Key Takeaways

- Strategic portfolio integration, automation, and digitalization are driving substantial cost reductions and productivity gains, positioning Newmont for sustained margin and earnings growth.

- Early leadership in ESG initiatives is enhancing access to capital and customers, supporting premium valuation multiples and long-term industry leadership.

- Shifting market trends, rising regulatory pressures, declining ore quality, acquisition risks, and geopolitical exposure all threaten Newmont's future profitability and earnings stability.

Catalysts

About Newmont- Engages in the production and exploration of gold properties.

- Analysts broadly agree that gold's role as a safe-haven asset is strengthening in today's environment, but they may be understating the impact of accelerating global de-dollarization and record central bank gold purchases, which could drive gold prices well beyond current forecasts and structurally elevate Newmont's revenue and cash flow for years.

- While analyst consensus expects operational optimization and cost discipline to modestly improve margins, there is increasing evidence that Newmont's transformational portfolio integration and advanced automation are enabling a much more dramatic reduction in all-in sustaining costs, potentially unlocking multi-year EBITDA margin expansion and supporting significant earnings leverage to higher gold prices.

- Newmont's aggressive divestment of non-core assets, evidenced by $3 billion in expected after-tax proceeds this year, is rapidly enhancing capital efficiency and supporting an unparalleled capital return program, including a new $3 billion share repurchase-meaningfully accelerating per-share free cash flow and EPS growth beyond peer expectations.

- The ongoing digitalization and automation of Newmont's core operations, combined with the deep technical talent bench and best-in-class asset reliability initiatives, is setting the stage for sustained productivity gains and production stability, materially improving long-term operating leverage and reducing earnings volatility.

- As ESG requirements become an increasingly stringent gating factor for capital flows and customer contracts, Newmont's early and sustained investment in decarbonization, water management, and community engagement positions it as the "go-to" partner for institutional capital and premium global jewelry/technology clients, increasing access to low-cost funding and supporting higher valuation multiples over time.

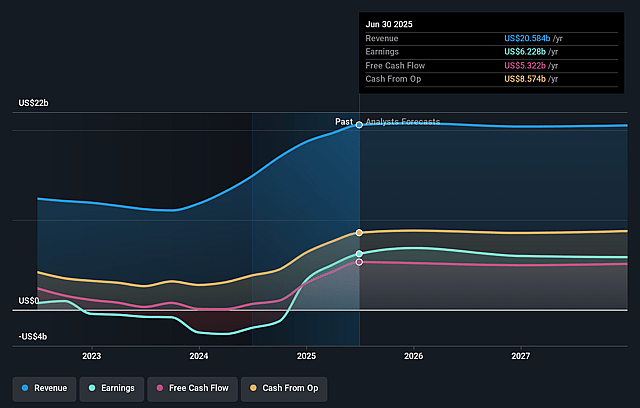

Newmont Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Newmont compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Newmont's revenue will grow by 8.1% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 30.3% today to 30.6% in 3 years time.

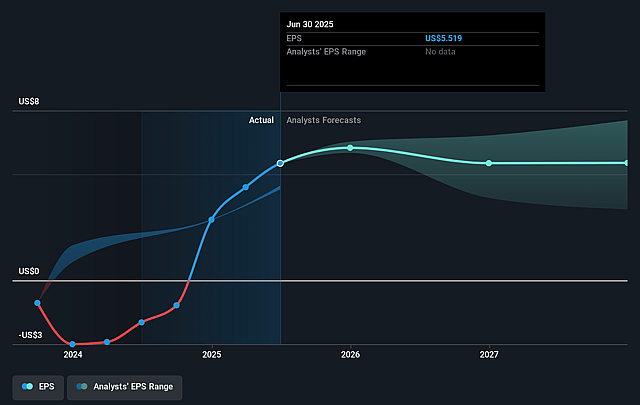

- The bullish analysts expect earnings to reach $8.0 billion (and earnings per share of $7.57) by about September 2028, up from $6.2 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 14.9x on those 2028 earnings, up from 13.3x today. This future PE is lower than the current PE for the US Metals and Mining industry at 22.5x.

- Analysts expect the number of shares outstanding to decline by 3.51% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.57%, as per the Simply Wall St company report.

Newmont Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The accelerating global energy transition and the rise of digital currencies may reduce gold's appeal as a long-term store of value, which could diminish bullion demand and pressure Newmont's future revenues and cash flows.

- Increasing ESG scrutiny and rising regulatory expectations around environmental and social impact could drive up Newmont's ongoing compliance and permitting costs, reducing net margins and putting pressure on profitability over the next decade.

- Declining average ore grades at key mines such as Cadia and Peñasquito, as stated in the company's outlook for lower gold grades in the coming quarters, will drive up extraction costs and could erode Newmont's profitability and net income over time.

- The operational challenges and integration risks from recent large-scale acquisitions-including the ongoing rationalization of Newcrest's assets-may strain efficiency and limit the return on invested capital, adversely impacting earnings growth in the medium to long term.

- Newmont's significant exposure to geopolitical and jurisdictional risk, with mining assets in countries prone to regulatory changes, higher taxes, or social unrest, could lead to production disruptions, asset write-downs, or higher tax burdens, directly affecting revenue stability and earnings quality.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Newmont is $96.99, which represents two standard deviations above the consensus price target of $74.75. This valuation is based on what can be assumed as the expectations of Newmont's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $104.0, and the most bearish reporting a price target of just $58.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $26.0 billion, earnings will come to $8.0 billion, and it would be trading on a PE ratio of 14.9x, assuming you use a discount rate of 7.6%.

- Given the current share price of $75.92, the bullish analyst price target of $96.99 is 21.7% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Newmont?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.