Narratives are currently in beta

Key Takeaways

- Expanding commercial partnerships and media rights deals are set to significantly enhance sponsorship and broadcasting revenue for Formula One Group.

- Increasing event attendance and innovative venue strategies could diversify and boost revenue streams from ticket sales and hospitality experiences.

- Financial risk and revenue volatility increase due to debt refinancing, event cancellations, and uncertain media rights negotiations, impacting overall earnings and market reach.

Catalysts

About Formula One Group- Through its subsidiary Formula 1, engages in the motorsports business in the United States and internationally.

- The completion of the MotoGP acquisition with funding secured, expectations for the acquisition to enhance growth, and decreased leverage imply potential revenue growth and a stronger financial position.

- Expanding the Formula One commercial partnerships with premium brands like LVMH, American Express, and Lenovo beginning in 2025 is likely to boost sponsorship revenue substantially.

- Increasing attendance and engagement at F1 events, including record-setting numbers at multiple races, suggest expanded revenue potential from ticket sales and hospitality experiences.

- The second Las Vegas Grand Prix serving as a hub for innovation, and potential year-round business opportunities could diversify and increase revenue streams from the venue.

- Strong media rights negotiations and growing streaming viewership are likely to boost broadcasting and digital revenue, especially with the potential renewal of U.S. media rights in 2025.

