Key Takeaways

- Shifting retail and CPG trends toward digital and automation threaten the relevance and revenue potential of Advantage's traditional and outsourced services.

- Margin pressures from rising costs, client consolidation, and market changes may constrain long-term profitability and limit future growth opportunities.

- Ongoing client losses, margin pressure, industry commoditization, and restructuring risks threaten long-term revenue growth, profitability, and earnings stability.

Catalysts

About Advantage Solutions- Provides business solutions to consumer packaged goods companies and retailers in North America, Asia Pacific, and Europe.

- Although Advantage Solutions is expanding its proprietary data analytics and AI-enabled decision-making platforms to deliver more value-added services and improve operational efficiency, the accelerated shift to e-commerce and digital-first strategies by retailers and CPG companies could further diminish the long-term relevance of traditional in-store marketing, threatening sustained growth in core revenues.

- While the company is seeing some stability in staffing and renewed client demand in experiential and retail services, the increasing adoption of AI and automation by large CPGs and retailers may reduce reliance on outsourced labor solutions, putting pressure on top-line revenue growth and limiting the impact of Advantage's workforce optimization initiatives.

- Although operational restructuring and automation are set to improve net margins over time, persistent margin pressure caused by rising labor costs and difficulty automating key field services could offset these gains, restricting long-term earnings expansion.

- Despite successful integrations of digital and in-store offerings positioning Advantage as a differentiated, full-service provider, consolidation among major consumer goods companies and retailers continues to strengthen client bargaining power, leading to ongoing fee and margin compression that could weigh on profitability.

- While the expansion of private brand advisory and end-to-end merchandising is opening new client channels, the proliferation of direct-to-consumer brands and increased retailer investment in in-house marketing may limit the addressable market for Advantage Solutions over the long term, constraining future revenue and market share opportunities.

Advantage Solutions Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Advantage Solutions compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Advantage Solutions's revenue will decrease by 0.5% annually over the next 3 years.

- The bearish analysts are not forecasting that Advantage Solutions will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate Advantage Solutions's profit margin will increase from -8.6% to the average US Media industry of 10.1% in 3 years.

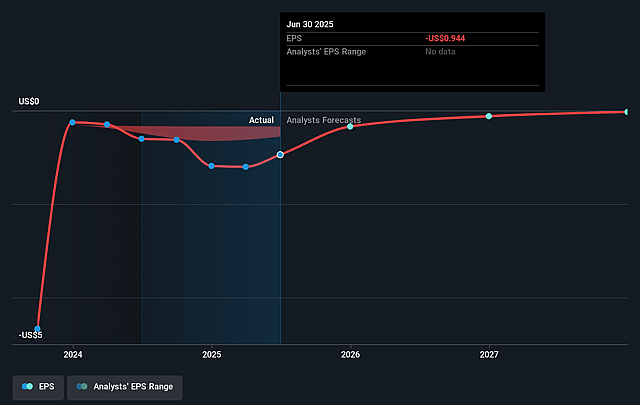

- If Advantage Solutions's profit margin were to converge on the industry average, you could expect earnings to reach $362.4 million (and earnings per share of $1.06) by about September 2028, up from $-304.0 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 2.6x on those 2028 earnings, up from -1.9x today. This future PE is lower than the current PE for the US Media industry at 20.7x.

- Analysts expect the number of shares outstanding to grow by 1.62% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 11.64%, as per the Simply Wall St company report.

Advantage Solutions Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- There is ongoing pressure on branded services, with notable client losses and reductions in order volume as some clients bring services in-house and pull back on sales and marketing investments, which could lead to continued top-line revenue weakness.

- Persistent margin pressure is evident due to rising labor costs and only partially offsetting these increases through price adjustments, risking further squeeze on net margins if wage inflation outpaces pricing power.

- The company remains dependent on a concentrated group of large retail and consumer packaged goods clients, and recent client losses have weighed significantly on adjusted EBITDA, posing continued earnings volatility if additional client churn occurs.

- Transformation investments and restructuring costs, while expected to taper, have negatively impacted profitability, and delays or underperformance in technology adoption or integration could result in stranded investments and impairment charges, harming net income.

- Industry trends such as increased in-sourcing by retailers, longer sales cycles, and a softer macroeconomic backdrop indicate potential for further commoditization of core services and diminished pricing power, negatively impacting long-term revenue growth and profitability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Advantage Solutions is $2.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Advantage Solutions's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $4.0, and the most bearish reporting a price target of just $2.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $3.6 billion, earnings will come to $362.4 million, and it would be trading on a PE ratio of 2.6x, assuming you use a discount rate of 11.6%.

- Given the current share price of $1.78, the bearish analyst price target of $2.0 is 11.0% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.