Key Takeaways

- AI-driven personalization, safety features, and premium offerings are set to enhance user engagement, retention, and monetization across geographies and demographics.

- Cost discipline, operational efficiency, and international expansion position Bumble for margin improvement and incremental long-term revenue growth.

- Market headwinds from shifting user preferences, mounting competition, and regulatory pressures threaten Bumble's growth, profitability, and relevance in a rapidly evolving digital landscape.

Catalysts

About Bumble- Provides online dating and social networking applications in North America, Europe, internationally.

- The accelerated rollout of advanced AI-driven personalization and safety features—which include algorithmic matching, identity verification, and member coaching—positions Bumble to deliver higher quality, more relevant experiences that increase user engagement, retention, and ultimately ARPU, driving sustained revenue and improving future earnings power.

- As digital socializing and online dating continue to become more normalized worldwide, Bumble’s trusted women-first brand and leadership in user safety resonate strongly, supporting differentiated user acquisition, deeper market penetration, and enhanced monetization opportunities across geographies and demographics—bolstering the company’s long-term revenue growth trajectory.

- The company is undergoing a reset with disciplined cost control, operational efficiency, and a sharp pivot towards organic growth, with immediate actions already reducing headcount and marketing spend by tens of millions of dollars—resulting in higher EBITDA margins and stronger net income in the medium

- and long-term.

- The planned, phased expansion into international markets is set to resume following the product reset, with a long runway for user base growth in large, underpenetrated regions where demand for digital connection is on the rise, directly supporting future top-line revenue acceleration.

- Bumble’s diversification into non-romantic social networking (such as Bumble BFF) and the introduction of new premium product features, coaching hubs, and community discovery tools are expected to create incremental revenue streams, boost cross-sell opportunities, and drive higher overall user lifetime value while supporting both revenue and margin expansion in years ahead.