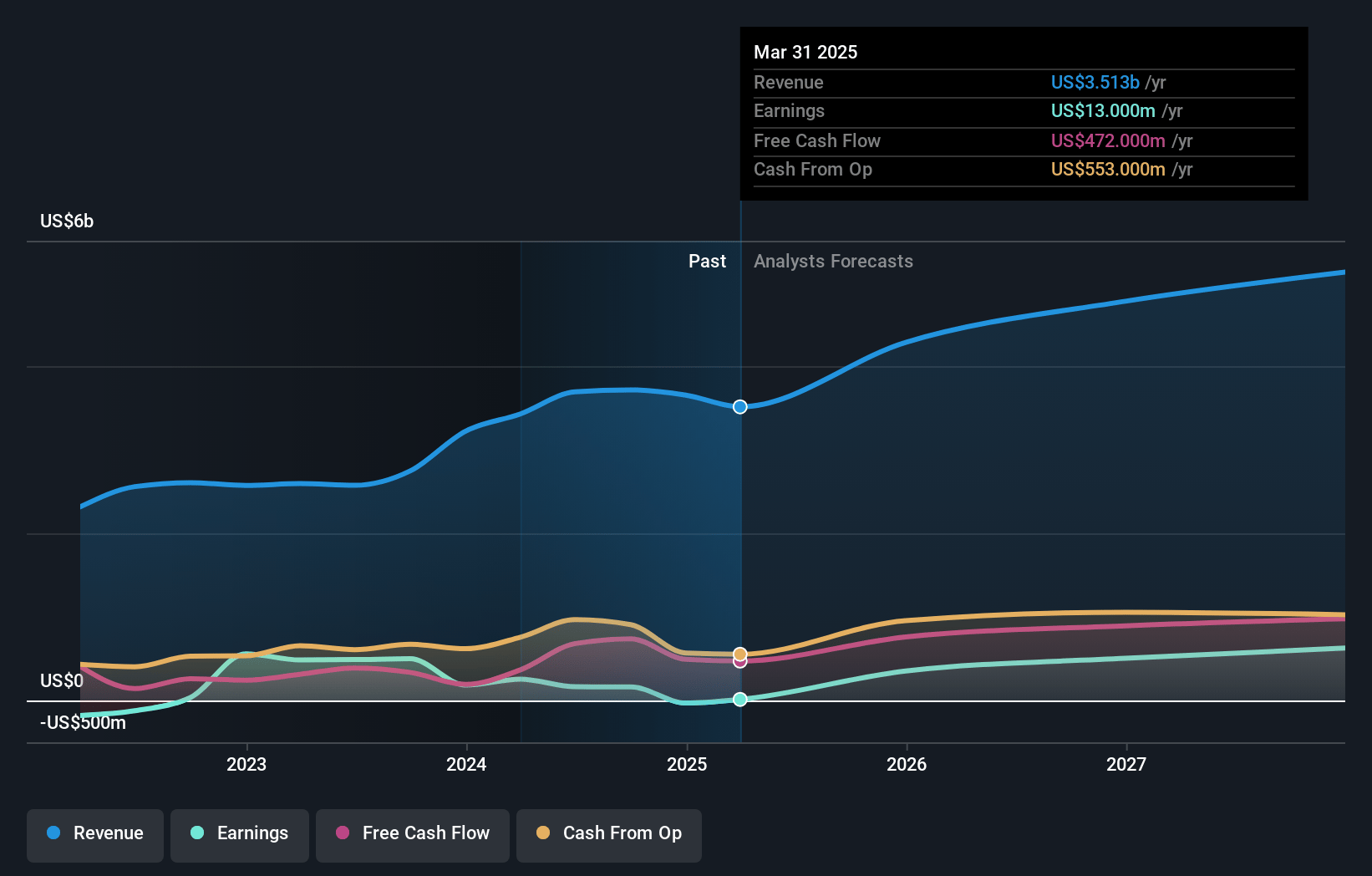

Formula One Group Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Formula One Group's revenue will grow by 8.8% annually over the next 3 years.

- Analysts assume that profit margins will increase from 7.5% today to 11.6% in 3 years time.

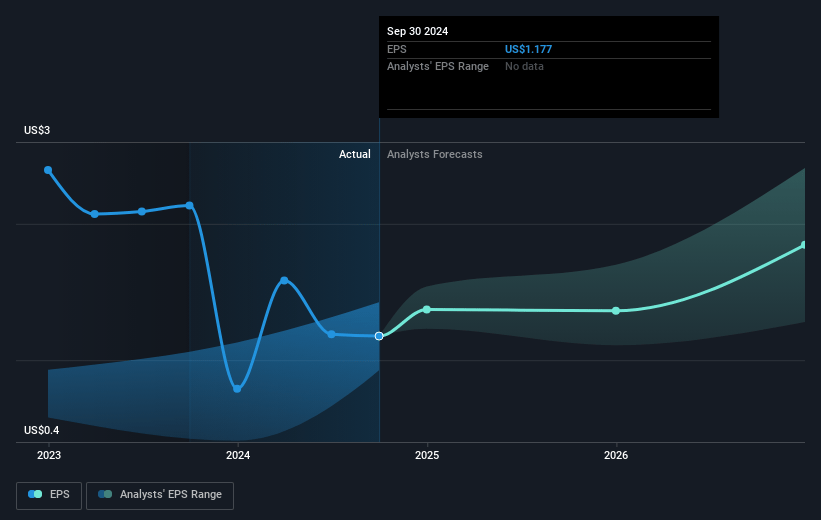

- Analysts expect earnings to reach $556.0 million (and earnings per share of $2.4) by about November 2027, up from $278.0 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $772.9 million in earnings, and the most bearish expecting $303 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 49.9x on those 2027 earnings, down from 72.7x today. This future PE is greater than the current PE for the US Entertainment industry at 21.5x.

- Analysts expect the number of shares outstanding to decline by 0.67% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.62%, as per the Simply Wall St company report.

Formula One Group Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The refinanced debt for Formula One Group, while necessary for funding acquisitions, increases leverage to a range of 3.5 to 4x after the MotoGP acquisition, which could heighten financial risk and affect earnings stability.

- The cancellation of the Valencia race in MotoGP due to flooding highlights potential operational and event risks resulting from unforeseen circumstances, which could negatively impact revenue.

- The reliance on high-profile events like the Las Vegas Grand Prix introduces revenue volatility, as seen with ticket revenue projections being down, potentially affecting overall revenue and profitability.

- Sponsorship revenue experienced a decline in the third quarter due to a lower pro rata recognition of race-based income, which could indicate potential fluctuations and uncertainties in revenue streams tied to race schedules.

- The ongoing negotiations around media rights, particularly in the U.S., and possible streaming partnership changes due to evolving viewer habits could introduce risks related to future revenue projections and market reach if not favorably resolved.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $96.36 for Formula One Group based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $125.0, and the most bearish reporting a price target of just $84.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $4.8 billion, earnings will come to $556.0 million, and it would be trading on a PE ratio of 49.9x, assuming you use a discount rate of 7.6%.

- Given the current share price of $85.59, the analyst's price target of $96.36 is 11.2% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives