Last Update09 Oct 25Fair value Increased 1.17%

Bilibili’s analyst price target has been adjusted slightly higher to $28.11. Analysts cite healthy user engagement and supportive ad momentum, which offset modest declines in expected gaming revenue.

Analyst Commentary

Recent updates from street research offer a balanced perspective on Bilibili’s outlook, reflecting both ongoing strengths and some areas of caution relating to near-term growth. Below are the key takeaways from recent analyst commentary:

Bullish Takeaways- Bullish analysts note that Bilibili’s user engagement and monetization trends remain healthy. Strong ad momentum is expected to continue into the second half of the year.

- Several price targets were adjusted higher, reflecting confidence in the company’s long-term margin outlook and successful cost controls, particularly in sales and marketing expenses.

- Restructuring in Bilibili’s gaming segment and the adoption of artificial intelligence within the advertising business are seen as supportive catalysts for future traffic growth and revenue diversification.

- Recent quarters have seen revenue and profit performance in line with, or ahead of, expectations. This has helped sustain a constructive view of Bilibili’s operational execution.

- Bearish analysts caution that game revenue is expected to decline in the near term due to a high comparison base. This presents a headwind for overall growth.

- The advertising outlook remains positive, but the removal of major new game launches as near-term catalysts may limit upside for the shares.

- Some see valuation as largely fair following the stock’s recent rally, with less attractive risk/reward dynamics going forward.

- Analysts are also monitoring the impact of challenging year-over-year comparisons, particularly in key segments like games and VAS. This could mute the effect of broader platform improvements.

What's in the News

- Bilibili completed the repurchase of 6,400,000 shares, representing 1.54% of shares, for $116.4 million under the buyback program announced on November 14, 2024 (Key Developments).

- Between January 1, 2025 and June 30, 2025, the company repurchased 5,560,833 shares, accounting for 1.33% of shares, for $100.04 million (Key Developments).

Valuation Changes

- Consensus Analyst Price Target (Fair Value) has risen slightly from $27.79 to $28.11.

- Discount Rate has declined modestly from 9.09% to 8.83%.

- Revenue Growth expectations have edged down marginally from 9.30% to 9.25%.

- Net Profit Margin has increased slightly from 8.79% to 8.80%.

- Future P/E ratio has moved up from 30.09x to 30.42x.

Key Takeaways

- Enhanced user engagement and creator monetization are fueling sustained revenue and margin growth, supported by a vibrant Gen Z+ user base and expanding value-added services.

- Strengthening proprietary content, rapid AI adoption, and disciplined cost control are driving operational efficiency, higher margins, and improving overall profitability.

- Heavy reliance on a shrinking youth audience, escalating costs, regulatory risks, and tough competition may constrain growth, compress margins, and threaten long-term profitability.

Catalysts

About Bilibili- Provides online entertainment services for the young generations in the People’s Republic of China.

- Bilibili is benefitting from the accelerating shift among young consumers toward interactive digital entertainment, with user engagement metrics such as DAU/MAU, paying users, and daily time spent all reaching record highs-this stronger engagement is likely to convert into sustained top-line revenue growth as the platform captures a larger share of wallet from Gen Z+ users.

- The expansion and monetization of Bilibili's creator ecosystem is creating new revenue streams through value-added services (memberships, fan charging, e-commerce), tapping into the rising demand for user-generated content and the growth of the creator economy; this supports higher ARPU and margin improvement.

- The company's strengthening of its proprietary IP ecosystem through the success of in-house animation and gaming, particularly with long-life cycle titles like San Mou (with international expansion planned), is likely to support higher content-driven revenues and reduced content cost pressures, positively impacting gross and operating margins.

- Rapid adoption of AI technologies-such as recommendation algorithms, content discovery, and AIGC-generated ad creatives-is improving operational efficiency and advertising effectiveness (as evidenced by a 10% lift in eCPM and 20%+ ad revenue growth), which should drive further margin expansion and positive earnings surprises.

