Key Takeaways

- Heavy reliance on digital ad markets and shifting consumer trends could lead to unstable revenue and strained financial outlook.

- Significant investments in advanced advertising technologies and partnerships may impact margins if not successfully monetized.

- NCM's innovative ad offerings, demographic reach, and strategic tech investments position it for growth in revenue, margins, and advertiser engagement.

Catalysts

About National CineMedia- Through its subsidiary, National CineMedia, LLC, operates cinema advertising network in North America.

- The company's strong reliance on a shifting advertising landscape away from traditional linear TV towards more digital and variable platforms could lead to unstable revenue streams. This ongoing shift increases the dependency on digital ad pricing and audience engagement metrics, impacting future revenue stability.

- The anticipated increase in high-value entertainment partnerships and strategic investments, such as those in programmatic and self-serve offerings, may require substantial capital investment, which could weigh on net margins and earnings unless these monetized channels perform optimally.

- With a growing interest in premium ad formats and increased scatter market purchases, any downturn or shift in advertiser demand could severely impact the company's pricing power and margins, thus affecting net profitability.

- The incorporation of advanced technologies, including new retargeting platforms and data analytic capabilities, represents a significant operational focus but also introduces risk if technological investments fail to drive predicted growth in engaged audiences and advertising effectiveness, which could dampen earnings.

- The noted decline in attendance and decrease in national advertising CPMs, juxtaposed with heavy reliance on the unpredictable box office performance, may lead to a strained financial outlook if consumer trends shift, adversely affecting revenue potential.

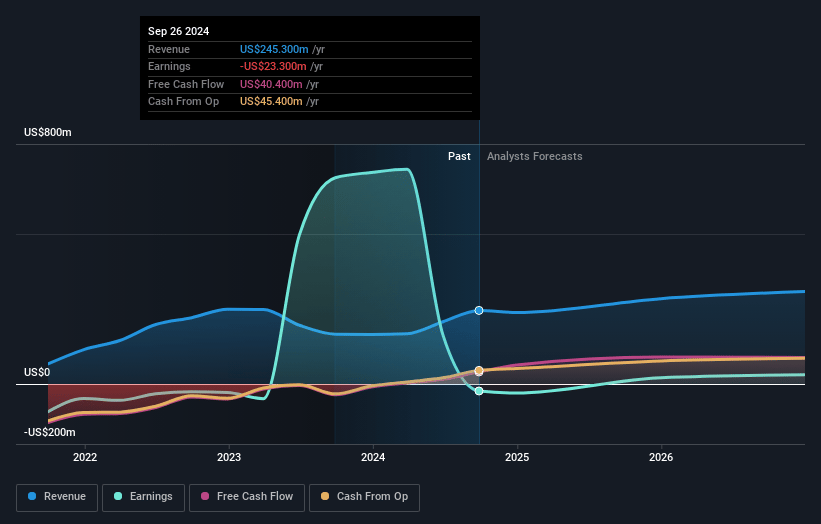

National CineMedia Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming National CineMedia's revenue will grow by 11.2% annually over the next 3 years.

- Analysts assume that profit margins will increase from -9.5% today to 17.3% in 3 years time.

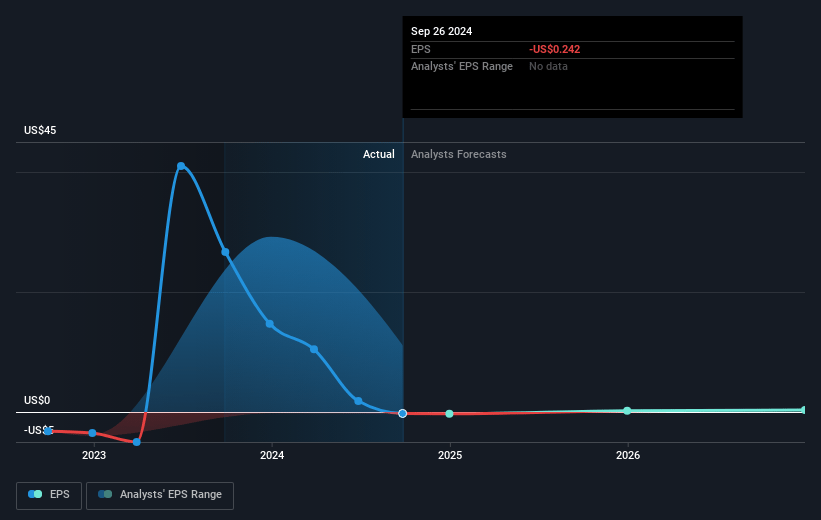

- Analysts expect earnings to reach $58.6 million (and earnings per share of $0.63) by about December 2027, up from $-23.3 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 15.2x on those 2027 earnings, up from -30.3x today. This future PE is greater than the current PE for the US Media industry at 14.9x.

- Analysts expect the number of shares outstanding to decline by 0.76% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.26%, as per the Simply Wall St company report.

National CineMedia Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The cinema industry demonstrated strong year-over-year growth, with several films breaking box office records and expanding NCM's potential revenue streams. This sustained box office momentum suggests a favorable environment for increasing NCM’s future revenue potential.

- NCM's ability to penetrate hard-to-reach demographics like Gen Z and millennials appeals to advertisers, showing the company's potential for increasing ad revenue through capturing valuable audience segments. This could positively impact net margins through enhanced advertiser interest.

- The shift in advertising budgets towards more flexible and real-time solutions in the scatter market rather than traditional upfront commitments has benefited NCM with a substantial rise in revenue per attendee, indicating room for earnings growth if the trend continues.

- NCM’s innovative advertising offerings, including high-value ad formats such as the Platinum unit, retargeting solutions like Boomerang and Boost, and experiential marketing, highlight a diverse revenue stream potential, which could stabilize and grow future revenue and profit margins.

- Strategic investments in technology and partnerships, such as with Snowflake, enable NCM to offer advanced targeting and performance analytics to advertisers, potentially enhancing the company's earnings by delivering measurable results and attracting more advertising spend.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $8.06 for National CineMedia based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $337.7 million, earnings will come to $58.6 million, and it would be trading on a PE ratio of 15.2x, assuming you use a discount rate of 6.3%.

- Given the current share price of $7.45, the analyst's price target of $8.06 is 7.6% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives