Key Takeaways

- Rising regulatory, environmental, and geopolitical hurdles are expected to increase costs, constrain production, and create significant earnings volatility for Newmont.

- Shifting investor preferences and weakening gold demand threaten long-term revenue growth and compress margins due to higher operating and compliance costs.

- Strong gold demand, operational discipline, and portfolio optimization are enhancing efficiency, earnings quality, and financial flexibility, supporting sustainable long-term profitability and shareholder returns.

Catalysts

About Newmont- Engages in the production and exploration of gold properties.

- As global capital allocators intensify their move toward decarbonization and renewable energy, the long-term investment case for physical gold may erode, leading to structurally lower demand for Newmont's primary product and ultimately driving realized gold prices and revenues down over the next decade.

- The aging global population and increasing adoption of digital financial assets are likely to deeply undermine gold's position as a safe-haven store of value, causing a persistent downward pressure on both demand and pricing, which will weigh on Newmont's future revenue and earnings growth.

- Compounded by ongoing depletion of economically viable reserves, Newmont will be forced to develop more lower-grade, higher-cost deposits, leading to a structural rise in all-in sustaining costs, which compresses operating and net margins even in periods of stable or rising metal prices.

- Intensifying regulatory and environmental scrutiny worldwide is expected to dramatically increase permitting and compliance costs, with heightened risk of project cancellations, delays, or asset impairments that will constrain Newmont's ability to sustain or grow production, thus directly impacting both revenue and long-term return on capital.

- Rising geopolitical fragmentation and protectionist policies threaten to disrupt Newmont's ability to efficiently market and export its output, leading to significant earnings volatility and increasing the risk of stranded assets or margin destruction across its global portfolio.

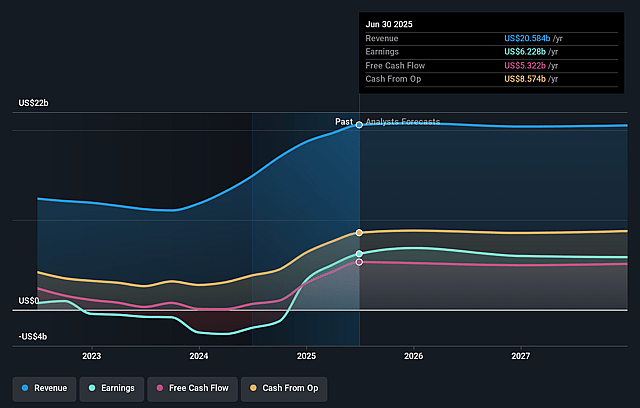

Newmont Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Newmont compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Newmont's revenue will decrease by 6.4% annually over the next 3 years.

- The bearish analysts assume that profit margins will shrink from 30.3% today to 22.0% in 3 years time.

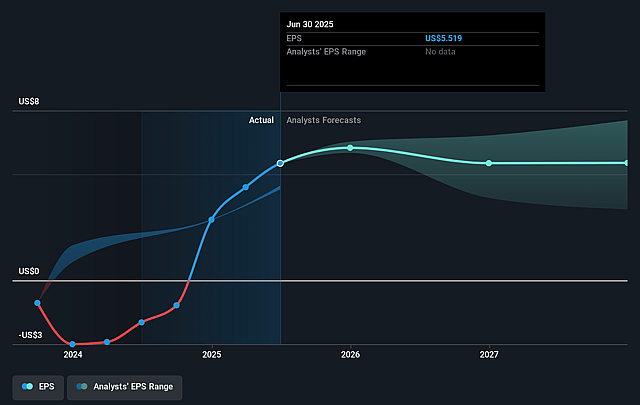

- The bearish analysts expect earnings to reach $3.7 billion (and earnings per share of $3.36) by about September 2028, down from $6.2 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 19.1x on those 2028 earnings, up from 13.3x today. This future PE is lower than the current PE for the US Metals and Mining industry at 22.5x.

- Analysts expect the number of shares outstanding to decline by 3.51% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.47%, as per the Simply Wall St company report.

Newmont Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Robust demand for gold remains a secular tailwind, driven by ongoing inflationary pressures, currency debasement, and a supportive macroeconomic environment, all of which could sustain higher gold prices and underpin strong revenues and free cash flow for Newmont.

- Newmont has demonstrated significant operational resilience, delivering record free cash flow of $1.7 billion in the second quarter and maintaining industry-leading cost discipline, with all-in sustaining costs and operational performance consistently meeting or exceeding guidance, which supports future earnings.

- The successful integration of recently acquired high-quality, long-life assets, along with ongoing portfolio optimization and divestiture of non-core assets, is creating a stronger, more focused and geographically diversified production base that enhances return on capital and could lead to higher long-term earnings quality.

- Investments in productivity enhancements, technology, and automation are translating into measurable improvements in mining efficiency and cost reductions across key operations such as Lihir, Boddington, and Cadia, increasing the likelihood of improved net margins and sustainable profitability in coming years.

- Newmont's strong capital allocation discipline-evident in aggressive debt repayment, substantial share buybacks, and consistent dividends-along with a robust balance sheet and substantial cash reserves, gives the company financial flexibility to weather industry downturns, pursue organic growth projects, and continue returning capital to shareholders, thus supporting share price stability or growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Newmont is $58.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Newmont's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $104.0, and the most bearish reporting a price target of just $58.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $16.9 billion, earnings will come to $3.7 billion, and it would be trading on a PE ratio of 19.1x, assuming you use a discount rate of 7.5%.

- Given the current share price of $75.42, the bearish analyst price target of $58.0 is 30.0% lower.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.