Key Takeaways

- Platform safety, regulatory pressures, and changing user behaviors are driving up costs and threatening user trust, revenue, and profit margins over the long term.

- Prioritizing higher-quality users over growth will likely cause persistent declines in revenue and earnings, with future recovery relying on unpredictable user adoption.

- Investment in AI, global expansion, and product innovation strengthens Bumble’s user retention, revenue potential, and market position, while financial discipline supports sustainable long-term growth.

Catalysts

About Bumble- Provides online dating and social networking applications in North America, Europe, internationally.

- Long-term concerns about platform safety and authenticity—including persistent issues with bots, scams, fake profiles, and low user trust—are forcing Bumble to undertake extensive verification and moderation initiatives. These efforts are likely to reduce the total addressable user base, incur higher compliance and technology costs, and result in persistently elevated churn, all of which threaten revenue growth and erode net margins.

- The company’s focus on “quality over quantity” requires a shrinkage of its near-term paying membership base, a move that management itself expects will result in sequential and potentially multi-quarter declines in both revenue and earnings, as a smaller, but higher-quality, user cohort is prioritized. Recovery in growth trajectory is dependent on difficult-to-predict improvements in word-of-mouth adoption, making long-term top-line predictability low.

- Rising public skepticism and regulatory pressure on algorithm-driven social platforms, alongside intensifying privacy laws (such as GDPR and emerging US data privacy rules), are likely to require Bumble to make ongoing, substantial investments in legal compliance and data protection. This will not only increase operating expenses but also increase the risk of fines or reputational damage, weighing on long-term net income.

- Demographic trends in key developed markets—including declining marriage rates, changes in how younger generations use digital platforms, and broader tech fatigue—threaten to contract or destabilize the addressable pool of users seeking traditional dating experiences, which directly jeopardizes the company’s ability to sustain both user growth and premium conversions, dragging down revenue and earnings potential over the next decade.

- The rapid emergence of generative AI chatbots and non-human virtual companions is creating strong secular competition for time and money previously spent on human matchmaking platforms; this raises the risk that Bumble's core app and any expanded products could see increasing user disengagement and diminished relevance, pressuring both monetization rates and long-term earnings power.

