Key Takeaways

- Declining youth demographics and increased competition threaten user growth, engagement, and the ability to monetize core audiences.

- Regulatory pressures and high operational costs undermine sustained profitability, while shifting consumer preferences limit future revenue streams.

- Robust user engagement, AI-driven monetization, diversified revenue streams, and operational efficiencies position Bilibili for sustained profitability and resilience against market and regulatory challenges.

Catalysts

About Bilibili- Provides online entertainment services for the young generations in the People’s Republic of China.

- Bilibili's future user and revenue growth is likely to be constrained by China's shrinking youth demographic, resulting in a smaller core audience and diminishing long-term engagement, which will erode the company's ability to grow its top line and monetize at historical rates.

- Heightened regulatory scrutiny and evolving content controls threaten the sustainability of user-generated and subculture content, significantly increasing compliance costs and introducing unpredictability for both monetization and innovation, with a direct negative impact on net margins and earnings.

- Intense competition from global and domestic platforms-especially short-video apps and AI-driven interactive media-poses a continual threat to Bilibili's market share, risking stagnating user metrics and diluting ad revenue growth as consumer preferences shift.

- Despite recent improvements in gross and operating margins, Bilibili's high ongoing costs for content acquisition, server infrastructure, and user acquisition are unlikely to decline meaningfully, putting sustained profitability and operating leverage at risk as revenue growth decelerates.

- Market saturation and user fatigue in the online video and interactive media sector are expected to curb both engagement and time spent per user, putting incremental pressure on advertiser demand and reducing long-term revenue streams, ultimately constraining future earnings growth.

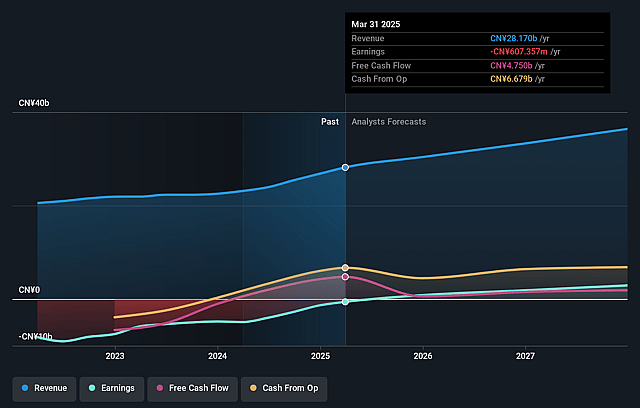

Bilibili Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Bilibili compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Bilibili's revenue will grow by 7.1% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 0.8% today to 8.5% in 3 years time.

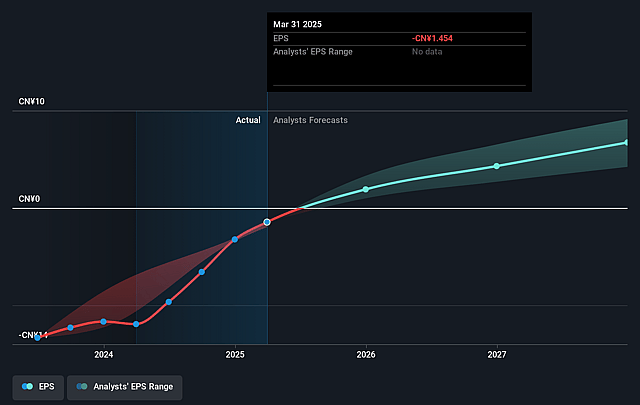

- The bearish analysts expect earnings to reach CN¥3.1 billion (and earnings per share of CN¥7.02) by about September 2028, up from CN¥220.3 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 26.3x on those 2028 earnings, down from 327.3x today. This future PE is greater than the current PE for the US Interactive Media and Services industry at 17.0x.

- Analysts expect the number of shares outstanding to decline by 1.21% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.99%, as per the Simply Wall St company report.

Bilibili Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- User growth and engagement remain robust, with daily active users reaching 109 million (up 7% year-over-year) and monthly active users rising to 363 million (up 8%), alongside increased time spent on the platform, all of which underpin Bilibili's potential to sustain and expand its revenue base.

- Bilibili's successful deployment of AI for advertising optimization and content recommendations has led to revenue growth in advertising and higher gross margin, suggesting the company can benefit further from digital transformation trends and enhance overall profitability.

- The rise in proprietary and high-quality user-generated content, coupled with a sticky Gen Z+ community and strong retention rates (12-month retention around 80%), supports continued improvements in monetization, potentially driving higher average revenue per user and earnings growth.

- Diversification of business lines-including substantial advances in gaming, e-commerce, and high-margin value-added services-provides multiple pathways for revenue expansion and increases resilience against market or regulatory shifts, which can help support stable or rising net margins over time.

- Operational efficiency improvements, disciplined cost control, and a clear pathway to higher operating margins (with a midterm OP margin target of 15–20%) point to a sustained trajectory toward greater net profit and improved returns to shareholders, which could positively impact the company's share price in the long run.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Bilibili is $22.18, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Bilibili's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $37.81, and the most bearish reporting a price target of just $22.18.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be CN¥36.1 billion, earnings will come to CN¥3.1 billion, and it would be trading on a PE ratio of 26.3x, assuming you use a discount rate of 9.0%.

- Given the current share price of $24.74, the bearish analyst price target of $22.18 is 11.5% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Bilibili?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.