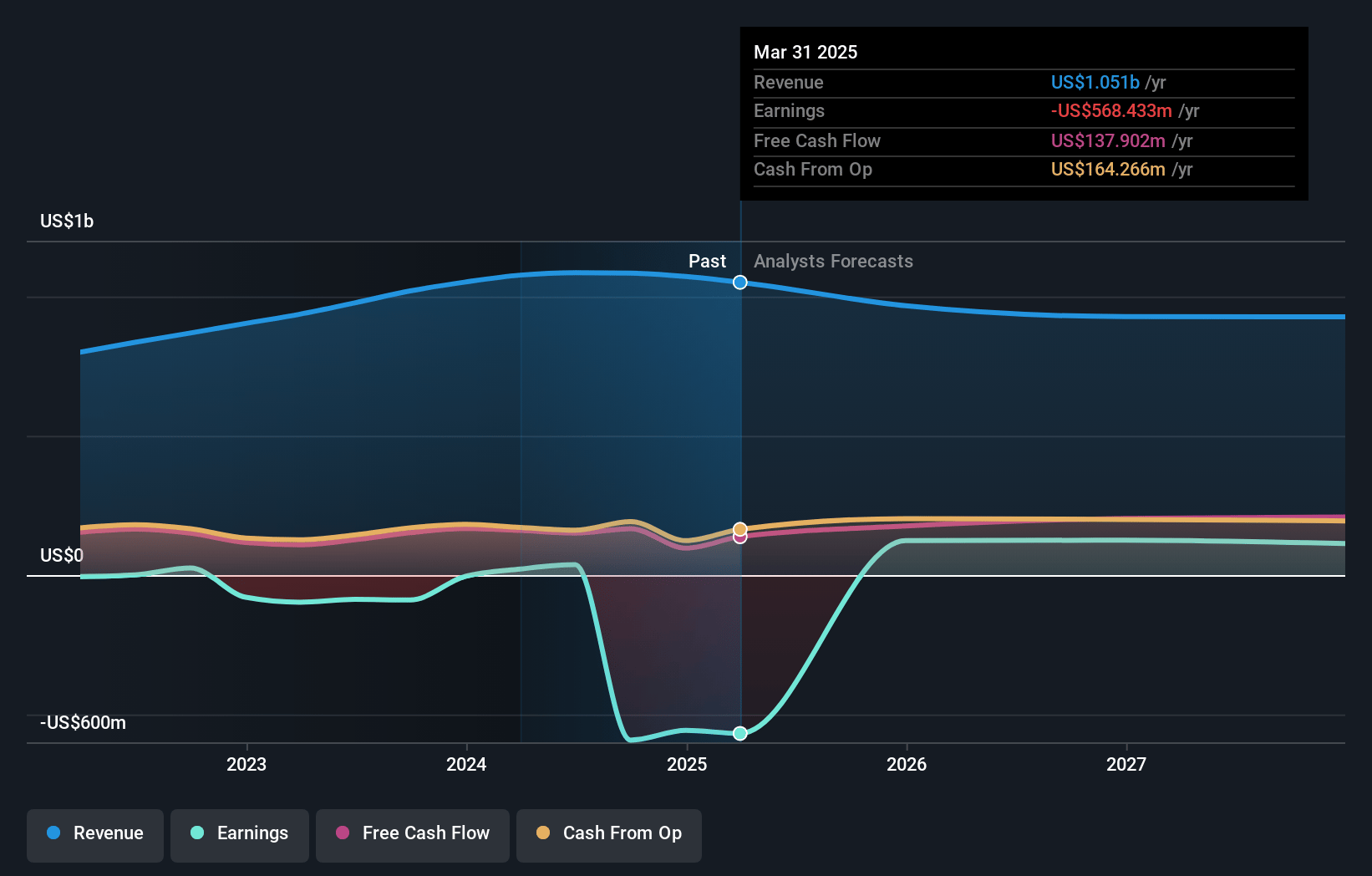

Bumble Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Bumble compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Bumble's revenue will decrease by 2.0% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from -54.1% today to 19.7% in 3 years time.

