Last Update 22 May 25

Fair value Increased 12%Generative AI is in fact, sustaining - Google I/O 2025

From early discussions in 2023 about how Alphabet's core business was going to be disrupted by ChatGPT, Alphabet has shown over the last 2 years that it can rise to the challenge and adapt.

I won't repeat what was covered at the Google I/O 2025 conference the other day, or the Q1 2025 earnings report, but if you don't want to watch the Google I/O 2025 event, check out The Verge's 32 minute summary here:

https://www.youtube.com/watch?v=bDVpI23q8Zg&ab_channel=TheVerge

And you can find its Q1 2025 earnings results slides here:

https://abc.xyz/assets/0d/82/1464241c40ca89c5981759fc541c/2025q1-alphabet-earnings-slides.pdf

As for how both of these impact my narrative on Alphabet, here are a few of my thoughts:

- The recent fear around Google Search being dethroned (as Apple's Safari possibly opens up to alternatives, and people use ChatGPT instead of search) seems to be a bit overblown from my point of view.

- While the search business is still performing well, it appears to be evolving and adapting to the changing landscape with reportedly less cannibalisation than I expected from AI overviews. While search is no doubt a legacy business, there are still industry tailwinds and they're heavily integrating Gemini, making it's output to users more useful. While it no doubt needs refinement, it's continually getting easier to ask Google search anything, and get a useful answer with AI overview.

- While I find it hard to validate, Sundar Pichai and the CBO, Philipp Schindler alluded to the fact that they're seeing roughly the same monetisation as with traditional search and that they're "happy with what they're seeing". While that may be true, I think Ads within AI overviews are so far incredibly rare(?), or if thy are present, they're a tiny fraction of what's shown at the moment(?). Not sure. So it remains to be seen if this is still the case as AI overviews (and ads within them), get rolled out more broadly. Something I'll need to continue watching.

- My catalyst for "Generative AI to be sustaining, not disruptive" seems to be playing out. From watching the I/O event, it appears that Generative AI has exponentially increased the value that Google can provide to users all across it's ecosystem of offerings.

- The company mentioned that it's Gemini app, a direct competitor to OpenAI's ChatGPT, has 400m MAU, while recent court filings indicate that ChatGPT has roughly 600m MAU. With their pricing plans for Google AI Pro ($20 USD/month) and Google AI Ultra ($250 USD/month), I expect to see additional revenue earned from these offerings as it's large user base slowly starts taking up these offerings. By the way, can one of the big tech names please create a product that isn't named pro, max or ultra? Cheers.

- A promising sign of the cloud business continuing to do well is evident in it's revenue (up 28% YoY) and margins (now 17.8%, up from 9.4% the prior year, and close to breakeven when I originally wrote the narrative). The trends here in both revenue and earnings are faster than my original estimates, which is great, and proof that this segment is moving in the right direction.

- We're also slowly seeing Alphabet's reliance on Google Services revenue reduce over time. In 2017, Google services revenue accounted for 99% of total revenue, and today, in 2025, it accounts for 86%.

- That's not even because Services revenue has reduced, it's simply because annual Google Cloud revenue has grown much faster, from $5bn in revenue in 2017, to $45bn LTM in the latest report.

- The company has a lot of operating leverage, and it's cost cutting initiatives have helped it's overall net profit margins from around 21% when I originally started this narrative, to now 30.9% as of Q1 2025 quarter.

- My original estimates were for 25% net margins by 2029, but the fact that it has reached 30% already shows I was too conservative. Reviewing the narrative, I don't believe there is a high probability of anything huge that will lead to a large enough decrease in revenue or increase in costs to send margins back down to 25% by 2029. For that reason, I'm going to update my valuation by increasing my profit margin estimates by a 5 percentage points to 30%.

- This increase my fair value estimate to $212 in 2030, up from $189 in 2029.

Overall, I'd summarise by saying that Google's dominance doesn't appear to be fading as much as many fear, digital advertising trends and cloud computing trends appear to still be a tailwind, Google has integrated and leveraged Generative AI into it's entire ecosystem (and monetised appropriately), and cost cutting initiatives and operational efficiency was even better than I expected, hence the upgrade in future profit margin estimates.

