Key Takeaways

- Advanced data and AI initiatives position the company to outpace competitors, capture premium value, and achieve sustained, above-market revenue and earnings growth.

- Automation and centralized workforce management are expected to structurally improve efficiency, enabling stronger margins, higher cash flow, and accelerated balance sheet improvement.

- Shift to digital channels, client consolidation, and automation threaten core revenues, margin stability, and reinvestment capacity due to declining demand and high financing costs.

Catalysts

About Advantage Solutions- Provides business solutions to consumer packaged goods companies and retailers in North America, Asia Pacific, and Europe.

- Analysts broadly agree that the company's investments in advanced data platforms and AI-enabled solutions are set to drive revenue growth and margin expansion, but in reality these upgrades may enable Advantage Solutions to significantly outpace competitors, monetize proprietary retail and shopper insights at premium pricing, and capture a disproportionate share of the rapidly expanding omnichannel and e-commerce enablement market, leading to sustained double-digit earnings growth.

- Analyst consensus views operational streamlining as supporting margin expansion, yet ongoing automation and the deployment of centralized labor management have the potential to structurally transform cost-to-serve; this could drive net margin accretion well above expectations as team utilization, talent retention, and back-office efficiencies sharply improve, unlocking higher cash flow conversion and allowing for faster balance sheet deleveraging than the market anticipates.

- The accelerating adoption of data-driven marketing and the rising importance of personalization in CPG is expected to enable Advantage Solutions to command premium pricing for its analytics and activation services, shifting its revenue mix toward higher-margin, recurring sources and lifting overall corporate returns.

- With the complexity of retail continuing to increase-demonstrated by expanded SKU counts and the proliferation of direct-to-consumer entrants-Advantage Solutions is uniquely positioned as a critical infrastructure partner to both legacy brands and new market entrants, driving durable, above-market revenue growth as brands increasingly outsource to specialists.

- The company's improved recruiting and retention systems-enabled by AI-driven hiring processes, centralized labor sharing, and integrated human capital management-could provide a distinct operational advantage, enabling Advantage Solutions to deploy labor at scale during peak periods, win incremental business, and support robust top-line growth in both experiential and retailer services.

Advantage Solutions Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Advantage Solutions compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Advantage Solutions's revenue will decrease by 0.5% annually over the next 3 years.

- Even the bullish analysts are not forecasting that Advantage Solutions will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate Advantage Solutions's profit margin will increase from -8.6% to the average US Media industry of 10.1% in 3 years.

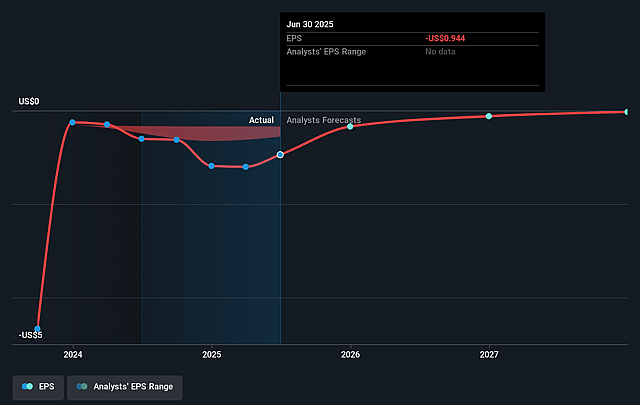

- If Advantage Solutions's profit margin were to converge on the industry average, you could expect earnings to reach $362.4 million (and earnings per share of $1.06) by about September 2028, up from $-304.0 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 5.2x on those 2028 earnings, up from -2.0x today. This future PE is lower than the current PE for the US Media industry at 20.3x.

- Analysts expect the number of shares outstanding to grow by 1.62% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 11.21%, as per the Simply Wall St company report.

Advantage Solutions Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The continued growth of e-commerce and digital marketplaces is threatening the core in-store marketing and merchandising business of Advantage Solutions, as clients are pulling back on traditional services and shifting budgets to digital, which will likely pressure long-term revenues and cause ongoing declines in the branded services segment.

- Rising automation and adoption of AI in retail are enabling clients to in-source marketing and field services or use technology for efficiencies, reducing demand for third-party providers like Advantage Solutions and placing downward pressure on net margins.

- The company's dependence on a concentrated group of large CPG and retail clients has already led to material client losses and revenue declines in branded services, signaling ongoing risk to both revenue stability and earnings if more clients decide to reduce or internalize these services.

- Ongoing consolidation among CPG manufacturers and retailers is increasing buyer bargaining power, evidenced by client cost-optimization efforts and reduced order volumes, which can result in tighter pricing, margin compression, and further reductions in revenue and profitability for Advantage Solutions.

- Elevated debt levels and high interest expenses persist, with interest expense remaining between $140 million and $150 million annually; if cash flow growth does not materialize due to these secular pressures, the company will have limited capacity to invest in innovation and may see net income eroded by financing costs.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Advantage Solutions is $4.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Advantage Solutions's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $4.0, and the most bearish reporting a price target of just $2.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $3.6 billion, earnings will come to $362.4 million, and it would be trading on a PE ratio of 5.2x, assuming you use a discount rate of 11.2%.

- Given the current share price of $1.91, the bullish analyst price target of $4.0 is 52.2% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Advantage Solutions?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.