Last Update 05 Dec 25

Fair value Increased 1.07%NEM: Shares Will Rise On Constructive Gold Cycle And Acquisition Ambitions

Analysts have nudged our Newmont fair value estimate modestly higher to approximately $105, reflecting a series of higher Street price targets, stronger expected revenue growth and margins, and sustained optimism around gold and broader metals pricing, despite a still challenging macro backdrop.

Analyst Commentary

Recent Street research for Newmont has skewed overwhelmingly positive, with multiple upward price target revisions and several rating upgrades clustered in a short time frame. Bullish analysts are coalescing around a view that higher gold price assumptions, improving operational execution, and an attractive relative valuation justify a higher fair value and support meaningful upside from current levels.

At the same time, even the more optimistic views acknowledge that the macro environment remains uneven, particularly around Chinese commodity demand and broader cyclical risks. This has led to a focus on balance sheet strength, cash flow durability, and the company’s ability to deliver on production and capital allocation commitments as key drivers of whether Newmont can realize the upside embedded in these higher targets.

Given that the latest notes are predominantly constructive, the key themes can be consolidated into a single set of takeaways.

Bullish and Cautious Takeaways

- Bullish analysts are lifting targets to reflect higher long term gold price decks and improving expectations for copper and other metals, which directly support higher revenue and margin forecasts in valuation models.

- Multiple upgrades highlight Newmont’s production growth pipeline, free cash flow yield, and capital management, with some citing more than 20 percent potential upside as the stock trades at a discount relative to peers.

- Target increases across U.S., Canadian, and Australian listings underscore a broad based view that Newmont is leveraged to a constructive precious metals cycle, with rising price targets in local currencies reinforcing the global earnings potential.

- More cautious elements center on a still challenging macro backdrop, particularly slower commodity demand from China, which could pressure realized pricing and sentiment unless offset by stronger demand from the U.S. and Europe.

- Execution risk remains a key watchpoint, as the investment case depends on Newmont delivering planned production, maintaining cost discipline, and translating higher commodity prices into sustained free cash flow and return of capital.

What's in the News

- Newmont is reportedly evaluating structures to gain full control of Barrick Gold's Nevada joint venture assets, potentially including a bid for Barrick's stake in the JV or a full takeover of Barrick followed by non core asset sales. Barrick shares rose and Newmont shares fell on the report (Bloomberg).

- A related report indicates Newmont could go as far as pursuing a complete acquisition of Barrick. This would underscore the company's appetite for large scale portfolio moves to consolidate tier one gold assets (Bloomberg).

- Newmont announced that its Ahafo North project in Ghana has reached commercial production. The asset is positioned to deliver 275,000 to 325,000 ounces of gold annually over a 13 year mine life and to become a cornerstone of the company's African portfolio (company announcement).

- The company reported third quarter 2025 attributable gold production of 1.42 million ounces and year to date output of 4.44 million ounces. It guided fourth quarter production to about 1.415 million ounces and indicated that 2026 volumes will likely track toward the lower end of the current range (company operating results and guidance).

- Newmont completed CEO succession planning, with long serving chief executive Tom Palmer set to step down at year end 2025 and President and COO Natascha Viljoen to assume the CEO role on January 1, 2026. This will mark the first time the company is led by a woman (company announcement).

Valuation Changes

- The fair value estimate has risen slightly to approximately $104.53 from about $103.42, reflecting modestly stronger fundamentals and pricing assumptions.

- The discount rate has increased marginally to roughly 8.19 percent from about 8.11 percent, modestly tempering the uplift from improved operating assumptions.

- Revenue growth has risen slightly to about 6.24 percent from roughly 5.61 percent, signaling higher expectations for top line expansion.

- The net profit margin has improved modestly to around 34.46 percent from approximately 33.99 percent, indicating a small uptick in projected profitability.

- The future P/E multiple has fallen slightly to roughly 14.76x from about 15.04x, suggesting a marginally more conservative valuation multiple despite the higher fair value estimate.

Key Takeaways

- Elevated gold demand and successful integration of acquired assets are set to drive stable long-term growth and strong cash flow performance.

- Focus on operational efficiency and ESG initiatives boosts margins, protects against regulatory risks, and enhances access to capital and valuation.

- Operational risks, declining asset quality, rising costs, reliance on divestments, and leadership transitions threaten Newmont's future revenue stability, earnings reliability, and cash flow.

Catalysts

About Newmont- Engages in the production and exploration of gold properties.

- Persistent global inflation and monetary debasement are likely to reinforce investor and central bank demand for gold, which will support higher sustained gold prices and directly increase Newmont's future revenues and earnings.

