Key Takeaways

- Bilibili is well positioned to outpace digital ad market growth and unlock new high-margin AI-driven revenue streams due to its strong content, user base, and sector leadership.

- Sustained growth in gaming and platform stickiness, aided by regulatory support, should drive robust recurring revenue and expanding profitability over the long term.

- Intensifying regulatory, competitive, and technological challenges could constrain innovation, raise operating costs, and threaten future growth and profitability across Bilibili's core digital media businesses.

Catalysts

About Bilibili- Provides online entertainment services for the young generations in the People’s Republic of China.

- Analyst consensus views Bilibili's advertising revenue acceleration and AI-powered ad efficiency as supporting modest growth, but this is likely understated given the platform's outsized appeal to high-value Gen Z+ demographics and surging advertiser demand in emerging sectors like AI and home goods, pointing to the potential for Bilibili to outpace broader digital ad market growth and drive a rapid expansion in both revenue and gross margin.

- While analysts broadly believe Bilibili's gaming revenue momentum will continue, the longevity, multi-device expansion, and upcoming international launch of flagship titles like San Mou, alongside a deep new title pipeline, signal that game-related revenue growth could significantly overshoot expectations, acting as a long-term earnings engine with strong operating leverage.

- As China's digital penetration and disposable incomes climb, Bilibili's rising daily active users and stickiness among highly engaged young consumers position the platform to capture a disproportionate share of fast-growing entertainment and lifestyle consumption-enabling higher ARPU, expanded payment conversion, and robust recurring revenue growth.

- The company's unique repository of high-quality Chinese video content and leadership in knowledge, animation, and gaming verticals equip it to become the dominant provider of next-generation AI training data, translation-ready content, and potential SaaS/commercialization opportunities in the broader AI ecosystem-unlocking novel, high-margin revenue streams.

- Regulatory normalization and policy support for high-quality content are likely to squeeze out less-compliant or lower-quality competitors, further reinforcing Bilibili's brand trust and community loyalty, and enabling sustained long-term growth in advertising, licensing, and premium memberships that could accelerate margin expansion and overall profitability.

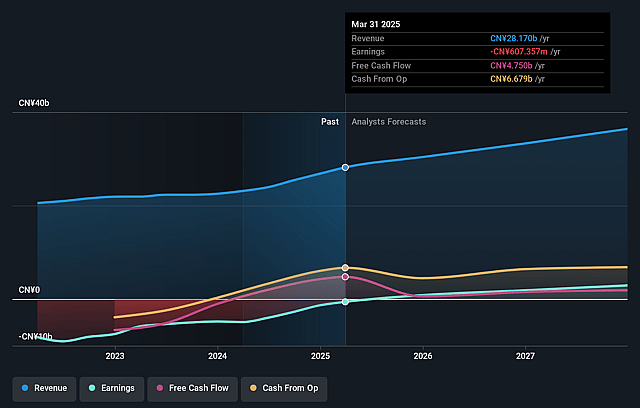

Bilibili Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Bilibili compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Bilibili's revenue will grow by 14.6% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from -2.2% today to 12.6% in 3 years time.

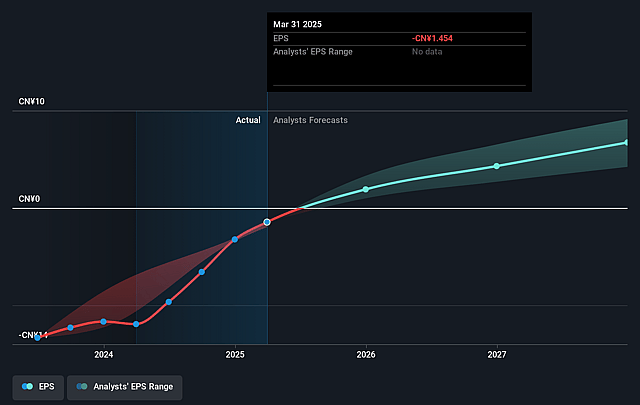

- The bullish analysts expect earnings to reach CN¥5.3 billion (and earnings per share of CN¥11.14) by about July 2028, up from CN¥-607.4 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 24.3x on those 2028 earnings, up from -119.6x today. This future PE is greater than the current PE for the US Interactive Media and Services industry at 17.4x.

- Analysts expect the number of shares outstanding to grow by 0.93% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.76%, as per the Simply Wall St company report.

Bilibili Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Heightened regulatory scrutiny and compliance demands in China's digital media sector could require Bilibili to further restrict content, rapidly adapt policies, and absorb higher compliance expenses, which may hamper user engagement, slow content innovation, and increase costs, ultimately pressuring both revenue growth and net margins.

- The Chinese internet user base is maturing, with user growth rates moderating industry-wide; despite recent record highs in DAUs and MAUs, Bilibili's long-term ability to accelerate audience expansion and drive higher monetization may be limited, impacting the future growth trajectory of its advertising and value-added service revenues.

- Rising global technology decoupling and export controls between the U.S. and China may restrict Bilibili's access to best-in-class video processing and generative AI tools; this could force greater R&D investments, increase costs, limit platform competitiveness, and reduce the pace of innovation, thereby threatening future margins and earnings potential.

- Bilibili's reliance on high user acquisition and retention spending, especially given intense competition for quality content and for Gen Z audiences, may continue to compress profitability; current improvements in gross margin and net profitability could stall if content and promotional costs escalate faster than revenue growth, weakening future net margins.

- Ongoing fragmentation in the digital media landscape, coupled with stricter IP enforcement and escalating content moderation challenges fueled by generative AI, can lead to intensified competition for engagement and ad dollars, as well as higher operational costs for licensing and moderation, all of which could erode gross margins and dampen both advertising and subscription revenues over time.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Bilibili is $33.5, which represents two standard deviations above the consensus price target of $25.83. This valuation is based on what can be assumed as the expectations of Bilibili's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $35.95, and the most bearish reporting a price target of just $20.11.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be CN¥42.3 billion, earnings will come to CN¥5.3 billion, and it would be trading on a PE ratio of 24.3x, assuming you use a discount rate of 8.8%.

- Given the current share price of $24.74, the bullish analyst price target of $33.5 is 26.2% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives