underpinned by a healthy balance sheet, significant cash reserves, and low leverage, which enables robust share repurchases and targeted M&A activity, supporting shareholder value through both earnings per share improvement and future growth opportunities.

- Ziff Davis is successfully leveraging proprietary first-party data and advanced AI-driven platforms to enhance advertising solutions for clients and build privacy-protected, high-value audience segments, which should help them capitalize on the growing shift toward performance-based, outcome-oriented digital marketing, underpinning future advertising and performance marketing revenue expansion.

- The company's exposure to secular trends such as growing digital transformation, increasing demand for digital health solutions, and rising global connectivity positions it to benefit from expanding addressable markets, supporting both sustained revenue growth and margin stability over the long term.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Ziff Davis is $35.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Ziff Davis's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $60.0, and the most bearish reporting a price target of just $35.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $1.6 billion, earnings will come to $224.6 million, and it would be trading on a PE ratio of 6.8x, assuming you use a discount rate of 9.5%.

- Given the current share price of $36.68, the bearish analyst price target of $35.0 is 4.8% lower. The relatively low difference between the current share price and the analyst bearish price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.