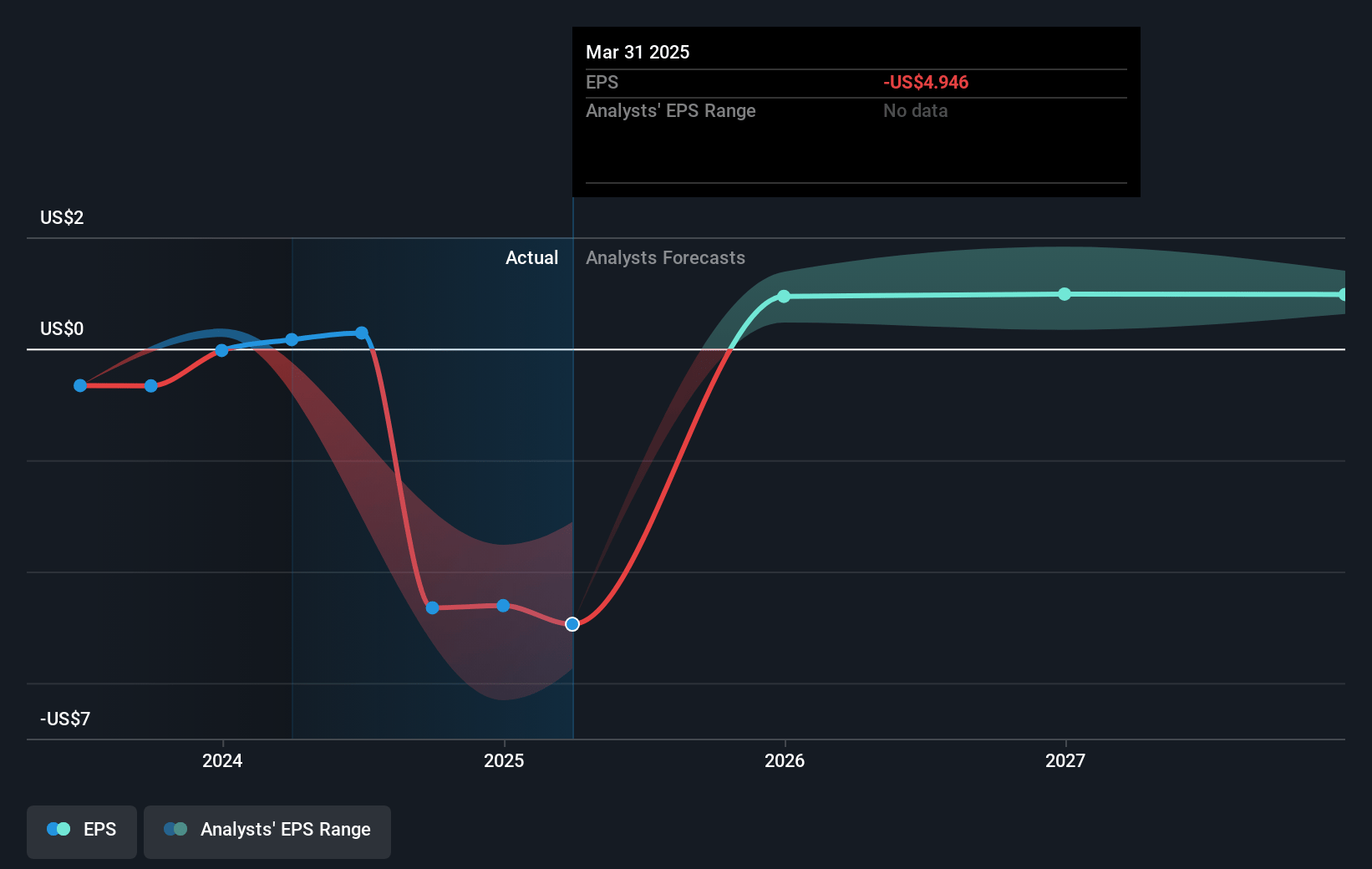

- The bullish analysts expect earnings to reach $194.7 million (and earnings per share of $1.98) by about July 2028, up from $-568.4 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 6.6x on those 2028 earnings, up from -1.2x today. This future PE is lower than the current PE for the US Interactive Media and Services industry at 17.1x.

- Analysts expect the number of shares outstanding to decline by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.18%, as per the Simply Wall St company report.

Bumble Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Rising digital fatigue and declining trust in social media and digital platforms, especially among Gen Z, could result in reduced user engagement and lower conversion rates to paid services, negatively impacting Bumble's future revenues and earnings.

- Intensifying competition, product commoditization, and a lack of significant differentiation may force Bumble to increase marketing spend or reduce prices, which can compress net margins and threaten the sustainability of earnings growth.

- Limited international penetration and the company's stated plan to delay aggressive expansion until product improvements are complete may constrain revenue growth in the near to medium term, particularly as local competitors and cultural dynamics dominate emerging markets.

- Increasing regulatory scrutiny around data privacy, user verification, and online safety could lead to higher compliance costs and restrict Bumble’s ability to personalize and monetize effectively, eroding profitability over time.

- A pivotal shift in user preferences toward matchmaking models powered by AI, decentralized platforms, or alternative forms of connection could challenge the relevance of traditional swipe-based dating apps, putting pressure on Bumble’s long-term market share and top-line growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Bumble is $8.23, which represents two standard deviations above the consensus price target of $6.11. This valuation is based on what can be assumed as the expectations of Bumble's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $9.0, and the most bearish reporting a price target of just $5.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $988.1 million, earnings will come to $194.7 million, and it would be trading on a PE ratio of 6.6x, assuming you use a discount rate of 9.2%.

- Given the current share price of $6.52, the bullish analyst price target of $8.23 is 20.8% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.