Key Takeaways

- Investments in advanced data platforms and operational automation are expected to drive client value, revenue growth, efficiency, and improved margins.

- Shifting retailer priorities toward private brands and third-party partnerships favor Advantage's service offerings, boosting revenue opportunities and long-term earnings growth.

- Revenue and earnings are at risk due to client in-sourcing, rising labor costs, high leverage, automation trends, and challenging macroeconomic and consumer dynamics.

Catalysts

About Advantage Solutions- Provides business solutions to consumer packaged goods companies and retailers in North America, Asia Pacific, and Europe.

- Growing demand for data-driven retail insights and digital activation is accelerating as CPG manufacturers and retailers prioritize omni-channel strategies and seek to optimize merchandising and supply chains amid ongoing channel and consumer shifts; Advantage's investments in advanced data platforms (category insights, AI-enabled Pulse decision engine, real-time dashboards) are expected to enhance client value and support revenue growth and margin expansion as these offerings gain adoption.

- The trend toward retailers increasing private label (private brand) offerings and outsourcing advisory, merchandising, and product development-highlighted by 85% of surveyed retailers prioritizing private brands-favors Advantage's market-leading Daymon business and should increase aggregate service revenues and wallet share with both existing and new clients.

- Ongoing operational streamlining and automation, including deployment of centralized labor management, AI-assisted workforce planning, and back-office technology upgrades, is expected to yield sustainable efficiency gains, higher team utilization, and reduced SG&A, thereby supporting improved net margins and free cash flow conversion over the medium and long-term.

- The completion of the company's transformation initiatives is set to result in structurally lower restructuring and shared service costs, with management guiding to a return to at least 25% net free cash flow conversion on adjusted EBITDA from 2026 onward, supporting long-term earnings growth and improving deleveraging capacity.

- The proliferation of emerging CPG brands requiring national retail entry and greater reliance on market activation partners-evidenced by Advantage's success with recent client wins and cross-sell opportunities-should drive incremental revenue growth as these trends are secular tailwinds for specialized third-party sales and marketing providers.

Advantage Solutions Future Earnings and Revenue Growth

Assumptions

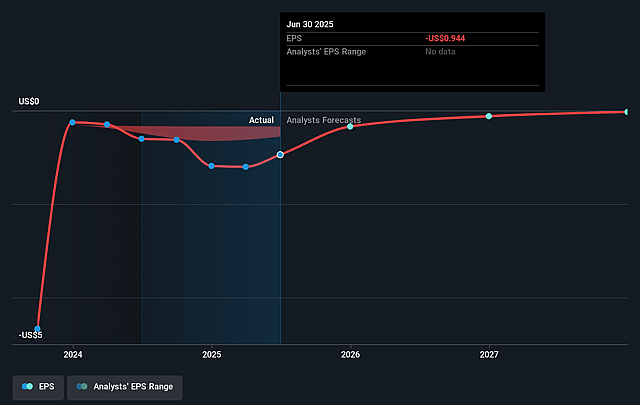

How have these above catalysts been quantified?- Analysts are assuming Advantage Solutions's revenue will decrease by 0.8% annually over the next 3 years.

- Analysts are not forecasting that Advantage Solutions will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate Advantage Solutions's profit margin will increase from -8.6% to the average US Media industry of 10.1% in 3 years.

- If Advantage Solutions's profit margin were to converge on the industry average, you could expect earnings to reach $349.3 million (and earnings per share of $1.02) by about September 2028, up from $-304.0 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 3.9x on those 2028 earnings, up from -1.8x today. This future PE is lower than the current PE for the US Media industry at 20.8x.

- Analysts expect the number of shares outstanding to grow by 1.62% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 11.67%, as per the Simply Wall St company report.

Advantage Solutions Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The ongoing shift by clients toward in-sourcing select services, coupled with reductions in order volume and pullbacks in sales and marketing investments, risks a sustained decline or stagnation in core branded services revenue, especially given difficulty reversing these trends quickly.

- Persistent wage inflation (running at about 3% annually) and tight labor market conditions, even if being partially offset by pricing actions, may compress net margins over time if the company is unable to consistently pass all increases through to clients.

- High leverage, with a net leverage ratio of approximately 4.6x adjusted EBITDA, and significant interest expense ($140-150 million annually) could constrain reinvestment in technology, limit flexibility to weather further macroeconomic pressure, and restrict earnings growth.

- Increasing adoption of automation and technology-reflected in both internal company initiatives (e.g., centralized labor management, AI-enabled platforms) and industrywide trends toward in-house solutions by retailers and CPG brands-could diminish the need for Advantage's traditional human-led services, potentially pressuring long-term revenues.

- Exposure to challenging macroeconomic factors and evolving consumer and retailer trends, including longer sales cycles, client consolidation, and shifting channel preferences (such as increased omni-channel and digital-first approaches), may create revenue headwinds and greater earnings volatility for Advantage Solutions over the long term.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $2.833 for Advantage Solutions based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $4.0, and the most bearish reporting a price target of just $2.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $3.4 billion, earnings will come to $349.3 million, and it would be trading on a PE ratio of 3.9x, assuming you use a discount rate of 11.7%.

- Given the current share price of $1.69, the analyst price target of $2.83 is 40.4% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.