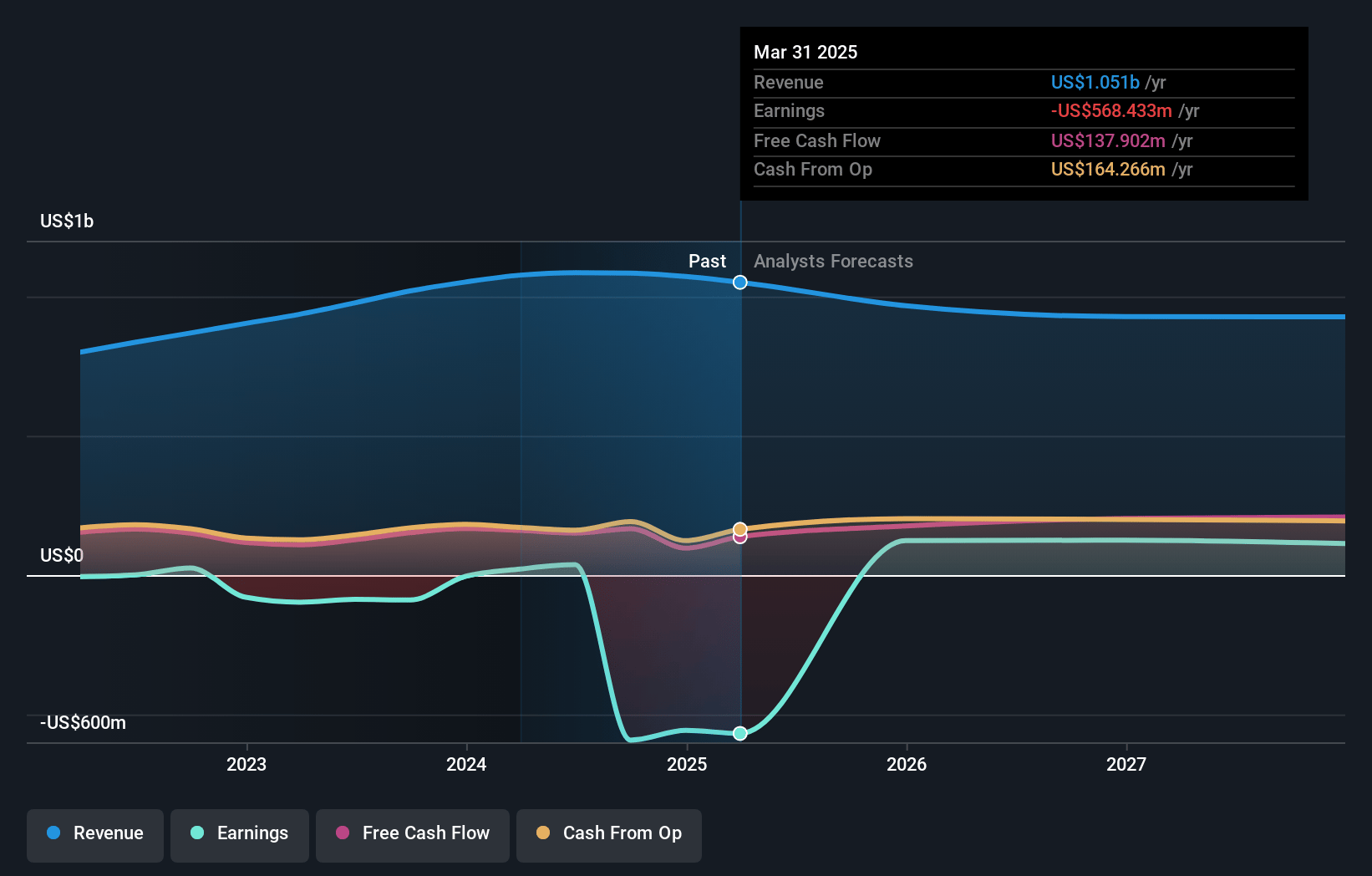

Bumble Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Bumble compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Bumble's revenue will decrease by 7.0% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from -54.1% today to 14.5% in 3 years time.