For now, Alphabet appears to be doing well and still have solid prospects ahead.

Key Takeaways

- Google’s dominance in search, and digital advertising industry growth will remain in tact.

- Cloud computing trends will support Google Cloud revenue growth

- Alphabet may implement AI slightly slower, but won’t fall behind

- Current estimates on costs per generative AI query are prohibitive to profitability

- Until processing power improves and makes generative AI cheaper, Google is unlikely to lose much market share.

- Cost-cutting initiatives will improve net profit margins to 25%.

Catalysts

Industry Catalysts

Secular Trend Of Digital Advertising Is Here To Stay

While it’s undeniable that the advertising market is going through a slowdown over late 2022 due to the huge increase in ad spend in the preceding 2-3 years, I believe these headwinds are temporary and driven primarily by macroeconomics factors. Decreased consumer discretionary spending due to inflation and higher interest rates have contributed to lower advertising spend from businesses.

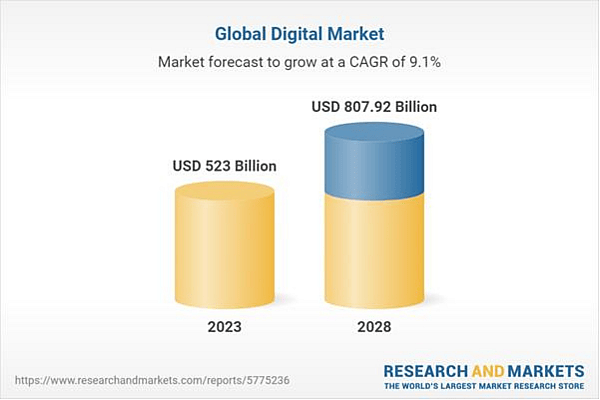

While this has led to Google’s year over year revenue growth being flat, it doesn’t spell the end for search or the company’s revenue growth. Digital advertising has largely undergone most of its higher growth phase already, but the market still has some growth left, which Google will benefit from. Industry reports from the likes of Research and Markets indicate that the global digital marketing industry could reach USD $807bn by 2028, up from an estimated $523bn in 2023, which is a compounded annual growth rate of 9.1%.

Source: Research and Markets

Cloud Computing Growth Will Continue Longer Term

Google Cloud is the fastest-growing segment in the company, at 37% growth between 2021 and 2022. However considering it only represents 9% of revenues, it will need to grow considerably to contribute a more meaningful amount to revenues.

Businesses want to remain competitive, and they are embracing the cloud-based digital solutions which will help them improve their efficiency, and scalability. And Alphabet is likely to benefit from this trend. Market.us conducted a report on the industry that estimates the Cloud computing industry will grow at 16% per year from 2023 to 2032.

Source: Market

Estimated Market Of Generative AI Solutions Will Benefit All Parties

According to Precedence Research, the market size for generative AI solutions is set to rise from $10.8B in 2022 to $118.1B by 2032. The generative AI market is expected to grow by a factor of 11X over the next decade, which translates to an annual average growth rate of 27%. This is the big opportunity for Google to get a slice of this market with its offerings, but I don't think this will occur in the short to medium term.

Company Catalysts

Generative AI To Be Sustaining, Not Disruptive.

Alphabet is well positioned for this technology to be “sustaining” rather than “disruptive” to its business. (concept from The Innovator's Dilemma book).

After all, Google’s research teams are the ones that made the technical breakthrough in 2017 for a better retention mechanism in these models, in the form of Transformers (which is the “T” in ChatGPT).

Google has been in the A.I. space since 2014 when they acquired DeepMind for more than $500 million. Since then it has had many milestones and accomplishments in the A.I. space that have resulted in it being identified as a pioneer in the A.I. space. It’s already using A.I. in many of its existing products, from Search and Maps, to Google Cloud. Some parts were built entirely off A.I., like Google Lens and Translate (Page 5 of the 2022 10-K) which used optical character recognition and machine learning.

Given they have a capable talent pool, technical capacity, huge amounts data, well established infrastructure and abundance of consumer touch points (15 products with >500 million users, and 6 of those have >2 billion users), they’re well positioned to implement valuable LLM use cases to their customers within their existing products and services (which they have already started).

Plenty Of Use Cases For Generative AI Within Google’s Ecosystem

Google views these latest Generative AI technologies that we’re becoming increasingly familiar with as experimental, which may explain why Google wasn’t the first to release to the public (like OpenAI did with ChatGPT). They have stated they want to take a “thoughtful and deliberate approach” to how they integrate these technologies into their existing products. While it seems the market viewed this as “lagging behind”, I am on board with this approach.

This tells me that as Google continues to incorporate PaLM 2 (and future generative AI models) into Search, Cloud and other services, they’ll do it in such a way that is in a finished state, and ultimately, valuable to the end user. Mainly because accuracy and dependability are crucial when it comes to offering a good online search experience or even certain generative A.I. tasks, depending on the use case. And currently, generative A.I. tech can still be a bit rough around the edges (admitted by Sam Altman, CEO of OpenAI).

LLM models are typically compared by the number of their parameters, where bigger is usually better. The number of parameters is a measure of the size and complexity of the model, and they define how the model behaves. For Google’s PaLM 2, it contains 540 billion parameters, compared to ChatGPT-3.5’s 175 billion parameters. While OpenAI has not confirmed the figure of parameters in GPT-4, rumours estimate it to be trained off 1 trillion parameters.

While that, on the surface, would make it more comprehensive than Google’s PaLM 2, there are other benefits that give more use cases and applicability to Google’s offering. PaLM 2 has multiple smaller models which are affectionately named “Gecko”, “Otter”, “Bison” and “Unicorn”, and these allow models to be implemented in different use cases.

Source: Google

Google stated: “Gecko is so lightweight that it can work on mobile devices and is fast enough for great interactive applications, even when offline”. This allows PaLM 2 to support an entirely different class of products and devices that might struggle to use GPT-4 (PaLM 2 will support 25 products and features within Google’s Suite).

During their I/O conference this year, Sundar Pichai had a screen behind him reading “Making AI helpful for everyone” with 4 sub-points being: “1. Improve knowledge and learning”, “2. Boost creativity and productivity”, “3. Enable others to innovate” and “4. Build and deploy responsibly”. If Google deployed a Generative A.I. model before it was ready and delivered incorrect results (like some instances with the technology), that would violate the first and last points they’re trying to deliver on.

While we have been provided visibility into how exactly these offerings are being implemented (through product announcements of their early stage product tests, and outlined use cases), it’s somewhat difficult to create financial estimates around the revenue impact of these innovations. We could estimate how these might be monetized and contribute to longer term revenue growth by assuming it's implemented in a similar manner to existing offerings on the market (which I’ll outline in my assumptions further down).

Additionally, consider nearly 60% of the world’s largest companies are Google Cloud customers, I’d imagine that their use cases align well with what these proposed AI services can offer (in terms of efficiencies), and what their budgets can allow. Google has outlined how some of their generative offerings, such as Vertex AI, Performance Max and others, can increase efficiency, and decrease workflow and costs, which I imagine will only improve with time and be quite appealing for many Cloud customers.

The Market Will Re-evaluate Google’s Prospects Once The Hype Settles

The market’s perception of Google versus Microsoft in the A.I race appears to be in favour of Microsoft due to the fact that consumers have first hand experience and visibility with ChatGPT at a large scale, and not many have firsthand experience with Google’s offerings.

I don’t see this as an issue, and in fact see it as an opportunity for when the market does start to grasp what Google has on offer, I believe they’ll re-rate the company accordingly with a higher earnings multiple. Currently, Microsoft trades at a PE multiple of 37x earnings, whereas Google trades at only 27x earnings.

Cost of Generative AI Is Currently Prohibitive To Profitability

An article in the Washington Post discussed the rarely talked about aspects of these AI chatbots: their costs. It said:

The tech giants staking their future on AI rarely discuss the technology’s cost. OpenAI (the maker of ChatGPT), Microsoft and Google all declined to comment. But experts say it’s the most glaring obstacle to Big Tech’s vision of generative AI zipping its way across every industry, slicing head counts and boosting efficiency.

This cost problem will eventually resolve itself as processing power becomes more powerful, efficient and cost effective to handle these demands. However the idea of A.I. being incorporated on a global scale into our lives in the very near future seems unlikely to me. Therefore, while I have no doubt it will happen eventually, it seems like we’re still a few years away from this occurring, which means market share for the likes of Alphabet will be relatively stable in the medium term.

Cost Cutting To Help With Improving Profit Margins

In the times of easy money, companies had expanding budgets and discretionary spending which hindered profit margins but expanded top line growth. For now, those days are over and companies are increasingly focusing on profitability and efficiency rather than growth.

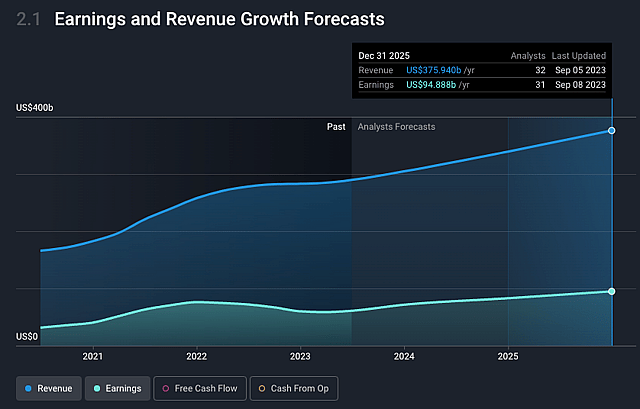

Source: Simply Wall St

Alphabet is no different, and the “company-wide OKR on durable savings to improve velocity and efficiency” will likely benefit shareholders. The workforce reduction, office space and infrastructure optimisation will likely flow through to bottom line, increasing profit margins.

Assumptions

Existing User Base Will Help With Uptake Of Generative AI Offerings

Google reportedly has 4 billion people who use its search engine, and 3 billion of those use G Suite products. I believe the Google Cloud part of the business will benefit from continued growth in the Cloud computing industry mentioned earlier, and the Generative AI opportunities listed at the top.

If Google offered a similar cost structure to the likes of ChatGPT for its G Suite products or search with its A.I. assistance integrated, and we assume it charges roughly $30 USD per month ($10 more than ChatGPT), per user, with a 2.5% uptake (75 million users), that could result in annual revenues of $27 billion, or 9.5% of current revenues (which are $284bn).

Again, these are all rough numbers and assumptions, but I do believe in 5 years time that this kind of revenue contribution could be possible. If it’s not done in this way, I believe they’ll develop some sort of monetisation method. I’ve attributed the $27bn to the Cloud business for valuation purposes).

Google To Be Re-rated Higher When Growth Becomes Apparent

When Google’s growth prospects become appreciated by the market, I believe it will trade at a higher earnings multiple. While I don’t expect Google to trade as high as 37x earnings like Microsoft, I do believe it could reach an earnings multiple of 30x.

Generative AI Adoption Will Be Slower Than Expected

While these big tech companies are proactively implementing this tech vertically within their businesses, costs are reportedly prohibitive to that being a profitable move to do at scale. I think the industry will more likely hit scale and generate meaningful revenues when they can offer these services on a more profitable, reliable and efficient basis. I believe this is likely to occur in 3-5 years time when processing power improves, and more widespread adoption occurs. I believe the competitive landscape will take time to change, and this assumptions contributes to my estimates of Google’s steady revenue growth and lack of market share decline.

Google's Cloud Computing Growth Will Match The Industry

Growth in the cloud computing market will be driven by increasing adoption of digital transformations initiatives within organisations. I assume that Google’s Cloud revenue will grow at 18.5% for the next 5 years, in line with expectations of the industry’s growth rate. This growth rate is about half its previous growth rate over the past year (37.5%).

Google Services To Grow Slightly Slower Than Industry

Based on the industry reports from Research and Markets, I believe that Google’s Search, Youtube and Network revenues will grow slightly below the industry average (9.1% p.a.), at 7% per year for the next 5 years.

Google Cloud Margins to Increase Over Next Few Years

Google’s Services business has net margins of around 34% net operating margins, ($86bn operating income / $253bn revenue), whereas Google Cloud (which only just became profitable in Q1 of 2023), has net margins of 2.5% ($191m / $7.4bn revenue). This will likely not persist as it reaches scale, and is worth comparing to bigger players to get an idea of where margins could get to. The likes of Amazon’s AWS reports profit margins of 24-29% for 2022, and so for Google Cloud, to be conservative, I assume it will reach 20% operating margins in 5 years time.

