Key Takeaways

- Regulatory risks and digital censorship in China limit Bilibili's content growth, dampen user expansion, and constrain monetization opportunities.

- Shifting consumer trends, economic headwinds, and competitive pressures threaten earnings, margin improvement, and the viability of Bilibili's business model.

- Enhanced user engagement, expanding high-margin businesses, and strategic AI investments are boosting monetization and profitability, supported by strong cost controls and a loyal Gen Z+ user base.

Catalysts

About Bilibili- Provides online entertainment services for the young generations in the People’s Republic of China.

- The stock price fails to acknowledge the mounting risks from increasing regulatory scrutiny and ongoing digital censorship in China, which threaten to restrict both the breadth of Bilibili's content and its ability to grow advertising partnerships, putting a long-term cap on user growth and monetization prospects that will directly suppress future revenue and profit expansion.

- Optimistic assumptions around continued growth in discretionary spending among young Chinese consumers ignore the reality of slowing domestic economic growth, with rising unemployment and wage stagnation in younger cohorts putting pressure on entertainment budgets, which may translate into stagnant or even declining ARPU and a deterioration in earnings growth.

- Bilibili's ability to diversify its revenue model remains in doubt, as persistently high content acquisition and creator incentive costs-exacerbated by fierce competition for both creators and users from Tencent, ByteDance, and global video platforms-will likely erode any gross and net margin improvements and diminish the company's ability to deliver sustainable profitability.

- The investment community appears to underestimate the existential threat posed by evolving user behaviors, with a market-wide pivot toward short-form, algorithmically-driven video content leaving Bilibili's long-form, community-centric model at a structural disadvantage, foreshadowing slowing MAU/DAU growth, reduced engagement, and falling advertising yields in the coming years.

- As Chinese regulators introduce stricter limits on youth digital consumption and gaming-such as screen time restrictions and age-based content bans-Bilibili's core demographic and overall market size are likely to contract, leading to downward revisions in long-term revenue forecasts and diminishing the company's ability to support elevated valuation multiples.