- Newmont's focus on operational stability, cost discipline, and productivity enhancements (e.g., at Lihir, Boddington, and across its core assets) is expected to drive lower operating costs and improved EBITDA margins, positioning the company for margin expansion and stronger net income over time.

- The realization of synergies and increased production scale following the Newcrest Mining acquisition, together with ongoing asset optimization and the ramp-up of expansion projects (such as Ahafo North and Tanami), should support long-term revenue growth and cash flow stability.

- Rising geopolitical tensions and wealth accumulation in emerging markets are likely to ensure resilient long-term demand for gold as a store of value, which should provide a strong macro tailwind for sustained revenue growth and upward revision in analyst outlooks.

- Newmont's continued investment in ESG initiatives, such as decarbonization, water management, and tailings remediation, enhances its reputation and access to capital with institutional investors, protects margins against potential regulatory costs, and supports premium valuation multiples over the long run.

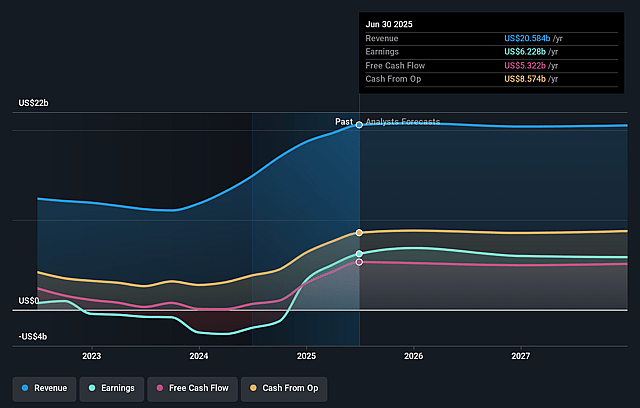

Newmont Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Newmont's revenue will grow by 1.6% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 30.3% today to 29.7% in 3 years time.

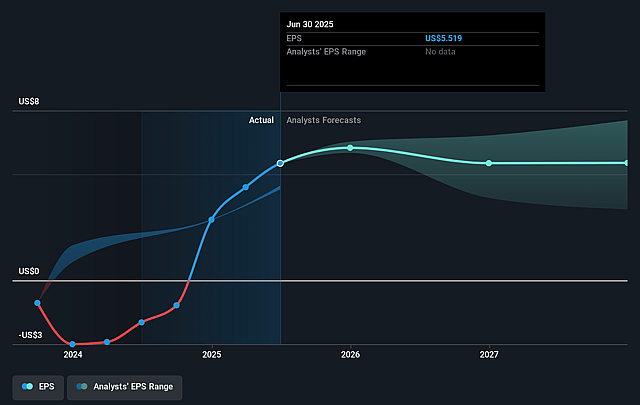

- Analysts expect earnings to reach $6.4 billion (and earnings per share of $6.48) by about September 2028, up from $6.2 billion today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $8.1 billion in earnings, and the most bearish expecting $3.8 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 14.0x on those 2028 earnings, up from 13.3x today. This future PE is lower than the current PE for the US Metals and Mining industry at 22.7x.

- Analysts expect the number of shares outstanding to decline by 3.51% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.47%, as per the Simply Wall St company report.

Newmont Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The fall of ground incidents at the Red Chris operation highlight potential operational safety and geotechnical risks, which could prompt costlier safety measures, production delays, regulatory scrutiny, and negatively affect future revenues and margins if similar disruptions occur or require ongoing investment.

- Several major assets, including Cadia, Peñasquito, and Lihir, are entering periods of lower-grade ore processing and planned production declines, suggesting future output and revenue may fall short of current strong results, especially if optimization initiatives do not fully offset mine sequencing headwinds.

- Planned increases in sustaining and development capital expenditures-especially for asset integrity, tailings remediation, and delayed shutdowns-will raise company-wide costs in the second half of the year and beyond, potentially compressing net margins and reducing free cash flow if commodity prices soften or cost-saving targets are not achieved.

- The heavy reliance on asset sales (e.g., Greatland Gold, Discovery Silver) and noncore divestments to fund capital returns implies that future shareholder distributions may be unsustainable once the current divestment pipeline is exhausted, placing long-term pressure on free cash flow and earnings if organic cash generation declines.

- Transition risks related to leadership changes (e.g., unexpected CFO departure, ongoing executive reshuffling) and complex integration of new assets could lead to strategic missteps, loss of institutional knowledge, and execution risk, threatening the stability of operations and negatively impacting earnings reliability over the long term.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $73.225 for Newmont based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $104.0, and the most bearish reporting a price target of just $58.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $21.6 billion, earnings will come to $6.4 billion, and it would be trading on a PE ratio of 14.0x, assuming you use a discount rate of 7.5%.

- Given the current share price of $75.42, the analyst price target of $73.22 is 3.0% lower. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Newmont?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.