Key Takeaways

- AI-driven ad upgrades, strong engagement, and ecosystem scaling position Bilibili for outperformance in monetization, user loyalty, and cross-platform revenue growth.

- Durable marquee games, unmatched Gen Z+ appeal, and advanced proprietary AI enable sustained ARPU expansion and significant structural profit gains.

- Rising content costs, regulatory risks, demographic challenges, and global uncertainties threaten Bilibili's ability to sustain growth, profitability, and international expansion.

Catalysts

About Bilibili- Provides online entertainment services for the young generations in the People’s Republic of China.

- Analyst consensus expects ongoing strength in advertising, but the scale of Bilibili's AI-driven ad infrastructure upgrades and record high engagement metrics could drive compounding, above-industry advertising and e-commerce growth, resulting in operating leverage and significant outperformance in both revenue and gross profit.

- Consensus recognizes new game launches as a driver, but the durability of marquee titles like San Mou-with proven potential as multi-year monetization engines, cross-market rollouts, and continuous in-game monetization tools-sets the stage for Bilibili's games revenue to structurally re-rate higher, with far greater impact on net income than analysts expect.

- Bilibili's unmatched hold on Gen Z+ mindshare and its dominance in longer-form, interactive video puts it at the center of a broad generational migration towards participatory, high-engagement platforms, enabling above-peer user monetization for years to come and leading to sustained ARPU expansion.

- The underappreciated scaling of Bilibili's integrated digital and offline ecosystem-including massive ACG events, growing international influence, and cultural brand leadership-provides a unique flywheel for user loyalty and category-leading cross-platform revenues.

- Bilibili's proprietary AI tools, trained on a uniquely rich set of organic user feedback signals, are poised to lower content costs while sharply amplifying content quality and creator productivity, directly supporting structural margin expansion and improving long-term profit growth.

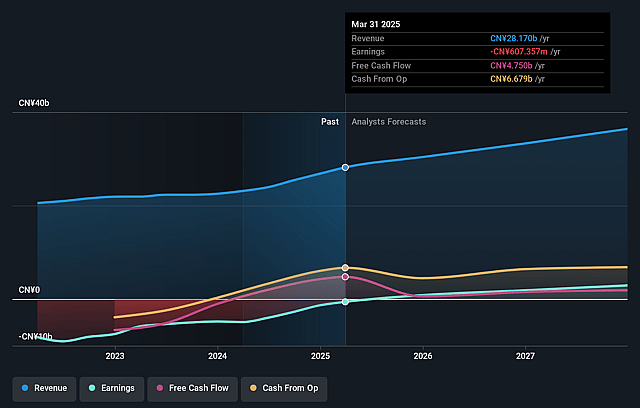

Bilibili Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Bilibili compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Bilibili's revenue will grow by 10.7% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 0.8% today to 13.7% in 3 years time.

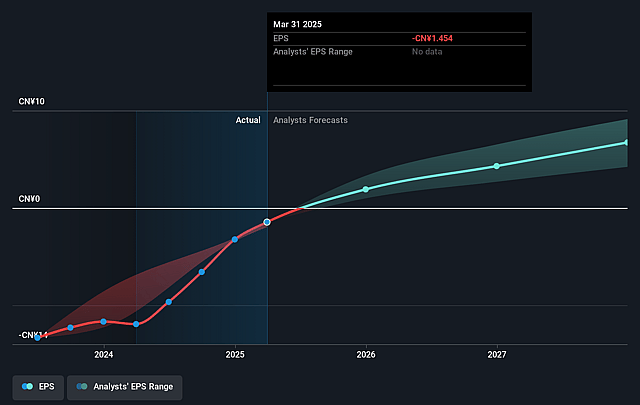

- The bullish analysts expect earnings to reach CN¥5.5 billion (and earnings per share of CN¥13.03) by about September 2028, up from CN¥220.3 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 22.9x on those 2028 earnings, down from 319.0x today. This future PE is greater than the current PE for the US Interactive Media and Services industry at 17.0x.

- Analysts expect the number of shares outstanding to decline by 1.21% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.99%, as per the Simply Wall St company report.

Bilibili Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Growing content acquisition and production costs, particularly with rising competition for premium IP and an increasing creator income base of 2 million, could compress gross margins and threaten long-term profitability, making it more difficult for Bilibili to sustainably expand earnings.

- Recent net income and margin improvements rely heavily on scalable hit content and robust advertising and games momentum, but fierce competition from well-capitalized rivals and the shifting adoption of decentralized and AI-driven media could undermine market share and slow revenue growth versus user base expansion.

- China's ongoing regulatory scrutiny and unpredictable policy environment for online communities and digital content may constrain user engagement and limit the launch or monetization of new features, posing material downside risk to both revenues and net income.

- The company's growth remains highly tethered to a youth-oriented Gen Z+ demographic, yet China's demographic headwinds-including a shrinking youth cohort and aging population-threaten to structurally slow Bilibili's long-term user growth and dampen future revenue streams.

- Efforts to expand globally and diversify market exposure, such as rolling out games internationally and attracting foreign attendees to events, face substantial risk from intensifying geopolitical tensions and the decoupling of China and the West, which could restrict international revenue potential and limit access to global partnerships or capital.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Bilibili is $34.62, which represents two standard deviations above the consensus price target of $27.82. This valuation is based on what can be assumed as the expectations of Bilibili's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $37.81, and the most bearish reporting a price target of just $22.18.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be CN¥39.9 billion, earnings will come to CN¥5.5 billion, and it would be trading on a PE ratio of 22.9x, assuming you use a discount rate of 9.0%.

- Given the current share price of $24.12, the bullish analyst price target of $34.62 is 30.3% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Bilibili?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.