Cost-Cutting Initiatives Will Improve Net Margins

I expect net profit margins will improve from 21% to 25% due to the cost cutting initiatives. This will be done from a 1% reduction (as a portion of revenues) in each of the operating expenses of the business, and cost of revenues. Research and Development will decrease from 14% to 13% of revenues, Sales and Marketing will decrease from 9% to 8%, and General and Admin expenses will decrease from 6% to 5%.

Comments from Google on its cost of revenues lead me to believe that increased efficiencies in data centres could reduce the Cost of Revenues expense from 45% to 44% of revenues.

Risks

Cannibalisation of Search Revenue With Higher-cost Generative AI Solutions

There is a risk that if these A.I. advancements are in fact “disruptive” and not “sustaining” for Alphabet’s business model, its core services and search businesses could be at risk. If these A.I. advancements were able to reach scale and widespread adoption in the short to medium term, it may force Google to deliver these services as loss-making products in order to retain market share and users. This could reduce short-medium term revenues and profits since these services wouldn’t be as profitable as search. However I don’t believe this is likely and believe the company is well positioned to handle the higher cost of Generative AI services, and continue generating revenues from its core businesses.

Reliance On Digital Search Revenues Business

Google currently generates 89% of its revenue from Google Services, which is primarily from the digital advertising industry. IF there’s a prolonged slowdown in the advertising market, or competitors take significant market share in this space (e.g. TikTok, Meta, Bing, etc), then that will impact my revenue growth forecasts significantly. While I do not view this as an impact with a high probability, it is possible and worth keeping in mind to watch for trends in the advertising space as they unfold. I’ll be keeping an eye of the advertising market, and market share / revenues of competitors.

Market Share of Bing and ChatGPT Could Increase

There is of course the chance that users could gravitate towards Bing and other competitors if they provide a much better offering that incentivises switching. While this was a fear when ChatGPT and Bing upgrades were first announced, we’ve now been enlightened to the AI advancements Google has made in this area, so they haven’t been twiddling their thumbs. Their I/O conference in May this year outlined advancements in Bard, Search, Workspace, Cloud, Android, tools for developers and more, which will likely satisfy existing users in their ecosystem enough to stay. I don’t view competitors increasing market share as a huge risk because the habits developed by existing Google users are hard to break, and competing products typically need to be much better to incentivise a user to switch.

Risk Of A.I. Being Over Regulated

European Parliament debates proposed law on AI regulation | DW News

There are concerns from all parties involved about A.I.'s negative consequences and how to regulate the technology. Sam Altman (OpenAI’s CEO) did a tour of 22 countries and spoke to leaders from from France, the UK, India and many others about AI and how to handle it. His discussions with them seemed to imply that all of these leaders acknowledged the economic and social benefits from this technology, but they’re equally aware of the risks as well (which are shared by most, including Altman). His purpose was to engage in conversation with world leaders, and help address concerns about the negatives of A.I.

From Sam’s point of view, he’s keen for regulation, but wants to strike a balance where development is regulated (for example, limitations of the speed of product releases), while not crushing its potential.

In mid June, the EU overwhelmingly passed an A.I. act with intentions to protect consumers from potentially dangerous applications of the technology, including algorithmically driven discrimination, prolific misinformation, and surveillance. While this is more swift action than its US counterparts, it isn’t as restrictive as originally feared. Regardless, there are risks that some governments may over-regulate the industry, and this could hinder the growth of these technologies and business’s growth prospects in those parts of the world.

Have other thoughts on Alphabet?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

Simply Wall St analyst MichaelP holds no position in NasdaqGS:GOOGL. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. This narrative is general in nature and explores scenarios and estimates created by the author. The narrative does not reflect the opinions of Simply Wall St, and the views expressed are the opinion of the author alone, acting on their own behalf. These scenarios are not indicative of the company's future performance and are exploratory in the ideas they cover. The fair value estimate's are estimations only, and does not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that the author's analysis may not factor in the latest price-sensitive company announcements or qualitative material.