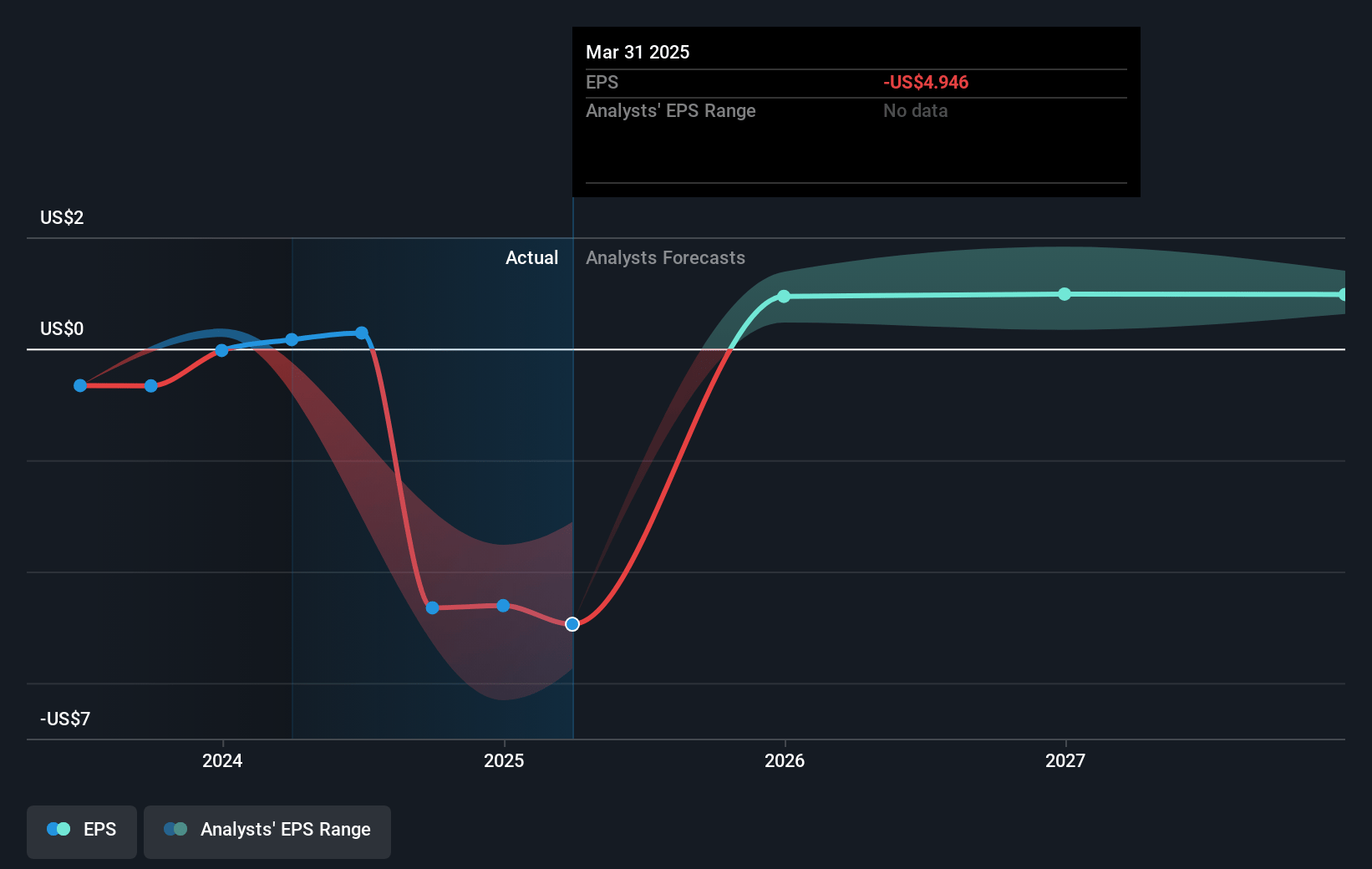

- The bearish analysts expect earnings to reach $122.8 million (and earnings per share of $0.88) by about July 2028, up from $-568.4 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 6.4x on those 2028 earnings, up from -1.3x today. This future PE is lower than the current PE for the US Interactive Media and Services industry at 16.8x.

- Analysts expect the number of shares outstanding to decline by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.14%, as per the Simply Wall St company report.

Bumble Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company is accelerating investments in AI-driven algorithms and profile verification, which could significantly improve user match quality, satisfaction, and stickiness, potentially increasing long-term user retention and conversion to paying subscribers, thereby boosting revenue and lifetime value per user.

- Bumble’s renewed focus on organic, word-of-mouth growth—once quality and user trust are restored—taps into secular trends of increasing societal acceptance of online dating, which could reignite sustainable user acquisition at lower cost, supporting stronger profit margins and revenue acceleration.

- The company’s robust expansion plans into international markets, where trends toward digital adoption and delayed marriage persist, could unlock major new growth opportunities and diversify earnings, positioning Bumble to capture a much larger global share of addressable user and revenue pools.

- Product innovation—with the launch of features like the Discover tab, a Coaching Hub, and continued growth of Bumble BFF—enhances ecosystem stickiness, provides cross-selling opportunities, and may improve ARPU and retention, positively impacting average revenue per user and long-term earnings power.

- A strong balance sheet, healthy cash flow generation, and disciplined cost control position Bumble to weather short-term growth headwinds, invest in product and brand building, and potentially consolidate market share if the competitive and regulatory environments intensify, supporting net margins and long-term profitability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Bumble is $5.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Bumble's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $9.0, and the most bearish reporting a price target of just $5.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $845.5 million, earnings will come to $122.8 million, and it would be trading on a PE ratio of 6.4x, assuming you use a discount rate of 9.1%.

- Given the current share price of $6.88, the bearish analyst price target of $5.0 is 37.6% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.