- Ongoing improvements in operational efficiency and disciplined cost control, underpinned by economies of scale and AI-driven automation, are resulting in stable or declining operating expenses and a path toward mid-to-high teens operating margins, positioning Bilibili to deliver expanding net margins and growing adjusted net profit.

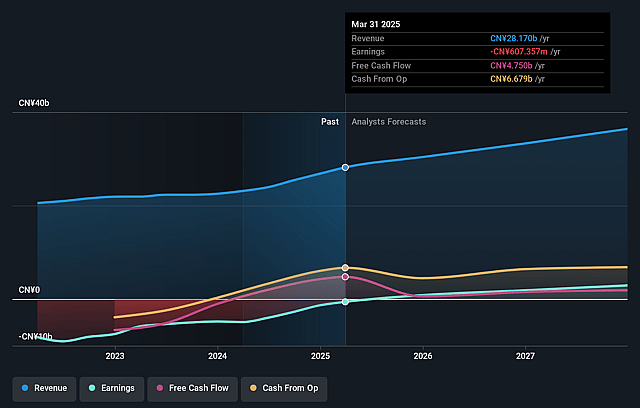

Bilibili Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Bilibili's revenue will grow by 9.3% annually over the next 3 years.

- Analysts assume that profit margins will increase from 0.8% today to 8.8% in 3 years time.

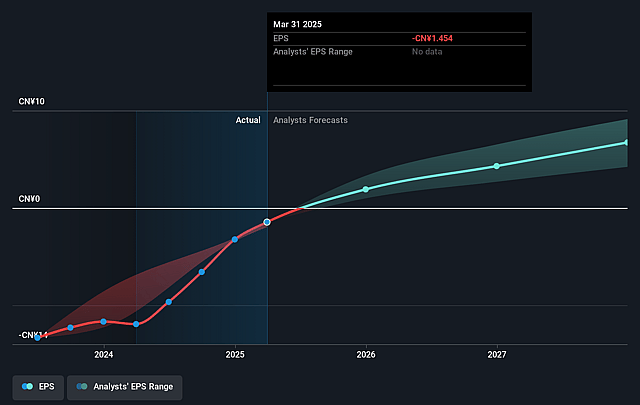

- Analysts expect earnings to reach CN¥3.4 billion (and earnings per share of CN¥8.03) by about September 2028, up from CN¥220.3 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting CN¥4.3 billion in earnings, and the most bearish expecting CN¥2.4 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 30.1x on those 2028 earnings, down from 295.5x today. This future PE is greater than the current PE for the US Interactive Media and Services industry at 16.9x.

- Analysts expect the number of shares outstanding to decline by 1.21% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.09%, as per the Simply Wall St company report.

Bilibili Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- As Bilibili's growth remains highly concentrated in China and focused on Gen Z+ audiences, demographic shifts such as a declining youth population or evolving content preferences could shrink its core addressable market over time, constraining user and revenue growth.

- There is significant execution risk tied to dependence on blockbuster titles like San Mou and a limited upcoming game pipeline subject to regulatory approvals, which may create volatility and concentration risk in games revenue and delay growth in this segment.

- Continued rapid expansion in content costs, including investments in exclusive content and creator monetization tools, alongside only incremental improvements in ARPU, may threaten sustained margin expansion and delay consistent profitability.

- Bilibili operates in a highly competitive digital media landscape, facing intensifying competition from diversified domestic giants such as Tencent Video, Kuaishou, and Douyin, which could drive up user acquisition costs, erode market share, and put downward pressure on net margins and long-term earnings.

- Persistent regulatory uncertainty in China, including heightened scrutiny of online content, licensing delays for games, and evolving standards for user-generated content, exposes Bilibili to risks of content takedowns, fines, or even platform restrictions, leading to unpredictable impacts on revenue and net profit.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $27.787 for Bilibili based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $37.73, and the most bearish reporting a price target of just $22.14.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be CN¥38.4 billion, earnings will come to CN¥3.4 billion, and it would be trading on a PE ratio of 30.1x, assuming you use a discount rate of 9.1%.

- Given the current share price of $22.28, the analyst price target of $27.79 is 19.8% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.