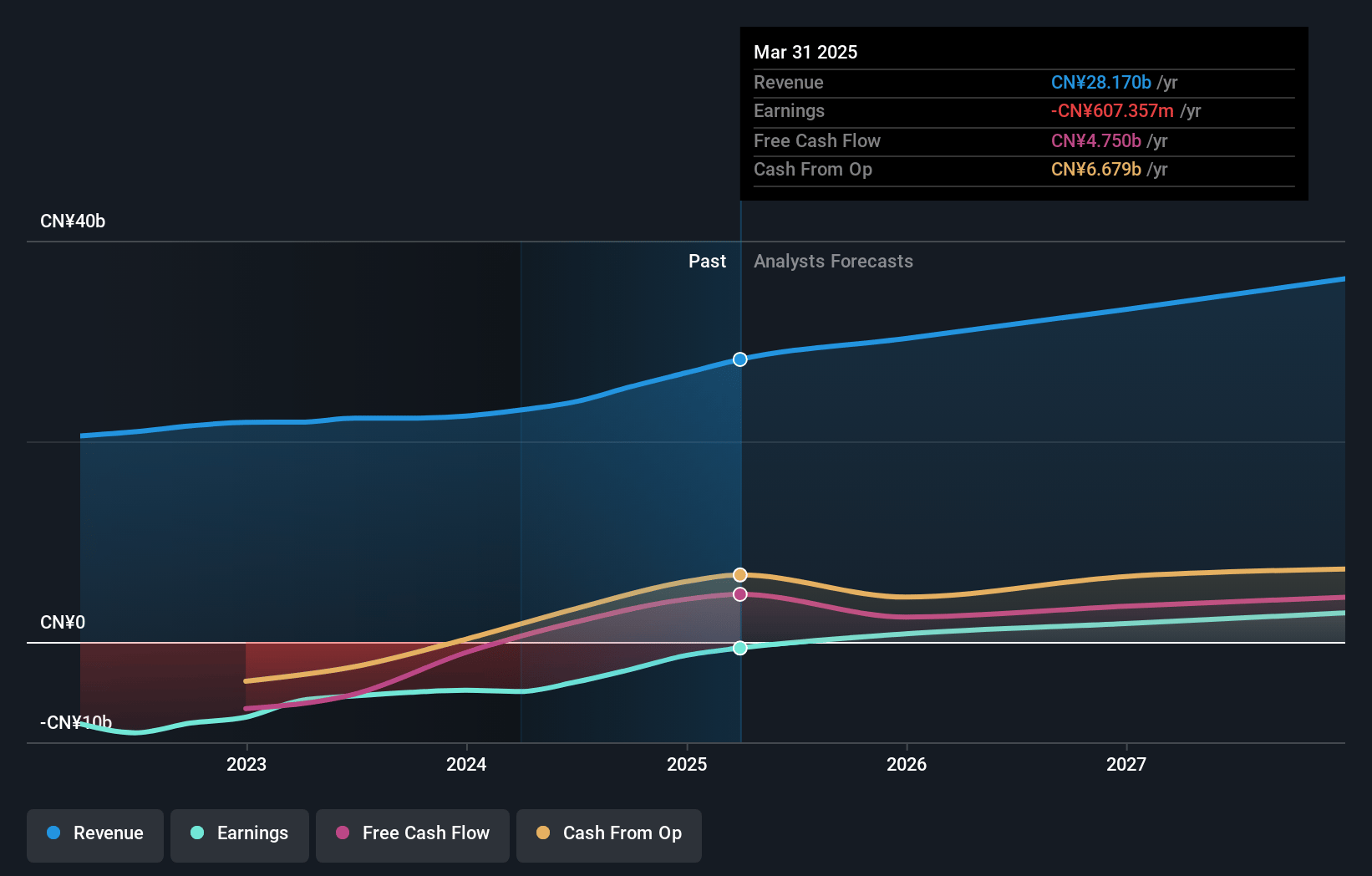

Bilibili Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Bilibili compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Bilibili's revenue will grow by 7.8% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from -2.2% today to 6.3% in 3 years time.

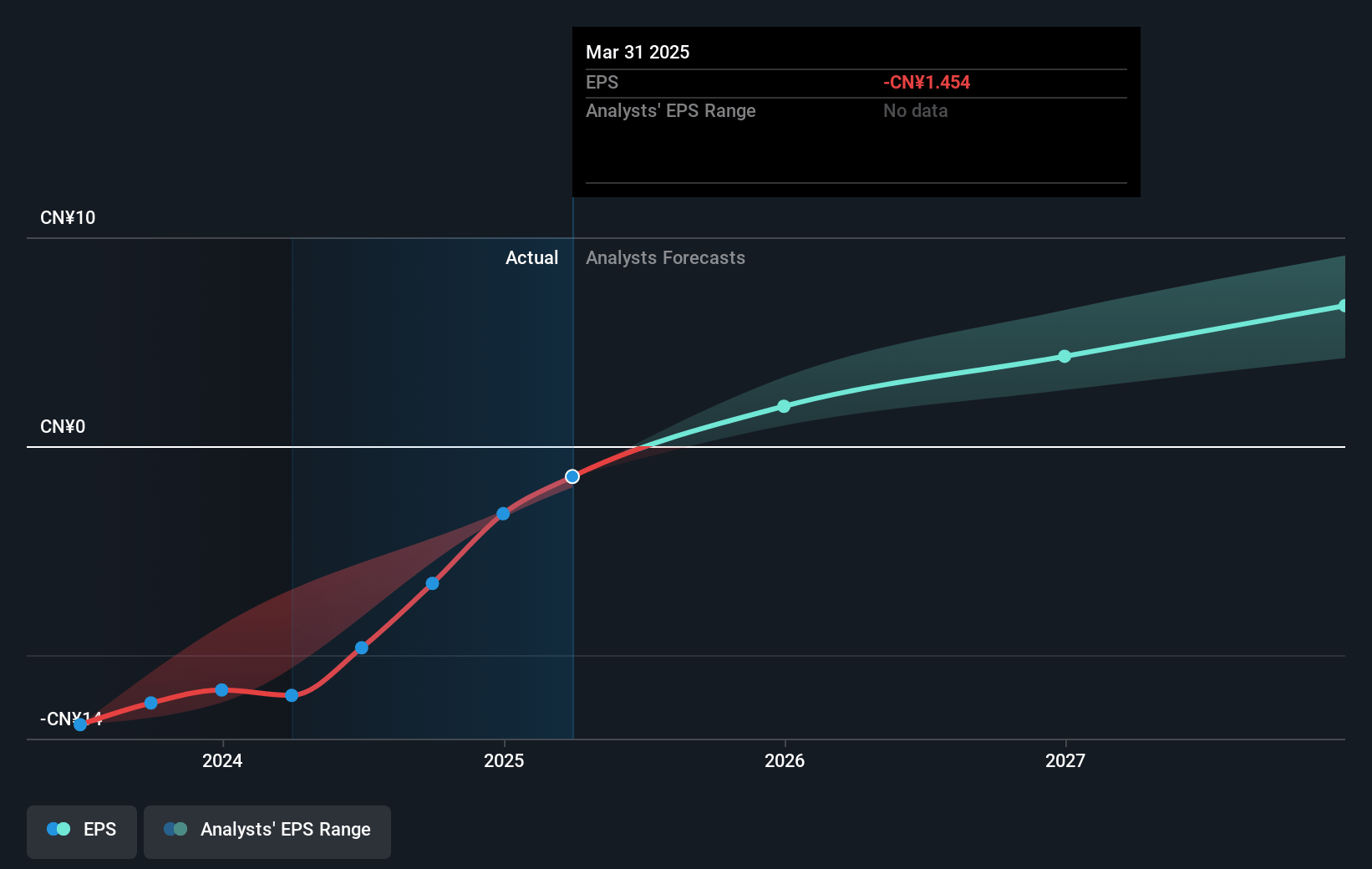

- The bearish analysts expect earnings to reach CN¥2.2 billion (and earnings per share of CN¥5.15) by about July 2028, up from CN¥-607.4 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 35.2x on those 2028 earnings, up from -120.8x today. This future PE is greater than the current PE for the US Interactive Media and Services industry at 17.4x.

- Analysts expect the number of shares outstanding to grow by 0.93% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.75%, as per the Simply Wall St company report.

Bilibili Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Sustained rapid growth in user engagement, evidenced by a new record of 108 minutes average daily user time spent and all-time high monthly paying users at 32 million, signals strong user stickiness that can drive recurring revenue and improve long-term earnings.

- High-margin advertising and gaming businesses continue to expand rapidly, with advertising revenue up 20% and game revenue rising 76% year-over-year, which has driven gross profit up 58% and resulted in positive adjusted net profit, suggesting improved profitability and operating leverage.

- Bilibili is leveraging its core Gen Z+ demographic, whose average age is now 26 and whose purchasing power is rising, translating to higher monetization across content, e-commerce, and lifestyle-related segments, providing a long-term tailwind for revenue growth.

- Strategic investments in AI and proprietary content, utilizing Bilibili's extensive video data repository, have enhanced ad targeting, performance-based advertising, and creator monetization avenues, which have already led to a 400% increase in AI-related advertiser demand and may further accelerate margin and revenue expansion.

- Management's disciplined cost controls, stable operating expenses as a percentage of revenue, and a clear path to sustained positive adjusted net profit-with a stated gross margin expansion target to 40–45% and long-term operating margin guidance of 15–20%-increase the company's likelihood of achieving durable margin growth and higher future earnings.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Bilibili is $20.11, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Bilibili's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $35.95, and the most bearish reporting a price target of just $20.11.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be CN¥35.3 billion, earnings will come to CN¥2.2 billion, and it would be trading on a PE ratio of 35.2x, assuming you use a discount rate of 8.8%.

- Given the current share price of $25.05, the bearish analyst price target of $20.11 is 24.5% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives